Nokia (NYSE: NOK) stock price lost substantial value in fiscal 2019 amid a steady decline in financial numbers. The lower than expected results for the third quarter and downside guidance for the full year added to bearish sentiments. NOK share price plunged close to 34% in the past twelve months; the shares are currently trading close to the lowest level in the last eight years.

The market analysts are suggesting investors capitalize on the buying opportunity. They see the Nokia stock price selloff a buying opportunity for value investors. The company’s investment in growth opportunities such as 5G and IoT is likely to enhance investor’s sentiments in fiscal 2020.

Analysts Raised Nokia Stock Target

Raymond James upgraded the NOK share price target to Strong Buy with a price target of $5. Nokia shares are currently trading below $4. The firm claims that poor financial results for the third quarter already priced into the stock. The firm also anticipates NOK share price to bounce back in the coming days amid its potential to regain its footing.

On the other hand, New Street increased its ratings from Neutral to Buy following a big selloff in the last few months.

Its true Nokia’s strategy of pausing its quarterly dividend had negatively impacted the share price performance. However, the strategy of reducing cash outflow would enhance its investment potential.

Dim Outlook Could Limit the Upside Potential

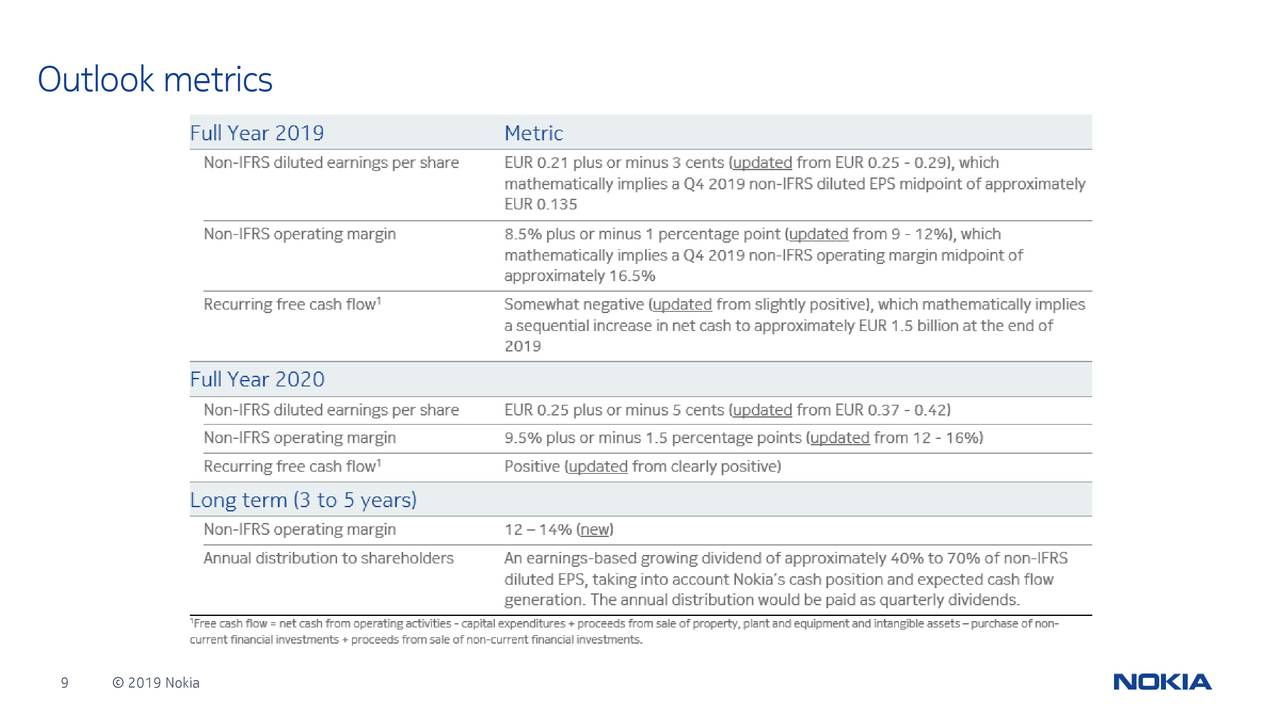

The company has reduced its outlook for fiscal 2019 and 2020. Non-IFRS FY19 EPS is expected at €0.21, down from earlier guidance of €0.25 – €0.29. Nokia also declined the fiscal 2020 earnings outlook to €0.25 compared to the prior guidance of €0.37 – €0.42. The company blames investment in new growth opportunities for downside guidance.

Its CEO said, “I am confident that our strategy remains the right one. We continue to focus on leadership in high-performance end-to-end networks with Communication Service Providers; strong growth in the enterprise; strengthening our software business; diversification of licensing into IoT and consumer electronics.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account