Opec and its key allies, including Russia, agreed to continue the cartel’s 9.7m production cut to support oil prices amid a slump in demand caused by the coronavirus pandemic.

In a virtual meeting on Saturday, Opec members including Iraq and Saudi Arabia, along with non-Opec allies extended the cuts, first agreed in April, until the end of July, citing a still challenging environment even as lockdowns are eased and economies reopen across the world.

“Together we are stronger, together we can restore stability to oil markets and help rebuild the global economy”, said Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman after the meeting.

The original deal, which consisted in a cut of 9.7 million barrels per day, contemplated declining cuts starting in July, but now any increases in output will be postponed to August or beyond, as the group also decided to meet on a monthly basis to monitor the situation.

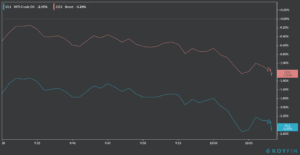

Oil prices are sliding on Monday, with commodity trading activity amid concerns that non-Opec countries, including the US shale producers, are preparing to restart operations to take advantage of higher oil prices.

The West Texas Intermediate, the US benchmark, is down 2.5% trading at $38.65, while the Brent, the global oil benchmark, is trading at $41.5, down 1.2% compared to Friday’s closing price.

Both a global oil glut caused by a price war between Saudi Arabia and Russia and a slump in demand sparked by the pandemic sent oil prices down to historical lows, with futures WTI prices closing in negative territory for the first time in history on late April amid limited storage capacity of crude around the world.

Opec+ cuts were vital in reviving oil prices in the last month, with the price of crude which is now nearly three times higher than the early May bottom of $12 per barrel.

The cartel, made up of 13 countries, said that they managed to comply with 89% of their 9.7 million quota of cuts, with Saudi Finance Minister adding:“Effective compliance is vital if we are to secure the hard won stability in the global oil market and restore confidence in the unity and effectiveness of the entire group”.

Meanwhile, Bjornar Tonhaugen, head of oil markets for Rystad Energy, also greeted the move at the weekend with optimism. He called the deal”a positive development and, unless a second Covid-19 wave hits the world, it will be the backbone of a quick recovery for the energy industry”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account