Uber (NYSE: UBER) stock price has hit the bottom of selloff after losing close to 35% of the value in the past couple of months. The stock has recently hit 52-weeks low of $26 a share.

Uber CEO Dara Khosrowshahi bought 250,000 shares this week. This shows that the stock has limited downside and investors have started capitalizing on the buying opportunity.

Its recent financial results along with the robust outlook are likely to support the share price. Analysts are also showing confidence in future fundamentals.

Analysts Upgraded Uber Stock Price to Buy

Argus has upgraded Uber from Hold to Buy. They provided a target price of $35, citing an improving competitive environment for the Eats and ride-hail businesses. The firm says Uber’s fundamentals are strong despite the steep share price selloff. The firm sees the dip as a buying opportunity.

Wedbush has provided a share price target of $45. Wedbush analysts expect Uber share price to bounce back if the company executes flawlessly in the following quarters.

Robust Revenue Growth Could Provoke Bullish Trend

The company has generated solid financial performance in the third quarter. Its revenue of $3.53 billion increased by 30% from the previous year period. It had generated year over year revenue growth of 14% in the second quarter of this year.

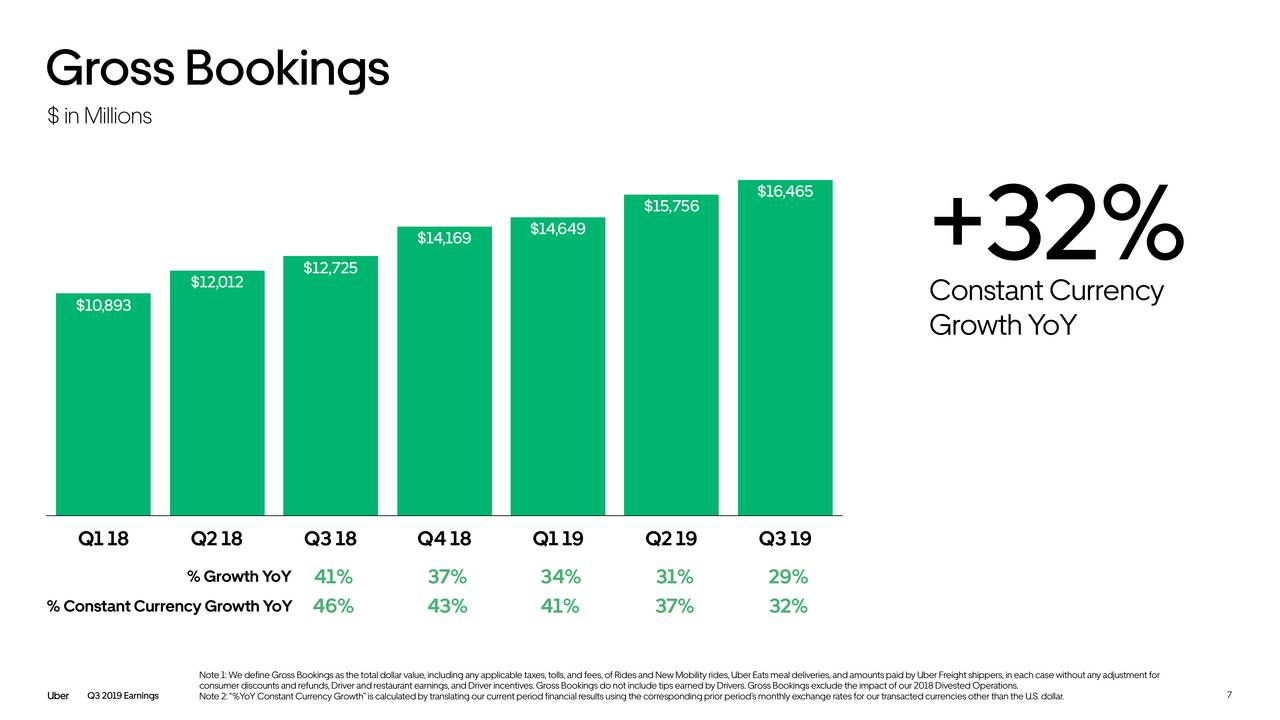

Moreover, its gross bookings jumped by $3.7 billion to $16.5 billion in Q3. This represents a jump of 29% year-over-year.

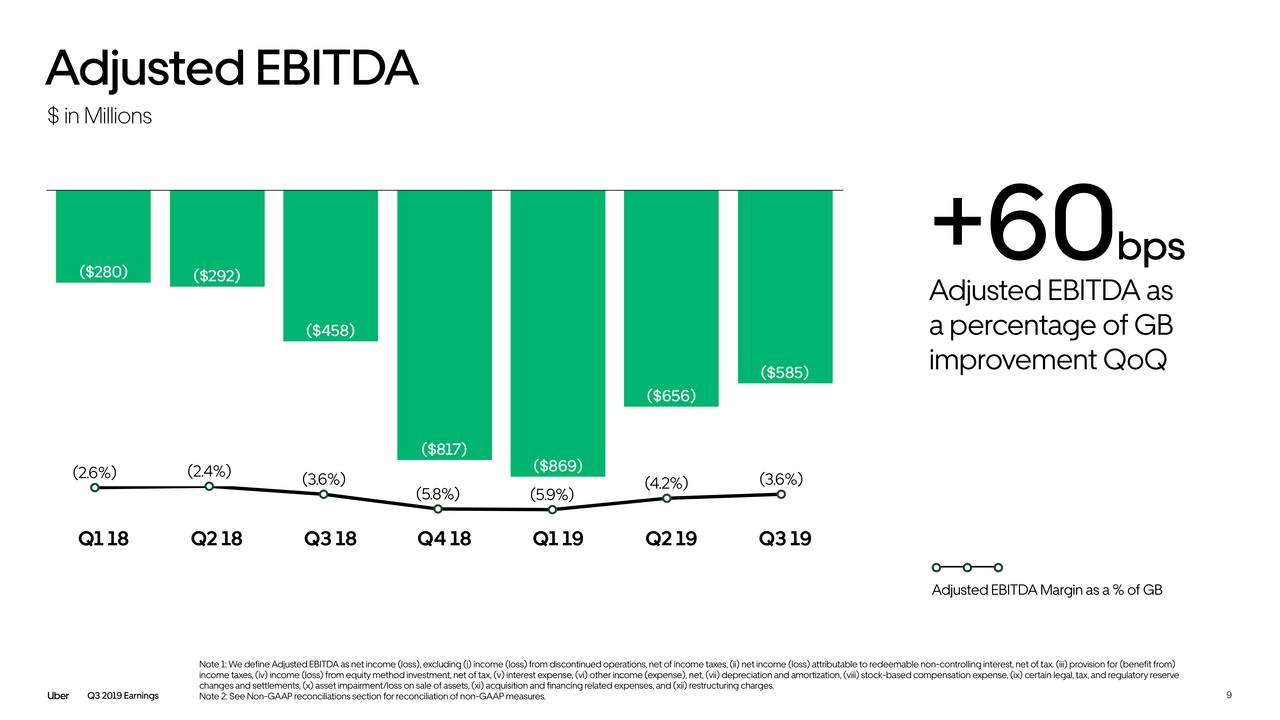

In addition, the company is steadily moving towards profitability. It has successfully narrowed third-quarter adjusted EBITDA loss by $71 million compared to the previous year period.

Dara Khosrowshahi, CEO said, “Rides Adjusted EBITDA is up 52% year-over-year and now more than covers our corporate overhead.”

The company expects a full-year adjusted EBITDA to stand around negative $2.8 billion. This is down from previous guidance for $3-3.2B loss. On the whole, financial numbers and future fundamentals are supporting Uber stock price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account