The largest US airlines including Delta, American, United, Spirit, and JetBlue, have already sent their applications for the government-backed economic stimulus approved by the US Congress in March, which contemplates a $53 billion targeted aid for this embattled industry.

Sources have cited that nearly 275 air transportation companies, including airlines, airports, and cargo operators, are waiting in line to apply for the cash grants and loans offered by the government, even though the same sources have mentioned that nearly 90% of the money may be destined to support the six largest airlines in the country.

President Trump commented on the matter during a press briefing held yesterday where he stated: “it is going to be a very acceptable package. Good for the country. Good for airlines. Good for a lot of people.”.

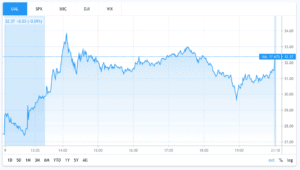

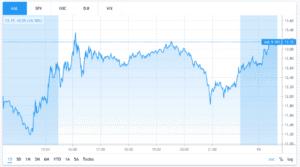

As a result, airline stocks have rallied during today’s early morning trading activity, with United Airlines (UAL) and American Airlines (AAL) leading the charge with 14.5% and 10.4% gains respectively, while other smaller operators have also opened the day with 5%+ gains.

The Coronavirus Aid, Relief, and Economic Security Act, also known as the CARES Act, was approved by the US Congress on March 25 and it specifically includes a $25 billion lifeline for airlines, along with $4 billion for cargo airlines, and $3 billion for airline contractors in the form of cash grants. Additionally, the bill also contemplates $25 billion in loans for passenger carriers and $4 billion for cargo airlines.

This industry-specific aid comes as a response to a significant drop in air traffic, which currently accounts for around 5% of the usual demand, as flight bans and travelling restrictions around the world continue to hurt the tourism industry hard.

Only a few days ago, American Airlines CEO, Doug Parker, told the company’s employees that this financial aid “will allow us to ride out even the worst of potential future scenarios”.

Meanwhile, the bill also imposes some restrictions to those who benefit from the aid, including prohibitions to buy back stock, issue dividends, or lay-off employees, along with a cap on executive compensation.

Industry associations and unions, including the Association for Flight Attendants (AFA), have responded positively to these restrictions, as the recently commented: “This is not a corporate bailout; it’s a rescue package for workers—for Flight Attendants, gate agents, pilots, mechanics, caterers, airport maintenance and janitorial staff and everyone who keeps our aviation system moving”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account