Nvidia shares have delivered eye-popping returns of 95% this year, with the stock is jumping 5.4% yesterday after the chipmaker said it will hold an event to unveil its latest gaming and graphics innovations on 1 September.

The Santa Clara-based chipmaker is scheduled to report its financial results for the second quarter of 2021 on Wednesday and some of the positive momentum seen by its stock lately will be put to test as the coronavirus crisis – a major catalyst for Nvidia shares – continues to unfold.

Analysts estimates for Nvidia’s second-quarter results

Revenues for the quarter for Nvidia, led by founder and chief executive Jensen Huang (pictured), are expected to come in at $3.65bn, up 41.5% from the $2.58bn the company saw a year ago.

Some of these new sales should come from its data center unit, which is expected to benefit from increased cloud-computing activity during the pandemic, as companies relied heavily on tech to perform their activities while workers were confined at home.

Meanwhile, the gaming business should also provide a boost to the company’s results, as stay-at-home policies increased the number of hours that people spent playing video games.

A poll from consulting firm Deloitte published in early July revealed that individuals of all ages tried a new video gaming activity during the pandemic, with millennials and Gen-Xers – 24 to 54 year old – leading the way with more than 35% of them giving video games a chance while on lockdown.

Earnings from Nvidia are expected to jump to $1.93 per share as a result of this positive momentum, resulting in a 31.3% increase compared to the $1.47 in earnings per share the company reported a year ago.

What are Nvidia (NVDA) shares doing lately?

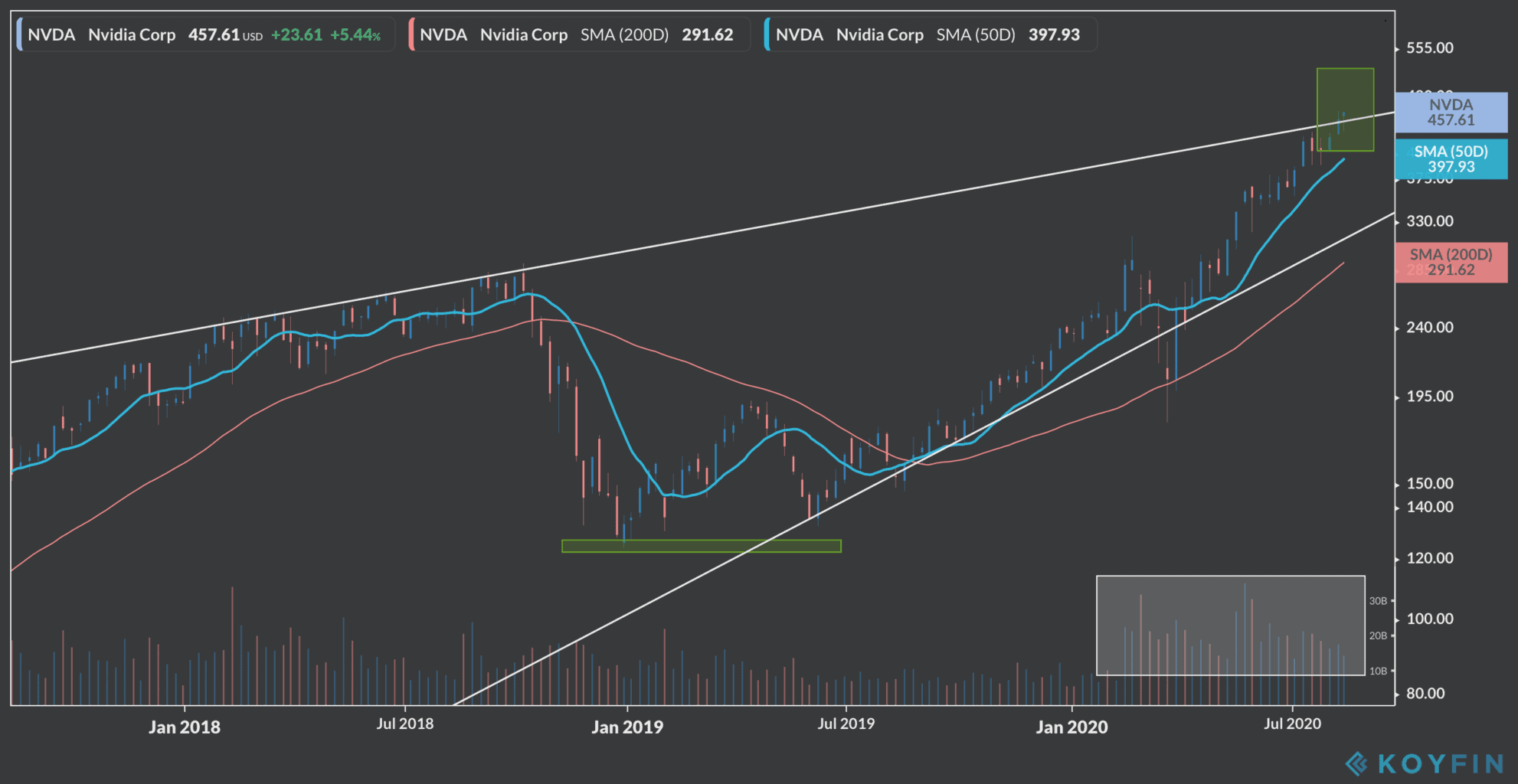

Nvidia shares have broadly risen since the stock price made a double-bottom in June 2019 at $135 per share. Since then, the stock has jumped 238% – currently trading at $457 per share – although a significant portion of those returns have come during the pandemic.

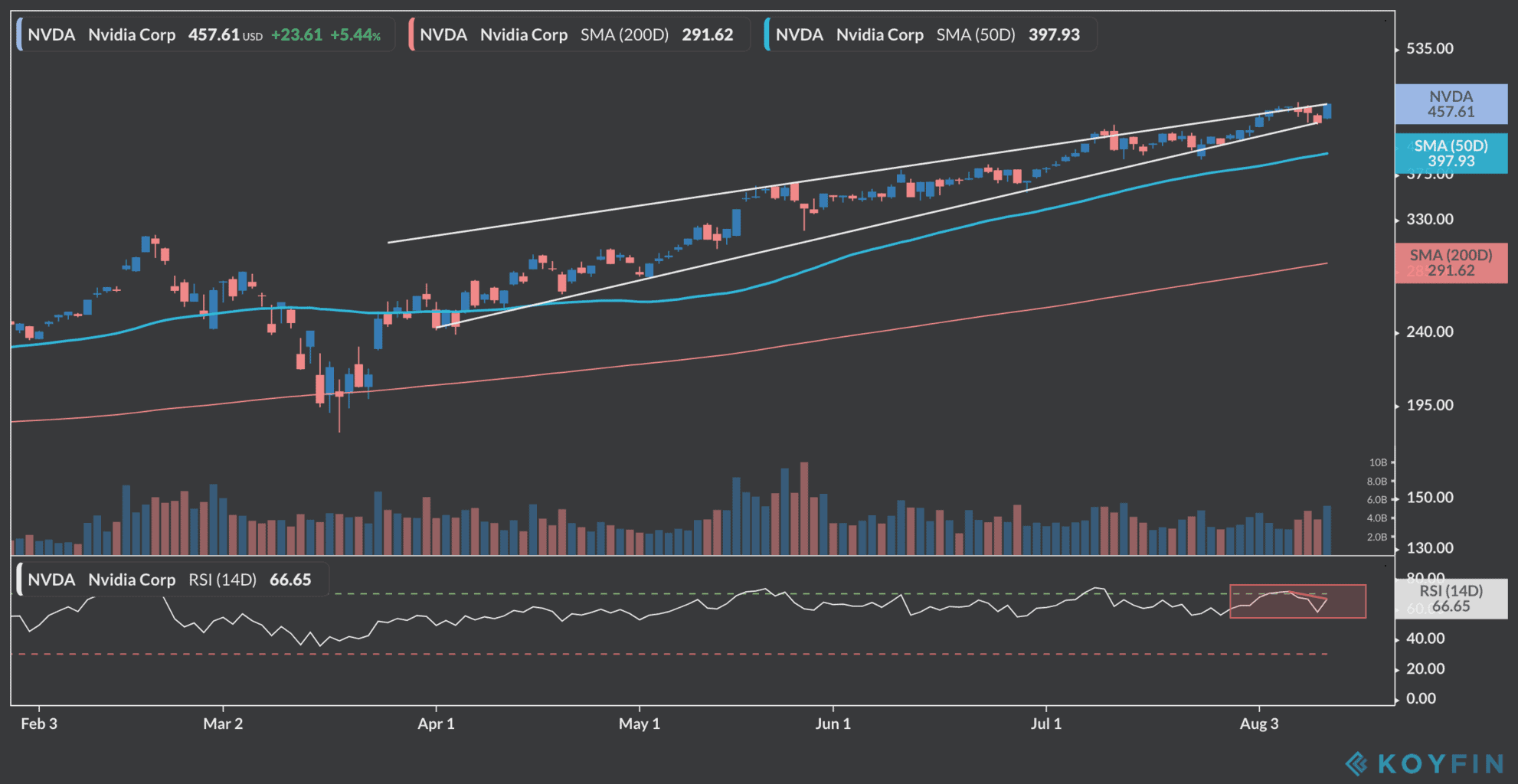

However, Nvidia shares appear to be forming a rising wedge, a bearish price action pattern that could lead to a downturn for the stock (see below). Additionally, the weekly relative strength index (RSI) continues to be in overbought territory – a situation that persists since late May. RSI scores range from 0 to 100, where the stock is considered overbought when the index is above 70 and oversold when below 30.

On a one-day perspective, the RSI posted a bullish divergence, meaning that the stock price moved higher while the RSI recorded lower highs.

However, if Nvidia disappoints investors with its quarterly results a big correction should be expected. On the other hand, mind-blowing results would probably be needed to provide another big push to fresh all-time highs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account