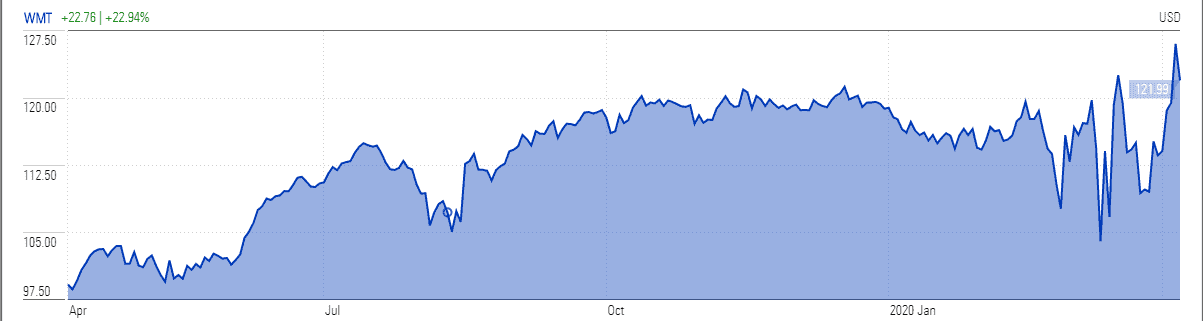

Walmart (NYSE: WMT) stock slipped back from a year high this week as investors wonder whether coronavirus cases have peaked, opening the door for shopping habits to return to normal in the near future. The largest US grocer is among the biggest beneficiaries of health emergency as people stockpile staples, the firm’s sales grew 20% in March and up 30% online over the last eight weeks.

Walmart stock price soared close to 6% in March amid robust sales and traffic growth, with the stock hitting a 52-week high of $129 in trading on Monday. Sales are likely to grow again in April because the pandemic is expected to peak in the US this month, more than 1,800 people lost their lives in the last 24 hours in the US – bringing the total death toll to nearly 13,000. The confirmed cases in America reached 398,000 on Tuesday, while cases have exceeded 1.4 million globally.

Credit Suisse increased Walmart stock ratings to outperform. “We see this unfortunate period accelerating structural changes in consumer shopping, possibly by 5-plus years. This change should be sticky, and favor Walmart, as it’s invested in its infrastructure, technology, and people, to evolve its model,” Credit Suisse analyst Seth Sigman said.

Credit Suisse anticipates the fiscal year 2021 earnings per share to stand around $5.20 on comparable sales growth in the range of 3.8%, up from Walmart’s estimates for comparable sales growth of 3% and EPS of $5 for 2021. Walmart had generated year over year comparable sales growth of 1.9% in the latest quarter.

Some market players believe the sales growth is not sustainable over the long-term as consumer’s purchasing power is likely to decline substantially in the coming months amid the robust growth in the unemployment rate, which could hurt its sales and stock price momentum. The unemployment claims jumped by 10 million over the last two weeks, according to the latest Labor Department data.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account