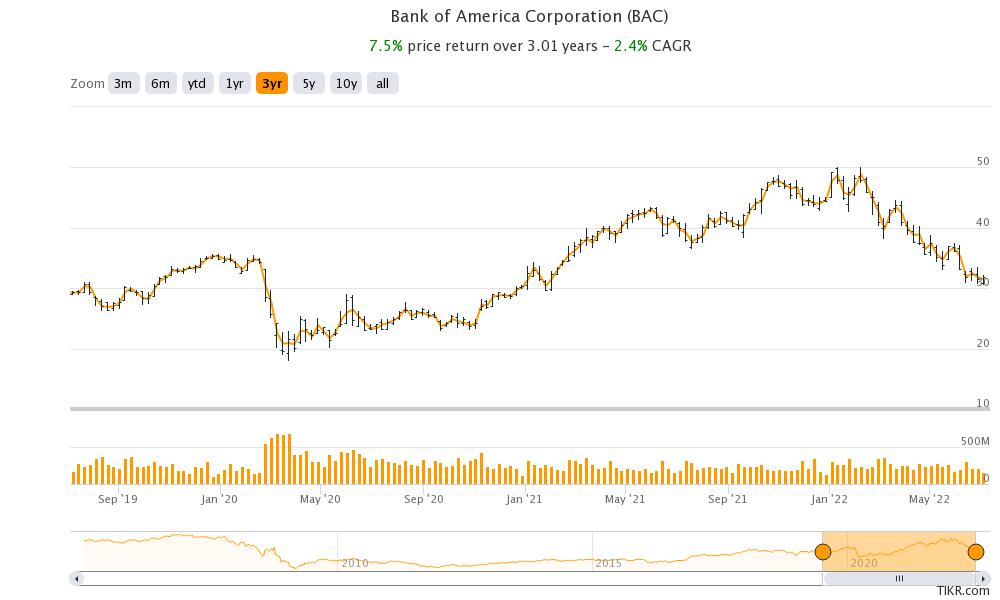

Bank stocks have looked weak in 2022 amid recession fears. Bank of America stock is down almost 29% in the year and is underperforming the markets by a wide margin. Citigroup and Wells Fargo have outperformed banking peers this year.

Meanwhile, despite multiple concerns surrounding bank stocks, Wall Street analysts are bullish on Bank of America stock. Here is what analysts project for the company and its second-quarter earnings estimates.

Bank earnings kickstart this week

The second-quarter earnings season for banks begins this week and JPMorgan, Wells Fargo, and Citigroup have scheduled their earnings for this week. Bank of America would release its second-quarter earnings next Monday before the markets open. Analysts would be watching bank earnings to get insights into the health of the US economy.

Also, banks are expected to report higher loan loss reserves this year amid the economic turmoil. The mortgage divisions of banks have also been feeling the pain from multi-year high mortgage rates. There have been widespread layoffs in the US mortgage industry as mortgage originations as well as refinancing has fallen this year.

What are analysts expecting from Bank of America’s earnings?

Analysts polled by TIKR expect Bank of America to post revenues of $22.8 billion in the second quarter, a YoY rise of 6.3%. However, the increase is coming from a lower base as the bank’s revenues had fallen 4.4% in the second quarter of 2021. Bank of America’s adjusted EPS is expected to fall 25.8% to $0.76 in the second quarter.

In the first quarter of 2022, Bank of America posted revenues of $23.33 billion and an adjusted EPS of $0.80. Both the metrics were higher than what analysts were expecting. Commenting on the earnings, Bank of America’s CFO Alastair Borthwick said “First-quarter results were strong despite challenging markets and volatility, which we believe reflect the value of our `Responsible Growth’ strategy.” He added. “Asset quality continued to remain strong with net charge-offs about half of the year-ago quarter amount.” Meanwhile, asset quality would be in focus in banks’ second-quarter earnings calls.

Societe Generale finds Bank of America a good buy despite recession fears

Societe Generale finds Bank of America a good buy despite recession fears. Today, Andrew Lim upgraded Bank of America to buy from hold calling it a “quality bank.” Lim said, “Bank of America (BoA) is the highest quality US universal bank in our view. It has the most defensive loan portfolio and high sensitivity to rising rates, which drove a premium P/TE valuation heading into 2022. That premium has dissipated with rising concerns about a recession.”

While Lim cautioned against buying bank stocks ahead of a recession, he said that Bank of America stock seems to be pricing a recession. He added, “Now trading at a 23eP/TE of only 1.31x for a 23e ROTE of 14% on our numbers, we think owning BoA has become a much more compelling proposition.”

Wells Fargo is also bullish on the stock

Last month, Wells Fargo also reiterated Bank of America stock as a buy and said that its risk-reward is attractive. It said, “What’s surprising to us is that BAC would still generate ROTCE [return on tangible equity measures] of an estimated 10% in a typical recession, showing support on the downside, in our view.”

Notably, Warren Buffett is also bullish on Bank of America stock and Berkshire Hathaway is the biggest stockholder in the bank. Usually, Buffett had a self-imposed limit of not increasing stakes in banks beyond 10% and in the past, the conglomerate sold shares to keep the stake below 10%. However, Buffett made an exception for Bank of America and increased the stake beyond 10%.

Warren Buffett added more Bank of America shares last year

Also, while Buffett has exited names like JPMorgan Chase, Wells Fargo, and Goldman Sachs, he added more Bank of America shares last year. This year, Buffett has picked a new stake in Citigroup, whose valuation multiples are lower as compared to banking peers.

This year, Buffett has also picked more shares of Apple, Chevron, and Occidental Petroleum. While Berkshire is the largest Occidental stockholder now with an almost 19% stake, it is the second-largest stockholder.

Meanwhile, the bullish report from Societe Generale is not helping Bank of America stock today and it is trading in the red today amid the crash in broader markets. The stock has a 52-week trading range of $30.45-$50.11 and carries a dividend yield of 2.67%.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account