Qualcomm (NASDAQ: QCOM) stock price soared 37% since the start of this year despite sluggish financial performance. The shares of chipmaker are currently hovering around $80, down slightly from 52-weeks high of $90 a share.

The steady upside moves since the start of this year are quite strange. This is because the company continues to generate a significant decline in financial numbers.

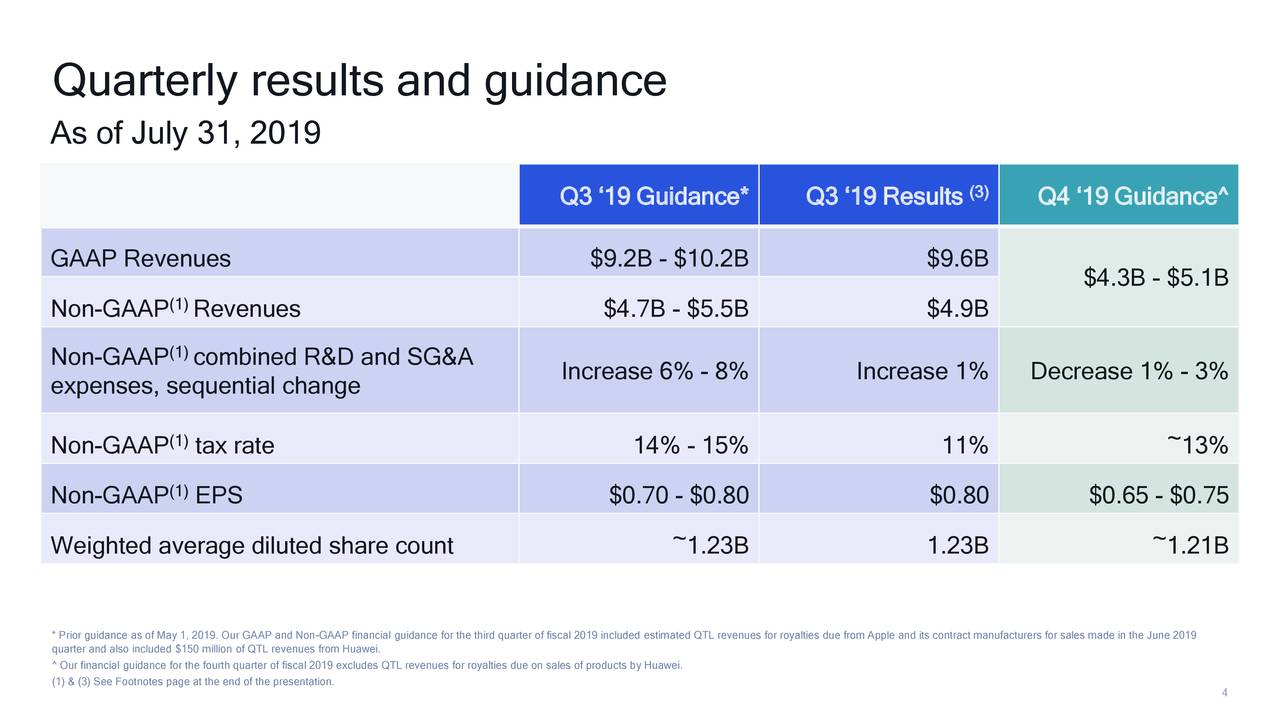

Its third-quarter revenue of $4.9 billion declined 13% year over year. Lower margins and revenues have also significantly impacted its earnings potential.

Its third-quarter net income of $1 billion dropped 34% from the year-ago period. The company blamed lower demand for 4G products along with the market’s transition towards 5G for negative financial growth.

“We delivered another solid quarter operationally in the midst of slower demand for 4G devices as the market prepares for the global transition to 5G,” said Steve Mollenkopf, CEO of Qualcomm Incorporated. “Our 5G design wins have doubled over the last three months, leaving us extremely well-positioned as 5G ramps in early calendar year 2020.”

The company has also provided lower the expected outlook for the fourth quarter. It expects Q4 revenue in the range of $4.3-$5.1B compared to the consensus estimate for $5.71B. The earnings per share outlook stand around $0.65-0.75. The analysts were expecting earnings per share at $1.10.

Market pundits turned bearish about Qualcomm stock price performance. Goldman Sachs has reduced its price target from $73 to $57 – with a Neutral rating. They blamed the weakness in the high-end 4G market in China for lower price target and financial numbers.

Goldman said, “QCOM’s guidance provided a materially worse-than-expected view of the overall market demand, signaling the possibility of a weaker H2 for smartphones.”

Despite a steep decline in revenue and earnings, its dividends are safe. This is due to the strong cash generation potential. The company has generated operating cash flows of $6 billion in the past nine months compared to dividend payments of $2.2 billion.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account