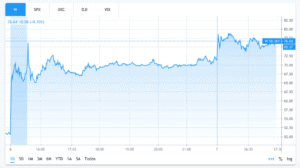

Online home-furnishing retailer Wayfair (W) saw its shares jump over 40% after the company said it expected to beat its revenue growth guidance for next quarter due to stronger demand. The startup saw its shares close more than $20 higher on Monday on the news, a surge that has resulted in a 205% increase in value since mid-March.

Chief executive and co-founder Niraj Shah (pictured, right) said: “We are encouraged by our increasing sales momentum, yet remain highly focused on our plan to rapidly reach profitability and positive free cash flow”.

The Boston-based company added that it expects to “meet or exceed” its 15% to 17% year-on-year consolidated revenue growth target. Wayfair’s stock was trading more than 7% higher on Tuesday afternoon.

Wayfair shares have been on a downward spiral over the last 12 months, even before February’s market crash, as the company has shown strong losses and no signs of turning the situation around in the short-term.

The stock was down 45% before the coronavirus crash and it is now down 52% over 12 months, even though the recent recovery may help the stock gaining back some lost ground if positive sentiment towards the company continues.

Founded in 2002 by Steve Conine and Niraj Shah, Wayfair has built a 20 million customer base, selling $9.1bn in home-furnishings online by the end of 2019 and employing 16,900 staff.

As a result of stay-at-home government policies and social distancing protocols, Wayfair appears to be benefitting from consumers who purchase home-furnishings while at home.

“Wayfair’s e-commerce model is uniquely suited to serving customers’ very real needs at this challenging time,” Shah told CNBC.

The fact that Wayfair does not run shops strengthens the company’s outlook, as there’s no clear indication of how long lockdown measures may last.

Investors seem to be relying on the possibility that the company could cash-in significantly from this temporary windfall to expand its customer base and potentially turnover its massive $1bn dollar loses and $600m negative free cash flow, even though the company carries a large debt burden that has sent the business into negative equity.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account