Western Digital (NASDAQ: WDC) stock price is likely to extend the upside momentum in analysts’ view. The market pundits are showing confidence in its future fundamentals and financial numbers. The second-quarter beat and robust outlook are adding to investor’s sentiments. WDC share price is currently slightly shy from the 52-weeks high of $75.

Western Digital stock price surged almost 45 per cent in the past twelve months. Despite a significant share price rally, the stock is trading around 20 times to earnings compared to the industry average of 25 times to earnings.

Analysts See Further Upside for Western Digital Stock

Susquehanna raised the WDC share price target to $100 from the previous target of $90, citing strong financial numbers and a robust outlook for steady upside momentum. “WDC’s earnings power is on the rise and now expects annualized EPS of about $8 by the end of this year and $10 by the end of 2021,” Susquehanna analyst Mehdi Hosseini said,

Cowen lifted the price target $88 with Outperform ratings. Cowen analyst forecasts NAND gross margins to enlarge to 35-40 per cent in the second half due to improving supply/demand and faster than expected enterprise SSD share gains. WDC ended the second quarter with $3.1bn of total cash and cash equivalents.

Second Quarter Results and 2020 Outlook is Boosting Sentiments

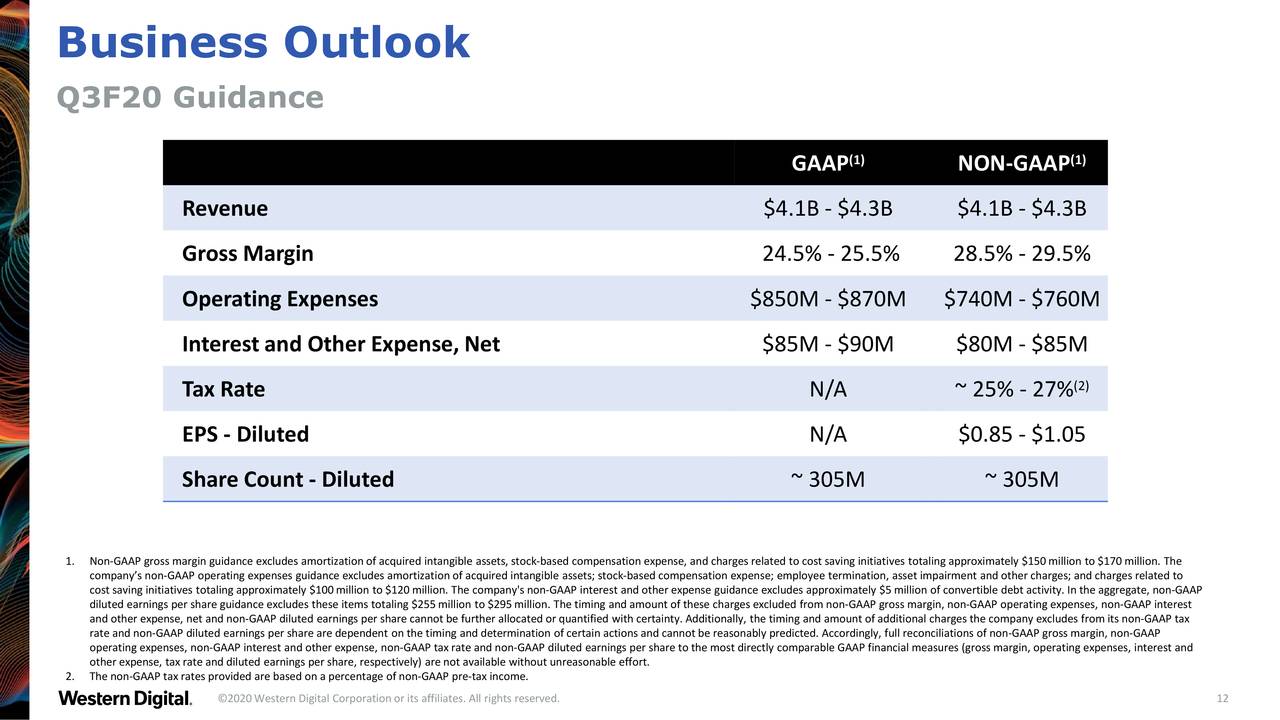

The company generated second-quarter revenue of $4.2bn, up 0.2 per cent from the year-ago period. It has also successfully declined losses compared to the past year period. Its second-quarter net loss of $139ml declined substantially from a loss of $487ml in the past year period. Although the company expects third-quarter revenue in the range of $4.1bn, it is anticipating a return to profitability in 2020.

“We expect an accelerated recovery in our flash gross margins, which coupled with ongoing strength in demand for both hard drives and flash, positions us well for continued profitable growth in the calendar year 2020,” Steve Milligan, chief executive officer, Western Digital (WDC).

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account