Palantir stock was trading sharply lower in US premarket trading today after releasing its fourth quarter earnings. Here are the key takeaways from the data analytics company’s earnings report.

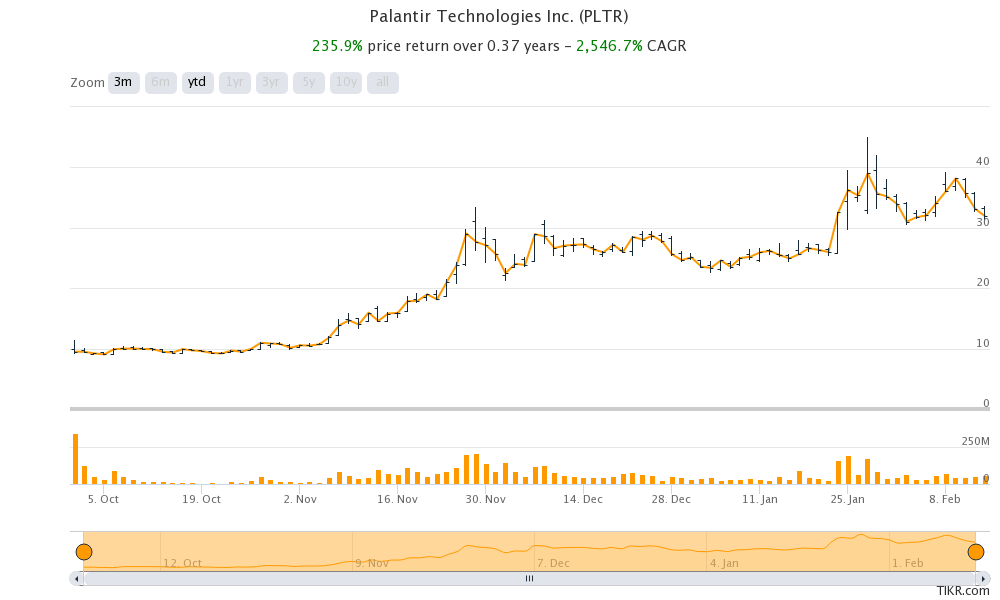

Palantir stock has been very volatile this year. It is among the stocks that were been pumped by the Reddit group WallStreetBets. Palantir stock had a 52-week high of $45 amid frenzied buying. However, as has been the case with other meme stocks, it is down sharply from its recent highs.

Palantir stock

Based on yesterday’s closing prices, Palantir stock has lost almost 30% from its 52-week highs. The drawdown is much lower than what we’ve seen in stocks like GameStop and AMC Theatres. But then, the rise in Palantir stock was also not comparable to the massive gains that we saw in these companies.

Fourth quarter earnings

Palantir reported a loss of 8 cents per share while analysts were expecting the company to post a profit of 2 cents per share. The company reported revenues of $322 million in the fourth quarter which were 40% higher than the corresponding quarter in 2019. In the full year 2020, its revenues increased 47% year over year to $1.1 billion. The company expects its revenue growth to be 45% in the first quarter of 2021. In the full year, it expects revenue growth to be over 30% which is largely in line with the 29% that analysts were forecasting

Palantir has been diversifying its business

Palantir has been diversifying itself away from government business that currently accounts for the bulk of its revenues. This year, it has signed many deals that would help it diversify its revenues. Earlier this month, Palantir announced that it has extended its partnership with energy giant BP for five more years.

“Palantir will provide its software to bp at the enterprise level, with global deployment across the organization in a multi-year, multi-million dollar deal,” said the company in its release. This month only, Palantir announced a partnership with IBM that would help it expand its sales staff. “This is the biggest [partnership[ we’ve announced — expect more,” said Palantir’s COO Shyam Sankar as he expects the company’s direct sales team to expand to 100 this year or triple from the current levels.

In January, Palantir signed an agreement with mining giant Rio Tinto for its Foundry Platform.

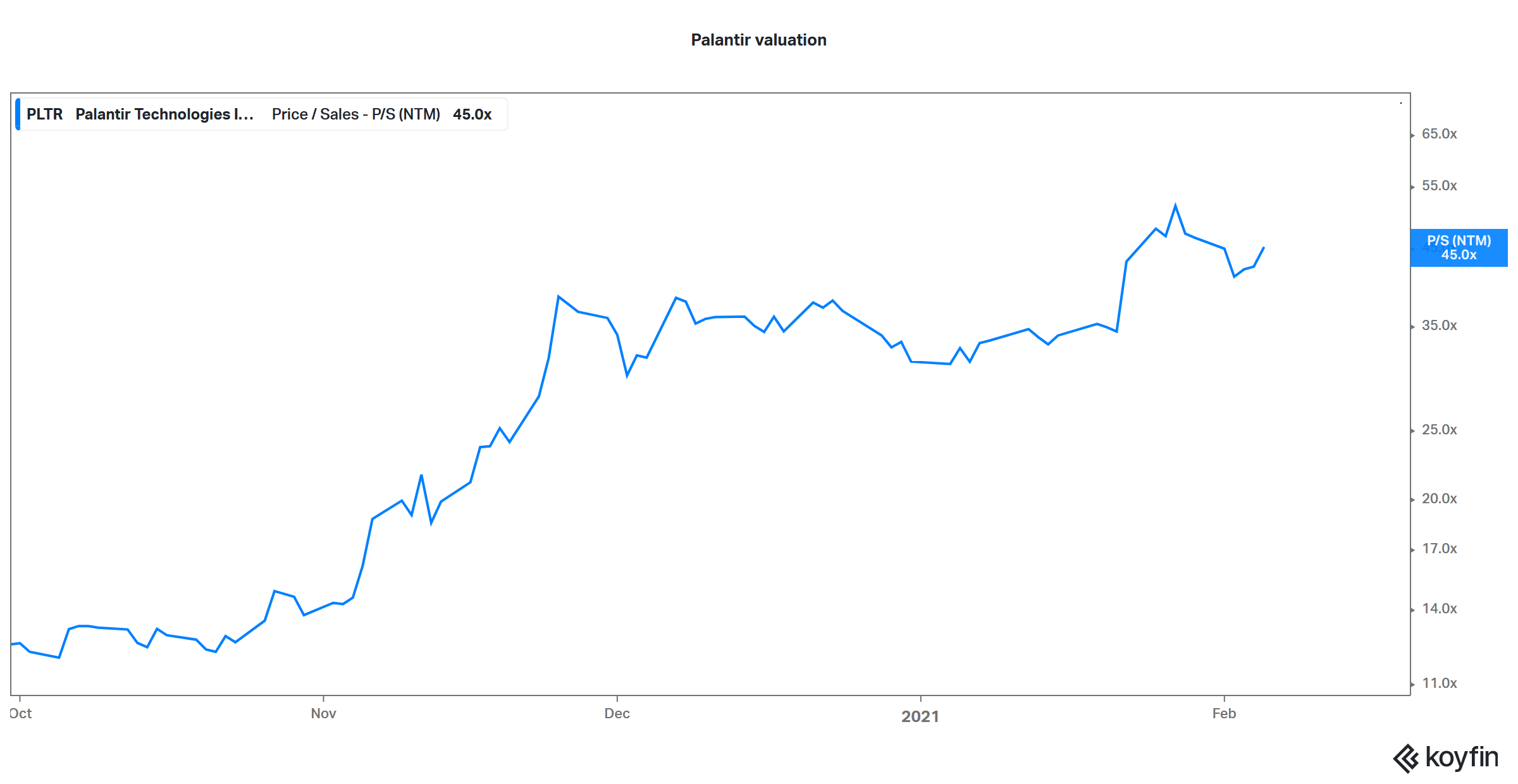

Palantir stock valuation

Palantir stock currently trades at an NTM (next-12 months) price to sales multiple of 45x. While the multiple is down from the 52x that it peaked at in January, it is still much higher than the 12.5x that it traded at its listing. Palantir had opted for a direct listing last year. Prior to Palantir, Spotify, Asana, and Slack had also listed through the direct listing process.

Could there be a sell-off post lockup expiration?

Palantir’s lockup expiration is this week only. Notably, while the lockup expiration period is between 90-180 days for companies that list through traditional IPO, the process is different for the direct listing. In a direct listing, the “insiders” anyway sell some of their shares on the listing date.

In Palantir’s case, the lockup period would end on the third trading day after 16 February. Some analysts are concerned that there could be a sell-off after the lockup period is lifted. There have been instances like in Nikola where stocks sold off after the lock-up period ended and insiders sold their shares.

Direct listing rules

Meanwhile, direct listing could receive a boost as under the new NYSE (New York Stock Exchange) rules companies doing a direct listing can also offer their shares to the public. Under the current rules, a company doing direct listing cannot offer its shares to the public and only current shareholders can tender their shares. Under these terms, while existing shareholders get an exit route, the company cannot raise cash from the direct listing.

After the new direct listing rules are implemented, companies can also tender new shares in the direct listing. This would increase the appeal of direct listing over traditional IPOs as well as SPACs (special purpose acquisition company). Incidentally, so far in 2021, the total money raised through SPACs, or blank cheque companies as they are known, have far exceeded that through traditional IPOs.

Palantir stock price prediction

According to the data compiled by TipRanks, Palantir has an average price target of $22.25 which is a 30% discount over its yesterday’s closing prices. Its highest price target is $40 while the lowest price target is $15. Of the five analysts covering the stock, only one rate it as a buy while three rate it as a hold or some equivalent. The remaining one analyst has a sell rating on the stock.

Recent analyst action has been mixed for Palantir. Citi downgraded Palantir to sell from neutral in January over the valuation concerns. “After a 150+% rise in the stock since the September direct listing, we believe the stock is vulnerable heading into 2021 with the upcoming lockup expiry, and an expected deceleration in growth. Specifically, we see risk around the lapping of COVID-19 related contracts, which have the potential to become headwinds in 2H21 into 2022,” said Citi analysts.

Should you buy Palantir stock

In January only, William Blair initiated coverage on the stock with a market perform rating. However, last week, Jefferies raised the stock from positive to buy and lifted its target price from $30 to a street high of $40.

You can buy Palantir stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account