Todd Gordon, managing director at Ascent Wealth Partners expects Visa stock to rally another 7% by next month as the “duopoly business” benefits from boosted digital transactions and e-commerce spending.

The payments industry is dominated by market leader Visa and runner up Mastercard that hold a formidable 45% and 24.5% share respectively in global card transactions. Calling the payments industry a “duopoly”, Gordon said: “There’s a very high barrier to entry in the payment space.”

Berkshire Hathaway chairman Warren Buffett who likes companies with “moats” or strong competitive advantage has invested in both Mastercard and Visa. Berkshire Hathaway is also the largest shareholder of American Express, another payments company.

Gordon added “several initiatives to expand their small business offerings — specifically digital and e-commerce — as well as their touchless point-of-sale offerings for brick and mortar,” to build Visa’s bull case.

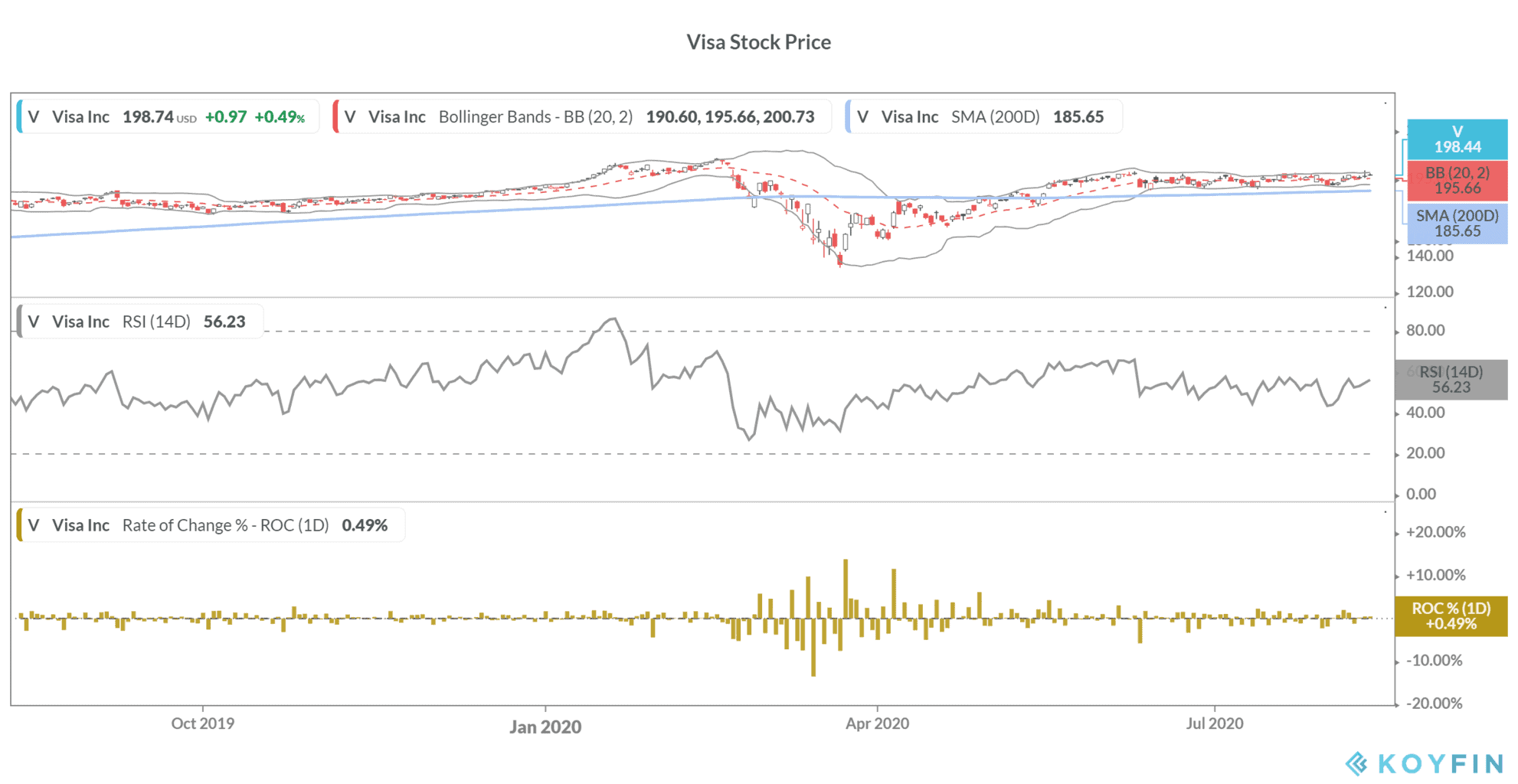

Visa shares: Watch out for $200 price level

Gordon adds that the $200 price level would be crucial to watch. Visa shares closed at $198.74 yesterday and are marginally up in pre markets today. Shares are up 6.1% this year, outperforming the S&P 500. However, while the S&P 500 is very near its all-time highs, Visa shares are 7.2% below their 52-week highs.

Gordon says that Visa shares are in consolidation and “It looks to be on the back of that green bond announcement that it looks to be we may be breaking resistance here.”

He is referring to the $500m green bonds offering that Visa announced on Tuesday “to finance projects focused on energy-efficient improvements, renewable energy and sustainability.”

Gordon added that Visa shares have support near the $200 price level. “We’d like to stay above 200 on the way up hopefully to retest those highs and we see no reason why that should not happen,” Gordon told CNBC’c Trading Nation on Wednesday.

He added: “We hold Visa in our global growth strategy. It’s one of our larger holdings. We are quite bullish on the space whether we do return to some normalcy with a vaccine or we do stay under lockdown as we are now. We see Visa as benefiting regardless.”

Bullish call spread

Gordon also suggested a bullish call spread in Visa options. In a bull call spread, the trader positions himself to benefit from the limited upside potential. In this strategy, the trader goes long on the call option with a lower strike price and sells the call with a higher strike price with the same expiration.

Gordon suggests buying Visa’s September $202.50 call option and selling the $212.50 call option at $4 per spread. The bet assumes that Visa stock could rise between 2% and 7%.

Analysts polled by Refinitiv expect Visa shares to rise 11% over the next 12 months. Wall Street is bullish on the stock and it has a buy or higher rating from 31 analysts while the remaining five analysts have given it a hold. None of the analysts have given it a sell rating.

You can buy Visa shares through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account