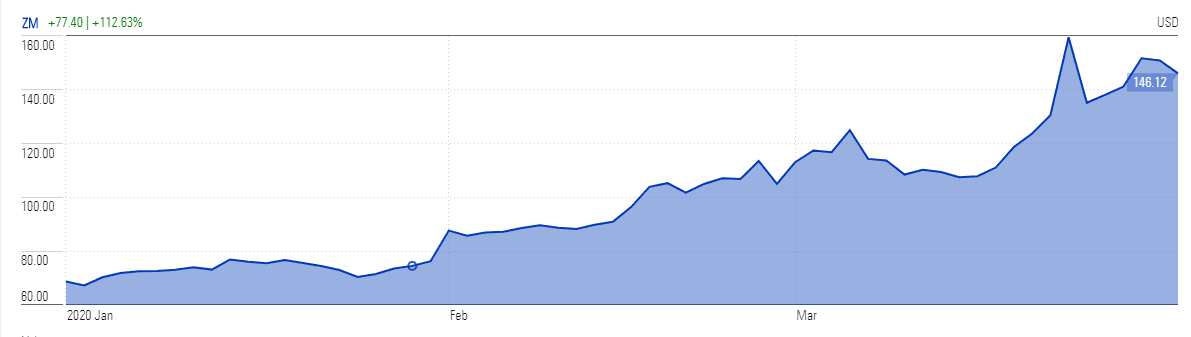

Video conferencing app, Zoom Video (NASDAQ: ZOOM) stock price has jumped by 110% over the last three months, driven by the shift to working from home with expectations that demand will continue to increase even after coronavirus outspread eases. Initially founded by Eric Yuan (pictured, centre) in 2011, an engineer at Cisco Systems’ teleconferencing business, Zoom has now achieved a market capitalization of almost $41bn and its daily US active users volume hit a new all-time high of 4.8 million this week. The active users of video conferencing app grew 151% year-on-year in March.

While Zoom’s stock price has already topped JPMorgan and Needham’s stock price targets, the user growth data and other financial matrices support further growth.

The demand for Zoom is set to remain robust in April and beyond, as lockdown periods imposed by governments seem likely to be lengthy, said JPMorgan analyst Sterling Auty claims. “Zoom’s demand to continue even after the pandemic eases since companies will want to be prepared to handle disruptions in the future,” Sterling Auty said.

Zoom stock price has already crossed JPMorgan’s target of $150; Zoom stock price notched an all-time high of $160 in trading last week before retreating to $145 range on privacy leakage concerns.

Meanwhile, Needham’s analyst Richard Valera believes Zoom is well set to sustain 40% annual revenue growth over the next five years. Thr firm had generated 78% year over year revenue growth in the fourth quarter of 2019. Also, the market analysts expect the business to beat the first-quarter revenue guidance of $199-$201m and a full-year outlook for $905-915m by a wide margin.

The group is also facing fresh scrutiny over its security and business practices as its popularity grows. New York Attorney General Letitia James has written to the firm raising concerns over its ability to cope with the rise in users.

Zoom has had security flaws in the past, including a vulnerability which allowed an attacker to remove attendees from meetings, spoof messages from users and hijack shared screens. Another saw Mac users forced into calls without their knowledge. In California, the firm is being sued for allegedly giving users’ personal data to outside companies including Facebook without fully informing customers that’s the case.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account