Nvidia (NASDAQ: NVDA) stock price bounced back sharply after experiencing the bearish trend in the first half. The share price momentum is driven by the trader’s confidence in improving market fundamentals for semiconductor companies.

Strengthening market position amid 5G is adding to investor’s sentiments. Nvidia stock price is currently trading slightly below from $200 level.

The shares have been struggling to cross $200 mark over the last eleven months. NVDA shares had hit a 52-week low of $135 at the end of the first half of this year.

Analysts See Gains for Nvidia Stock Price

Despite the recent share price rally, analysts are seeing further upside momentum for NVDA shares. For instance, Bank of America has set a price target of $250 with a Buy rating.

The bank says the trader’s confidence in NVDA’s growth profile is improving due to the natural language processing tech. The bank said, “NVDA’s data center growth is on the cusp of benefiting from the next-big AI landmark.”

BofA, on the other hand, believes NVDA is in a better position to outperform peers. “No other company is able to leverage common parallel compute architecture at scale,” BofA said.

RBC Capital Markets has increased the price target to $217 with a buy rating. The upside target is because of RBC’s confidence in improving gaming GPU demand along with the potential growth in the data center business. RBC said, “We believe that we’re past the bottom from a demand perspective.”

Trade Deal Supports Share Price

Tech companies have experienced significant volatility in financial numbers and share price amid trade war conflict between the two largest economies. The initial trade deal between the United States and China helped in enhancing the trader’s sentiments.

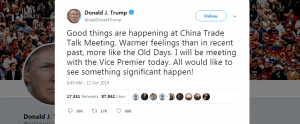

President Trump recently tweeted that good things are happening at the China trade talk meeting. The warmer feelings from the president indicate good things are likely to happen. Overall, the trader’s sentiments regarding Nvidia stock price is escalating.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account