Oil prices are retreating from their post-pandemic highs despite a beyond-expected drop in crude inventories reported by the United States only two days ago.

The front-month contract of Brent futures is trading 0.5% lower in early commodity trading action today at $68.65 per barrel while the price of WTI futures – the US benchmark for crude – is slipping 0.53% at $65.28 per barrel.

March was a particularly good month for commodities and crude was not the exception, with both the West Texas Intermediate (WTI) and Brent advancing 7.5% and 6.4% respectively amid what analysts have categorized as a super-cycle in the commodities market, primarily supported by a strong economic recovery in the United States, China, and Europe.

Meanwhile, the month of May has started strong for oil prices as well, with both benchmarks advancing 3.1% and 2.9% respectively on the back of an unexpected drop in US crude inventories reported by the Energy Information Administration (EIA) yesterday.

According to data from the agency, US crude inventories slid by 8 million barrels to end last week at 485.1 million barrels, making this the third strongest weekly drop in US inventories reported this year. Meanwhile, analysts had predicted a milder decline of 2.3 million barrels.

Strong refining activity and lower imports may partially explain this weekly drop in oil inventories, while analysts are keeping an eye on the situation in both India and Japan as the demand from these two countries could be affected for longer than expected by a worsening virus situation.

In this regard, Commerzbank analysts shared the following comments in a note to clients: “The record numbers of new infections in India have been making the headlines and fueling fears that demand may recover more slowly”.

Meanwhile, analysts from ING Economics stated: “If we were to eventually see a national lockdown imposed, this would likely hit sentiment”.

Just yesterday, India reported the highest daily virus tally since the second wave started, with the number of cases jumping to approximately 412,000 while daily deaths also climbed to 3,982.

Meanwhile, the virus situation in Japan appears to be improving, as cases seem to have topped near the 6,000 level on 30 April with the numbers starting to retreat since then to 4,075 daily cases reported yesterday.

What’s next for oil prices?

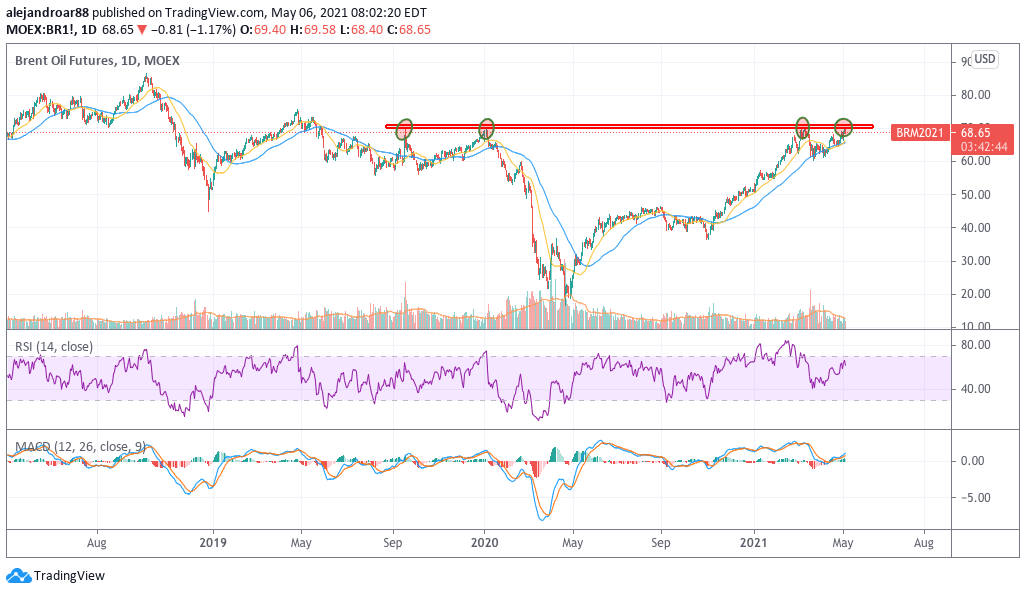

The latest price action in Brent futures has resulted in a fourth tag of a long-dated resistance at the $70 level. The more this threshold is tagged, the higher the probabilities that the price could break above in short notice.

That said, there is the risk that this could also be a near-term double-top formation, a pattern that had disastrous consequences back in 2019-2020 before the pandemic started.

For now, both the MACD and RSI are in positive momentum territory while the short-term moving averages for Brent futures just posted a golden cross. Based on these indicators, the outlook continues to be bullish for crude prices but there are risks that the situation in India could derail the performance of both benchmarks if a national lockdown is imposed.

Only two days ago, the political opposition and business leaders have called for further measures to slow down contagions but so far the government has refused to follow through with these demands, with Prime Minister Narendra Modi strongly opposing another nationwide lockdown.

Traders should keep an eye on this situation moving forward as the current technical setup for oil is quite dangerous and the presence of a negative catalyst could quickly reverse the latest uptrend.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account