Veteran money manager Mark Mobius (pictured) warned that stock markets have not hit “absolute bottom yet” as investors prepare for an earnings season turned on its head by the coronavirus pandemic.

The Mobius Capital Partners founder said: “I don’t think we’re at the absolute bottom yet because the implications of this shutdown are incredible.” He added that he expected corporate first-quarter earnings to be “pretty bad”.

Earnings season kicks off on Tuesday with JPMorgan Chase and Wells Fargo posting as well as Pharma giant Johnson & Johnson, giving investors a sense of how industry is faring after broad sectors of the US economy went into lockdown in March.

Profits across the S&P 500 are forecast to be 10.7 per cent down across the board, according to data from Bloomberg Intelligence. However, earnings at energy firms are expected to fall by as much as 50.9 per cent in the first quarter, according to broker IG.

Mobius, 83, said investors keep cash in hand to capitalize on potential buying opportunities. He said: “Although there are some opportunities to buy, I would say it’s probably a good idea to keep some powder dry for another downturn. We might see a double bottom.”

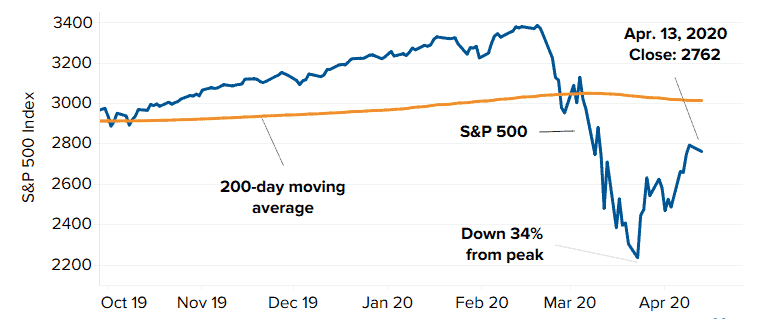

The US benchmark stood around the 2,790 level after hitting a three-year low of 2,237 on March 23. The Dow Jones industrial average currently hovers around 23,390 points, the index is still down more than 18% from the 52-weeks high that it had hit in February.

Mobius has the executive chairman of Templeton Emerging Markets Group from 1987 to 2015; he managed more than $50bn in emerging markets portfolios in a career spanning 40 years. Mobius launched Mobius Capital Partners in 2019 together with his former Templeton colleagues Greg Konieczny and Carlos von Hardenberg.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account