Raytheon (NYSE: RTN) stock price soared to a new all-time high amid investor’s confidence in product innovation and strong backlog. RTN looks like a good play for long-term investors who like to get dividends along with a steady share price appreciation. The company offers a quarterly dividend of $0.94 per share. Its dividend yield stands around 1.7% despite massive share price gains in the past twelve months.

Raytheon stock price is trading close to $230 at present; RTN share price grew 42% in the last twelve months. RTN share price is trading around 19 times to earnings compared to the industry average of 25. The strong growth in financial numbers is offering support to valuations.

Fundamentals are Supporting Raytheon Stock Price

The company’s future fundamentals are strong. This is because of its backlog and new contract wins. RTN recently received almost $3B in contracts from the U.S. Department of Defense. On the other hand, RTN has generated stronger than expected financial numbers for the third quarter. Its revenues jumped 9% year over year to $7.45B compared to the past year period.

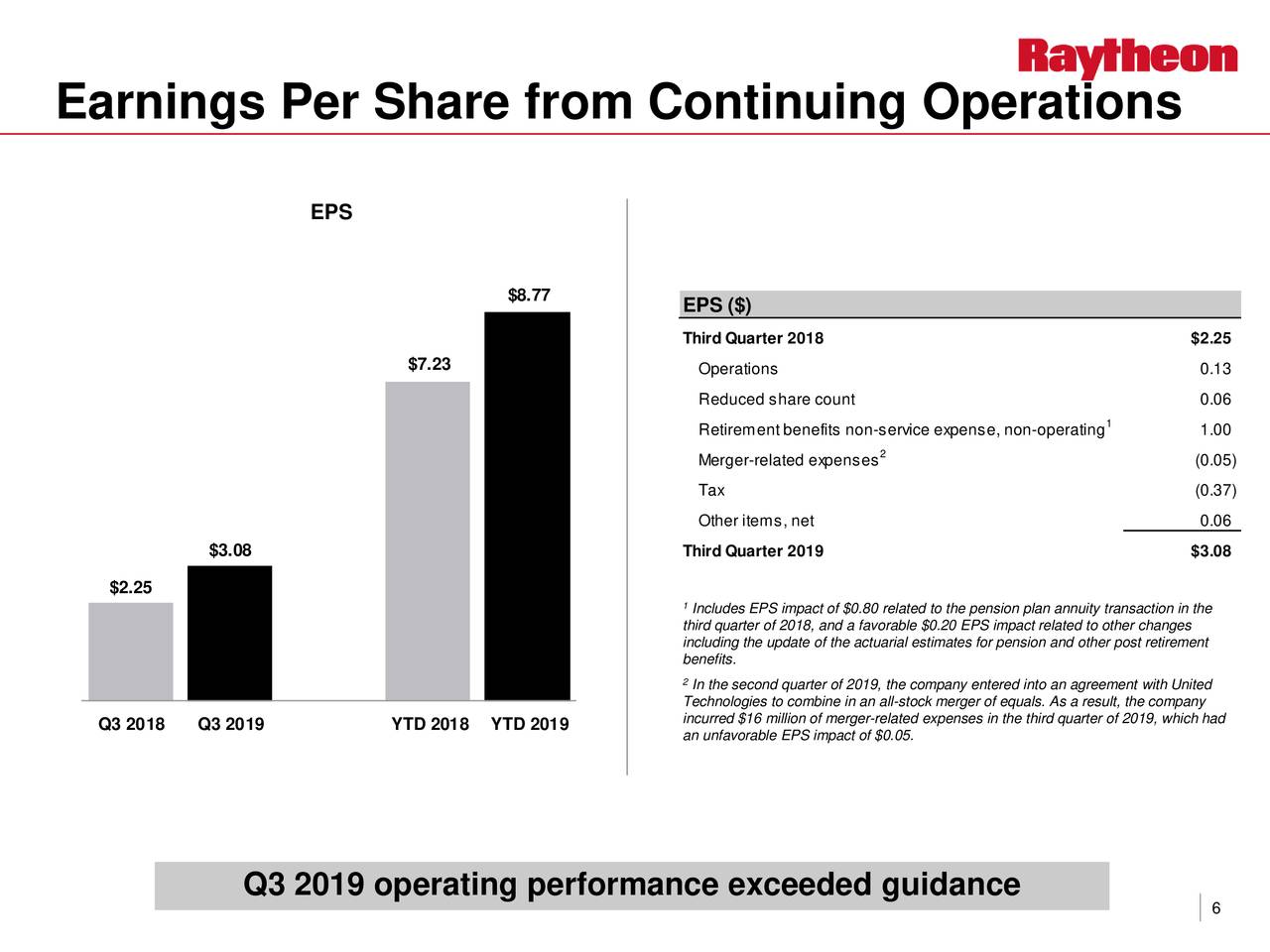

In addition, the company has also been experiencing steady growth in margins. Its earnings per share from continuing operations grew 36% from the year-ago period.

“Higher Q3 profit margins due to timing were helpful in the quarter and across the business units, the segment margins of 12.1% exceeded our expectations,” CFO Toby O’Brien said.

Its cash returns are safe. Indeed, its financial numbers are offering a room for more dividend increases in the coming days. It has increased dividends in the past 18 consecutive years.

Outlook is Robust

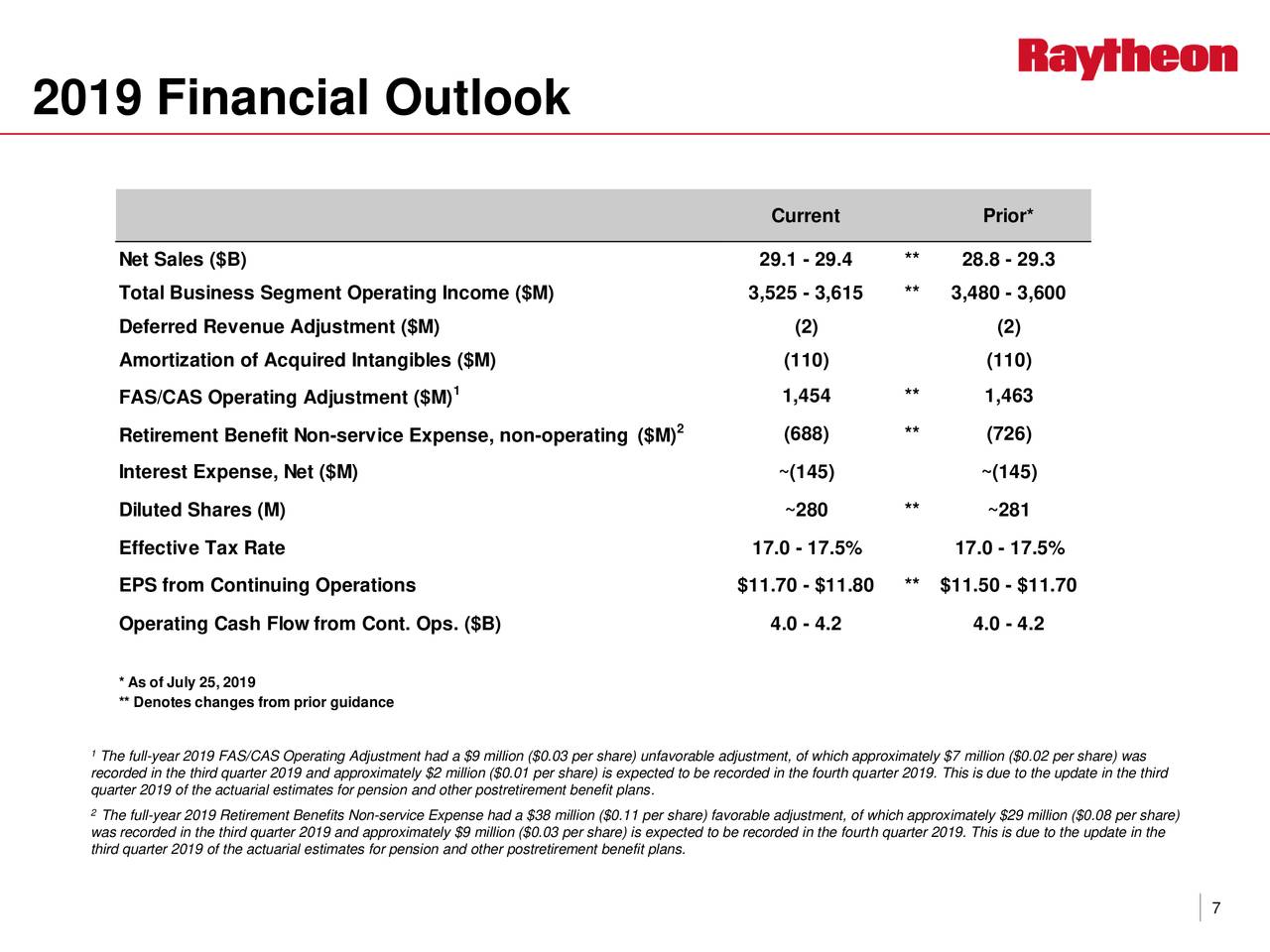

The company expects to generate high single-digit growth in revenues and double-digit growth in earnings. For the full year, RTN anticipates earnings per share in the range of $11.70-$11.80, in line with analyst consensus. RTN expects a full-year revenue of $29.1B-$29.4B. Overall, Raytheon’s stock price is receiving support from several fundamental factors.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account