Chinese electric car maker Xpeng Motors has raised $400m ahead of an initial public offering (IPO) in New York later this year.

The Tesla rival has attracted funds from existing investors Chinese tech giant Alibaba and sovereign wealth fund Qatar Investment Authority, as well as new cash from Abu Dhabi’s wealth fund Mubadala.

That expands Xpeng’s pre-IPO funding round to $800m, after raising $500m last month. The increased funding reflects investor demand, according to Bloomberg citing people familiar with the matter.

The Guangzhou-based carmaker has already confidentially filed paperwork to the US Securities and Exchange Commission that may see it go public as soon as this quarter.

Electric car maker stocks on a high

An IPO by Xpeng, founded in 2014, would follow other Chinese electric carmakers such as Li Auto and Nio who have already listed in the US.

Last week Li Auto sold 95 million American depositary shares for $11.50 and raising $1.1bn, while Nio went public in 2018 selling shares at $6.26 raising $1bn.

China is the world’s largest electric car market and has many players, partly driven by large government subsidies on offer to firms in this industry.

However, the market has also attracted a lot of investor interest, sparked by the share price gains of listed electric car companies.

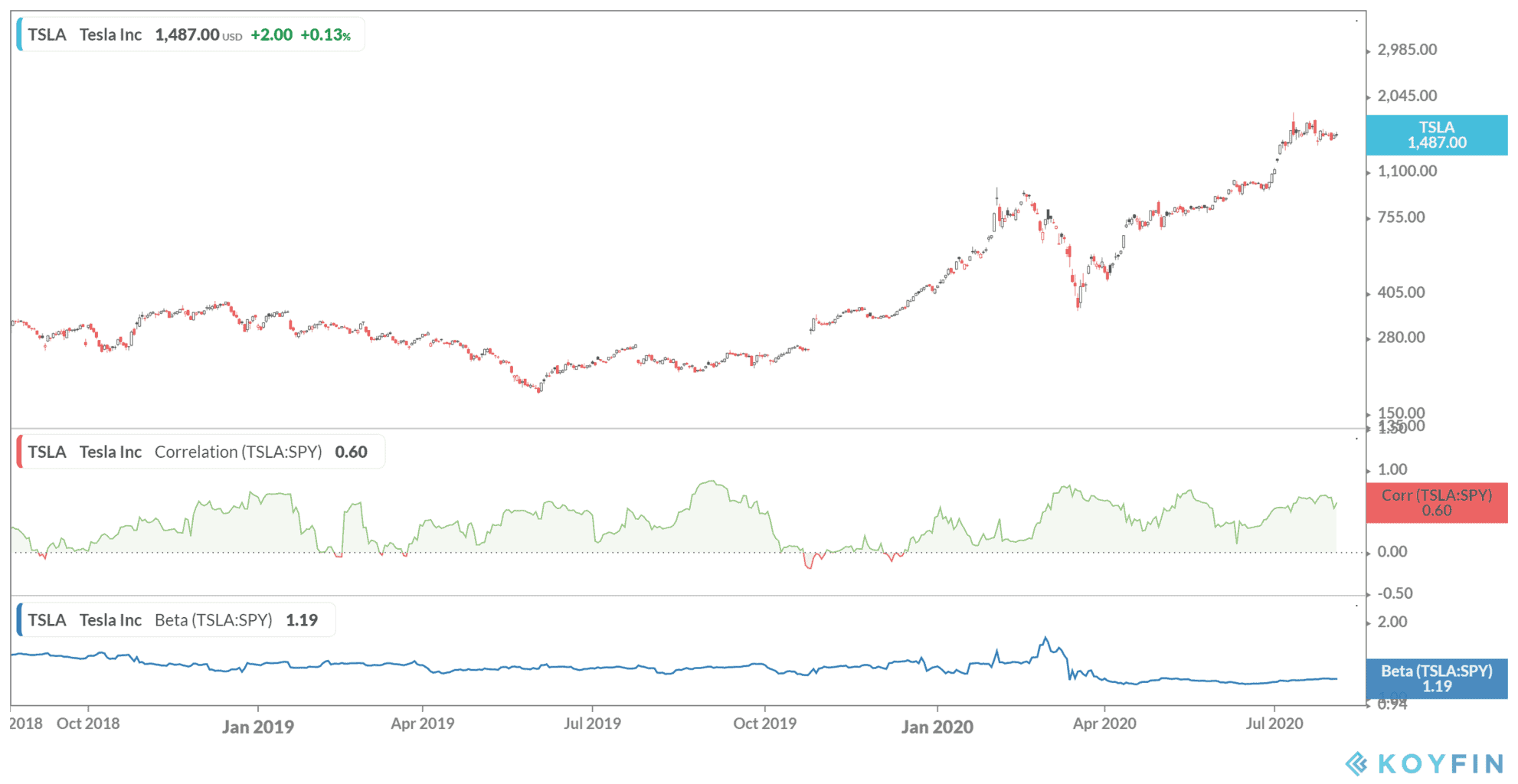

Nio’s stock is up 239% this year while Li Auto, which listed last week, has seen its shares rise 45% since its debut. Meanwhile, Tesla, lead by billionaire chief executive Elon Musk, is over 237% higher in 2020.

Chinese IPOs under scrutiny

However, Xpeng’s impending listing comes at a time of rising trade tensions between the US and China.

This week US President Trump gave Microsoft until 15 September to buy social media app TikTok’s US operations from Chinese owners ByteDance, or he would shut it down.

In May, the US Senate passed quick-fire legislation that increased scrutiny on Chinese firms trading on American exchanges which would see them delisted for failure to comply with the tighter rules.

The month before China-based cafe chain Luckin Coffee reported that its chief operating officer fabricated some $310m in sales. Luckin Coffee is listed in New York.

Last month, Xpeng Motors started deliveries of its new P7 sedan, a competitor to Tesla’s Model 3. In January, Tesla began rolling out Model 3 cars made at its Shanghai factory to customers in China.

Xpeng delivered 5,185 units of its first vehicle, the G3 SUV, in the first half of the year. It began deliveries of its second model, the P7 sedan (pictured), in July, shipping 1,641 units that month.

You can check out a list of recommended stock brokers if you want to invest in stocks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account