Speaking at a monetary conference in Washington, Fed chair Jerome Powell said that interest rates might not need to rise as much as expected to curb inflation due to the stress in the banking sector.

Powell said that the Fed hasn’t yet decided on the policy action for its June meeting and reiterated that it would decide “meeting by meeting.”

During the panel discussion, Powell said, “We face uncertainty about the lagged effects of our tightening so far and about the extent of credit tightening from recent banking stresses.”

Powell said banking sector stress would mean rates would not rise as much as expected

Notably, three US banks including SVB and First Republic have failed this year. While the Fed provided a backstop for all SVB depositors – JPMorgan Chase acquired First Republic.

Powell said, “The financial stability tools helped to calm conditions in the banking sector. Developments there, on the other hand, are contributing to tighter credit conditions and are likely to weigh on economic growth, hiring, and inflation.”

The Fed chair added, “So as a result, our policy rate may not need to rise as much as it would have otherwise to achieve our goals,” while cautioning “the extent of that is highly uncertain.”

US inflation has moderated

US inflation peaked at 9.1% in June last year and the annualized inflation has since fallen every month and hit 4.9% in April – which is a tad below the psychologically crucial 5% level. The core PCE (personal consumption expenditure) which is the Fed’s preferred inflation gauge was 4.6% in March.

While inflation is still over twice the 2% level that the Fed targets, it has nonetheless fallen substantially over the last three quarters.

Powell says lowering inflation to the target range would take time

Powell meanwhile said that recent data points “support the committee’s view that bringing inflation down will take some time.” Notably, despite the Fed’s rate hikes the US job market is still quite strong and the unemployment rate is at 3.4%, which ties for the lowest since 1953.

Powell said, “We’ve come a long way in policy tightening,” while adding “We face uncertainty about the lagged effects of our tightening so far and about the extent of credit tightening from these banking stresses.”

Lowering inflation is Fed’s priority

On multiple occasions, Fed has reiterated that lowering inflation is its top priority. Speaking in Washington, Powell said, “Many people are currently experiencing high inflation, for the first time in their lives. It’s not a headline to say that they really don’t like it.”

He added, “We think that failure to get inflation down would, would not only prolong the pain but also increase ultimately the social costs of getting back to price stability, causing even greater harm to families and businesses, and we aim to avoid that by remaining steadfast in pursuit of our goals.”

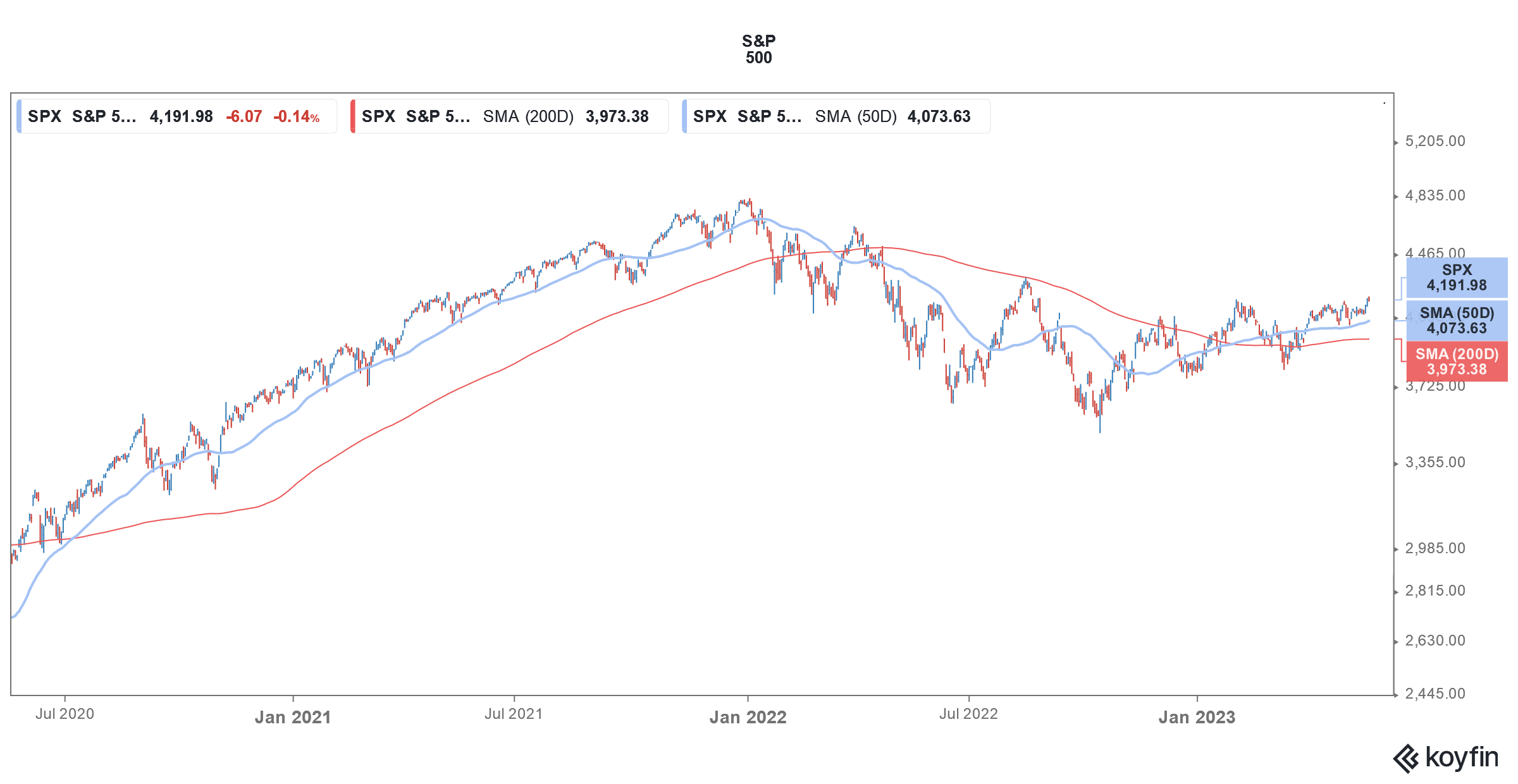

Fed has lifted interest rates to multi-year highs

The Fed embarked on its rate hike cycle in March 2022 when it increased its policy rates by 25 basis points. The US central bank raised rates at every meeting since then including four consecutive hikes of 75 basis points last year.

In December, Powell announced a 50-basis point rate hike and so far in 2023, the Fed has raised rates thrice by 25 basis points each to bring the Fed fund rates to 5.0%-5.25%.

After the May meeting, the Fed signaled a pause in the tightening cycle and the post-meeting statement omitted reference to “the Committee anticipates that some additional policy firming may be appropriate.”

The Fed’s statement has raised hopes that the US central bank is now nearing the end of the rate hike cycle.

Traders reset their expectations after Powell’s comments

Meanwhile, after Powell’s comments, traders have reset their expectations from the Fed’s June meeting. 82.6% of traders polled by CME now believe that the Fed won’t raise rates in June – which is almost 18 percentage points higher than the previous day.

The remaining 17.4% of traders see Fed raising rates by 25 basis points next month.

Would Fed pivot to rate cuts later this year?

The consensus view calls for rate cuts later this year. On multiple occasions, Powell has ruled out rate cuts and reiterated his stance after the May Fed meeting.

He said that the FOMC has “a view that inflation is going to come down not so quickly.”

Powell added, “It will take some time, and in that world, if that forecast is broadly right, it would not be appropriate to cut rates and we won’t cut rates.”

Meanwhile, after Powell’s speech yesterday, the two-year US treasury fell by 0.1 percentage points as markets now believe that a pause on Fed’s rate hike cycle now looks around the corner – even if a pivot to rate cuts might take longer.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account