Verizon (NYSE: VZ) stock price continues to trade in the range of $50 to $60 over the last twelve months. The range-bound movement is due to soft financial performance. It’s stock price currently trades around $58, slightly lower from 52-weeks high of $61 a share.

The company missed revenue estimate for the second quarter by $349 million. Its Q2 revenue of $32.1 billion declined 0.4% from the previous year period.

The growth in wireless service revenue was offset by lower than expected revenue from wireline service revenue and wireless equipment revenue. Its FIOS video dropped by 52K compared to the consensus estimate for a decline of 54,470.

Chairman and CEO Hans Vestberg said, “Verizon made history this quarter by becoming the first carrier in the world to launch 5G mobility. We are focused on optimizing our next-generation networks and enhancing the customer experience while we head into the second half of the year with great momentum.”

Its earnings per share of $95 cents in the second quarter declined from earnings of $1.00 per share in the previous year quarter.

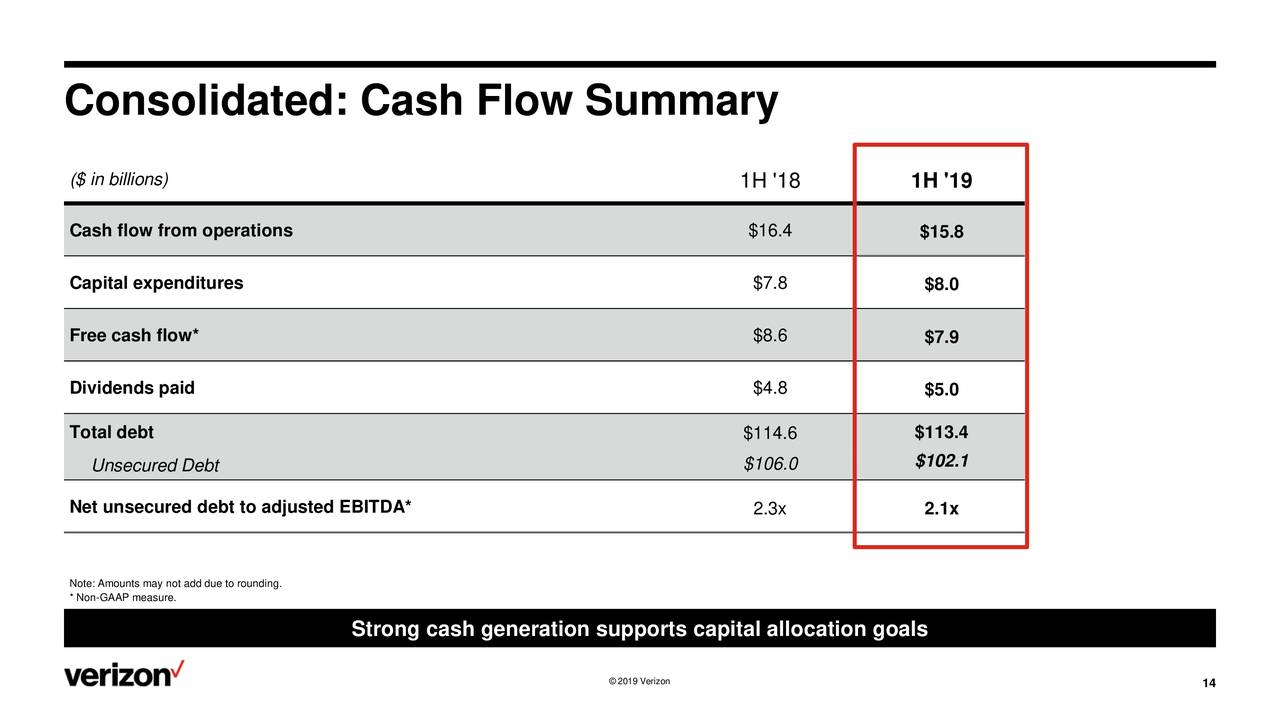

With the decline in revenue and earnings, its cash flows also dropped from the previous period. Verizon has generated $15.8 billion in operating cash flows in the second quarter. This represents a decline of $600 million year over year in Q2.

On the positive side, its free cash flows offered a complete cover to dividend payments. The company generated almost $7 billion in free cash flows when dividend payments stood around $4.9 billion. The company was left with $2 billion in free cash flows after dividend payments – which they can use for share buybacks and investments in growth opportunities.

The company expects its revenue to drop slightly in fiscal 2019 compared to the previous year. Its adjusted earnings per share are likely to increase at a low mid-single-digit rate this year. Consequently, lower financial numbers could create a negative impact on Verizon stock price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account