Philip Morris International Inc. showed off its earnings numbers for the three months ending September 2015 on Thursday, October 15 before the bell for the day on in New York. The firm’s earnings came in at $1.24 per share for the quarter while revenue came in at $6.90B.

In the same period of last year, Philip Morris International Inc. managed to earn $1.39 per share. Sales for the same quarter in 2014 came in at $7.90B. In the three months heading into the release of today’s results, Philip Morris International Inc. stock has gained 3.56% of their value.

Here’s what Wall Street expected from Philip Morris International Inc.

Heading into the publication of these numbers, Wall Street forecast that Philip Morris had earned $1.11 per share by consensus. Revenue was thought to have hit $6.76B for the quarter.

17 analysts were following Philip Morris International Inc. in the months before the firm put out these numbers. 2 analysts told clients the firms were a Buy, 5 analysts said they thought investors should make the stock Overweight, 8 analysts reported that the best strategy was to Hold the shares. 2 analysts advised that their readers hold the firm Underweight and none of the analyst thought the best move was to Sell the stock ahead of earnings.

Philip Morris International Inc. earnings in context

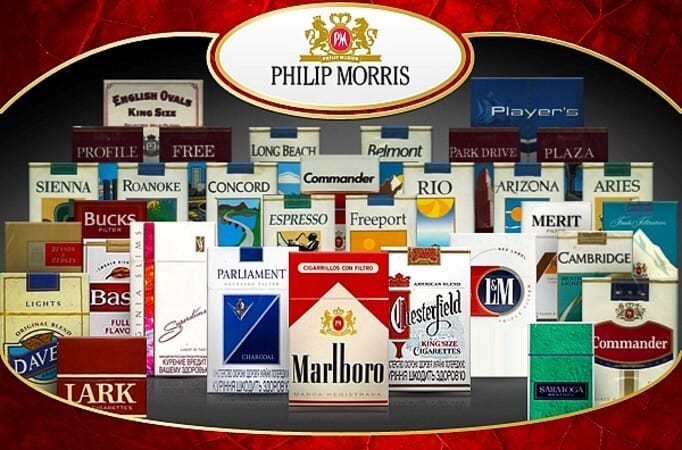

Philip Morris International Inc. is a holding company engaged in the manufacture and sale of cigarettes, other tobacco products and other nicotine-containing products in markets outside of the United States. The Company’s products are sold in more than 180 markets, which include a range of international and local, premium, mid-price and low-price brands. Its premium price brands include Marlboro, Merit, Parliament and Virginia Slims; mid-price brands are L&M and Chesterfield, and international brands include Bond Street, Lark, Muratti, Next, Philip Morris and Red & White.

For the twelve months in 2015 Wall Street thinks that Philip Morris will manage a profit $4.39 per share. The full sales number for the fiscal year is expected to amount to $26.84B. In its prior fiscal year Philip Morris International Inc. made $5.02 per share. Total revenue for the firm’s last fiscal year came in at $29.77B.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account