Online trading platform Plus 500 (PLUS) said its revenue soared almost five times due to volatile world markets caused by the coronavirus outbreak

The Israel-based company reported on Wednesday that its first-quarter sales rocketed 487% to $316.6m, compared to a year ago. It also doubled its active users which jumped to 194,024 from 97,921.

The firm added that its average revenue per active user (ARPAU), an important metric that gauges the performance of its trading activities, jumped by 200%, showing that traders increased the bets they made as markets dipped and rose as the health emergency stalled economic activity across Europe and the US.

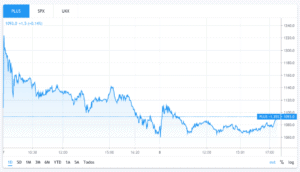

The London-listed stock, which sponsors Atletico Madrid (pictured), has performed well this year, yielding a 21.6% return year-to-date compared to a 28.3% loss in the FTSE 250 Index. Shares in the business closed up 1.5% to 1,093.5p on Wednesday.

Chief executive Asaf Elimelech said: “As a result of the exceptional first-quarter performance, revenue and profitability for the full year are expected to be substantially ahead of current consensus expectations. However, as we remain at an early stage in the financial year, and there are global markets uncertainties as well as ongoing regulatory changes, it remains difficult to predict the outcome for the full year.”

The business said it will distribute at least 60% of its net profits to shareholders.

Plus 500 is a trading app that offers users financial instruments called Contracts for Difference (CFDs) to place bets on potential price swings in more than 2,000 currencies, commodities, and stocks, allowing them to leverage their positions by using margin accounts.

The firm’s first-quarter 2020 revenues represent 90% of the company’s annual 2019 sales, indicating the business is on track for a significant increase in its net profits by the end of the year.

However, analysts at Peel Hunt said is rate is unlikely to be sustained once “customers realise they’ve actually lost most of what they were willing to stake”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account