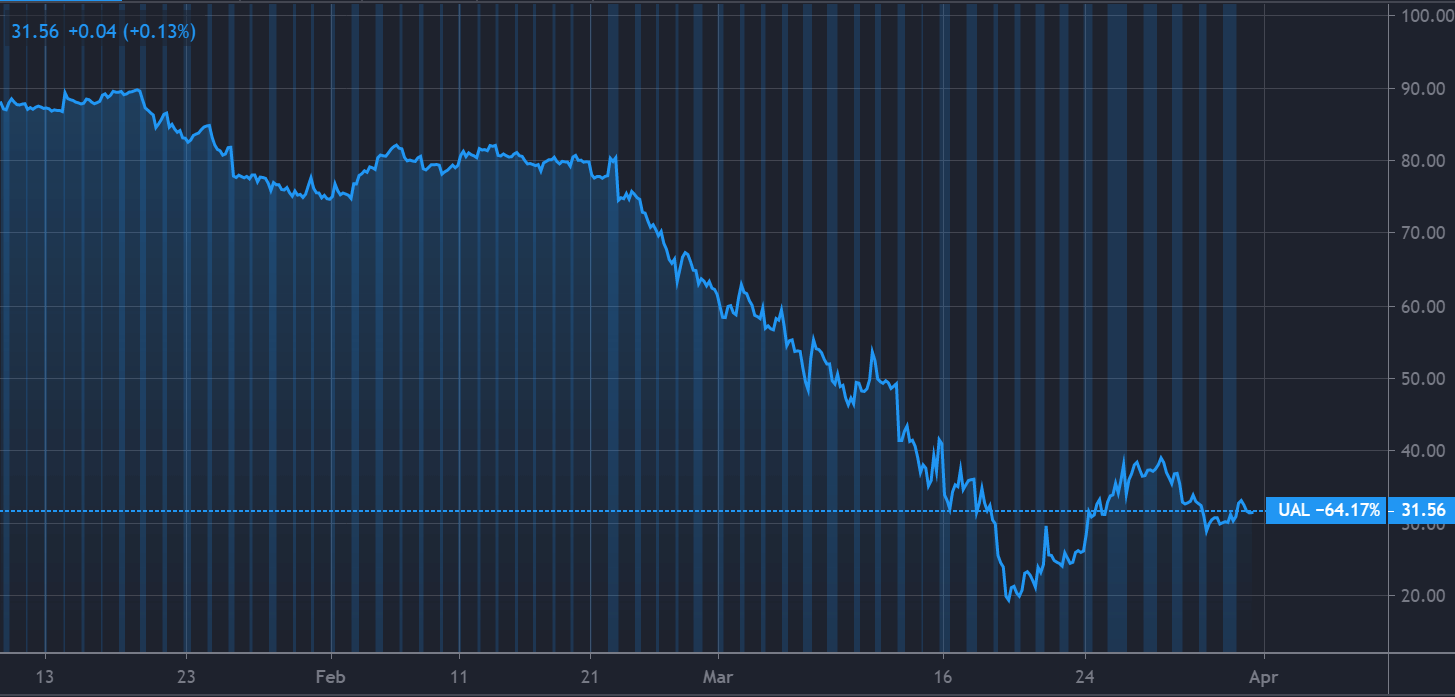

United Airlines (NASDAQ:UAL) saw its stock slide by around 18% on Wednesday as investors continue to weigh up the carrier’s warning of more job cuts to come despite the industry’s earmarked $50bn bailout.

The Chicago-based airline saw its shares fall to just under $26 in afternoon trading, amid a fall that has seen the company lose almost three-quarters of its value this year, with carriers among the hardest hit by the coronavirus slowdown because of additional travel restrictions. The S&P 500 has lost 20% of its value in 2020.

The ongoing pandemic has turned the aviation industry upside down. Flights by American Airlines, United Airlines, and many other airlines are increasingly worried as the virus spreads across the globe while more and more flights are being cancelled.

The White House earmarked $50bn in loans and grants for the industry last Friday, as part of a broader $2trn economic stimulus plan designed to help the airlines through the health emergency. The cash comes with restrictions, including prohibiting layoffs or furloughs until the end of September.

However, late on Friday, after markets had closed, chief executive Oscar Munoz and president Scott Kirby sent a candid letter staff warning of job cuts after September.

They wrote: “Based on how doctors expect the virus to spread and how economists expect the global economy to react, we expect demand to remain suppressed for months after that, possibly into next year.”

The executives added: “That means being honest, fair and upfront with you. If the recovery is as slow as we fear, it means our airline and our workforce will have to be smaller than it is today.”

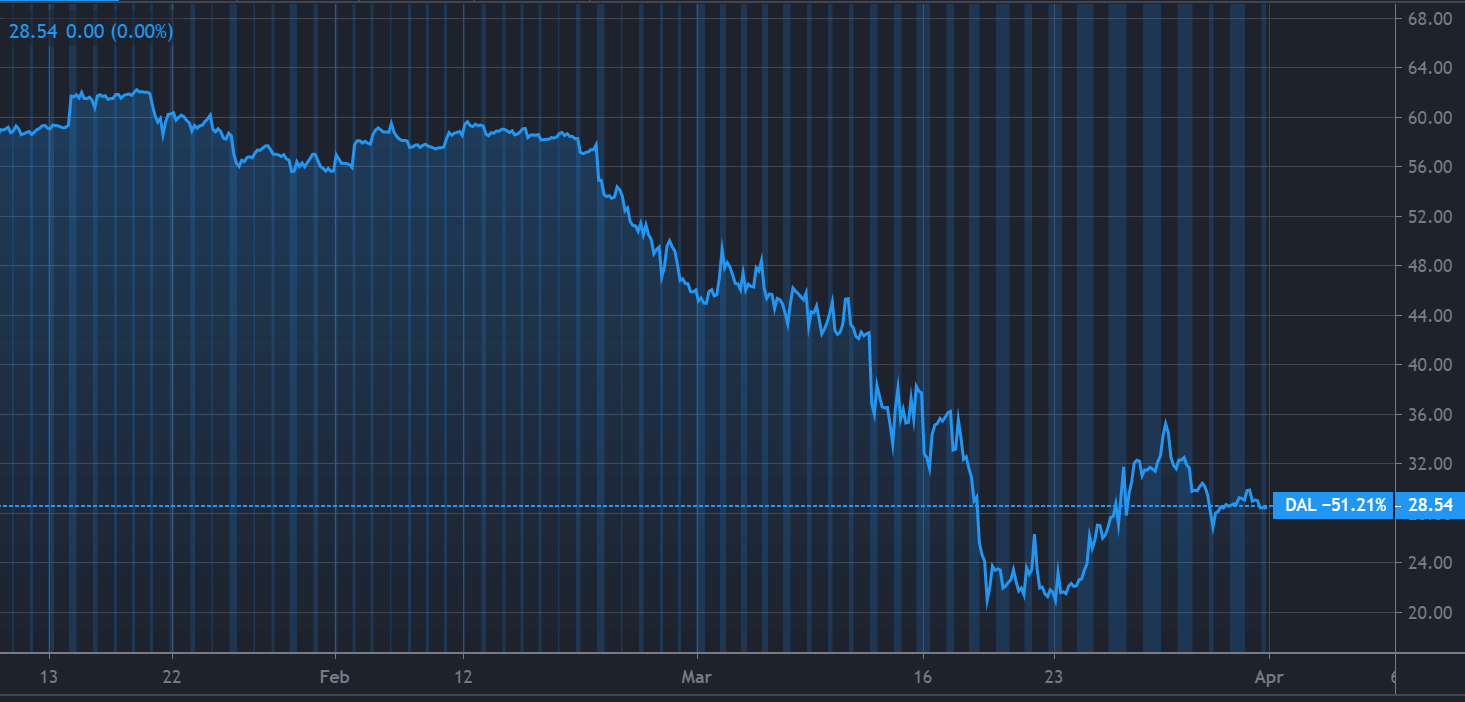

United Airlines isn’t alone, as the entire sector has been nailed by selling. Delta Airlines (NYSE:DAL), which has also warned about becoming a “smaller” airline, saw its stock fall almost 16% on Wednesday afternoon trading. It has lost 60% of its value this year.

Some observers say investors reminding themselves that it might take many months after the emergency is over before these firms recover.

Global airlines around the world also have to drastically stop their operations, suspend the number of flights, abandon ticket policies and find ways to cut costs. Over the past two months, airlines have seen their shares plummet due to the sharp decline in travel demand as a direct consequence of the pandemic.

Despite the ongoing stress in the airline industry, both Deutsche Bank and Standpoint Research have rated UAL a buy. DAL has multiple buy ratings, including one from Citigroup.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account