See’s Candies, a small candy chain owned by Warren Buffett, said it will furlough workers, after closing retail locations across the US to combat the spread of coronavirus. The decision to suspend employees indicates steep challenges for 95-year-old company as the US tries to contain the health emergency.

The chain has more than 240 retail locations across the country, and will provide health benefits for eligible employees until the end of May, it said in a statement on Wednesday.

The business employed a total of 2,488 workers at the end of 2019, according to Berkshire’s annual report, although it’s unclear how many are affected by the furloughs.

See’s Candies chief executive Pat Egan said: “While this step is unprecedented, it is a result of something we’ve never done before, closing stores for a sustained period. We did that because our commitment to public health, including the health of our employees, had to be uncompromising in these times. We’re supporting our employees by ensuring access to health care.”

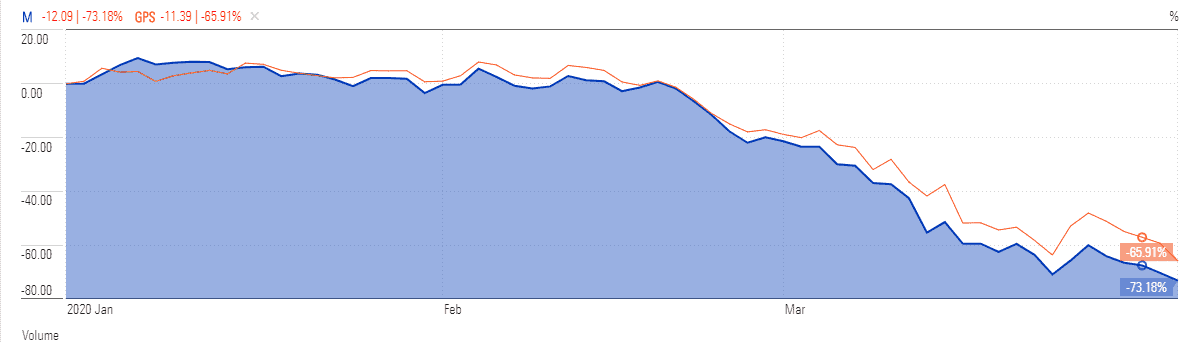

Several other retailers have also been facing similar headwinds. Macy’s stock price tumbled more than 70% this year in market trading, driven by store closure and negative debt ratings from Fitch. It has recently announced to furlough most of its 130,000 employees as a result of the health crises. GAP says it furlough as many as 80,000 of its workers in the US and Canada, announcing to lower headcount across corporate functions.

More than 6.6 million people filed new claims for unemployment benefits last week, the Labor Department said Thursday, which means nearly 10 million people have made jobless claims in the last two weeks as the pandemic grips the nation.

Billionaire investor Buffett always praises the quality of See’s business model, calling it a “dream business”. He bought See’s Candies in 1971 for $25m, and it currently accounts for 0.2% of Buffets Berkshire Hathaway portfolio.

“We put $25m into it and it’s given us over $2bn of pretax income, well over $2bn , and we’ve used it to buy other businesses,” Buffett said during the last year’s annual meeting.

“We’ve had 10 or 12 ideas, some of them we tried more than once,” Buffett said. “The truth is none of them really work. The business is extraordinarily good in a very small niche. Box chocolates are something that everybody likes to receive or maybe give as a gift,” he added.

See’s annual earnings grew from $31m and close to $5m in pretax income when Buffett bought it in 1970 to an estimated $430m in 2018. In the past ten years, it increased the store count from 167 to 214 stores, representing a growth rate of around 2% per year. Its annual average revenue growth rates in the past ten years stood around 3%.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account