Uber (NYSE: UBER) stock price soared close to 10 per cent after beating fourth-quarter revenue and earnings estimates. The strong year over year revenue growth along with strength in the booking is adding to sentiments. The company also enhanced market pundit’s confidence by indicating the prospects of profitability in fiscal 2020.

The majority of market analysts lifted the price target for Uber stock amid stronger than expected performance in fourth-quarter combined with a robust outlook for 2020. Uber stock bounced 10 per cent to the highest level in the five months. UBER share price is currently trading around $40, down from an all-time high of $47.

Uber Stock Jumped on Solid Financial and Operational Performance

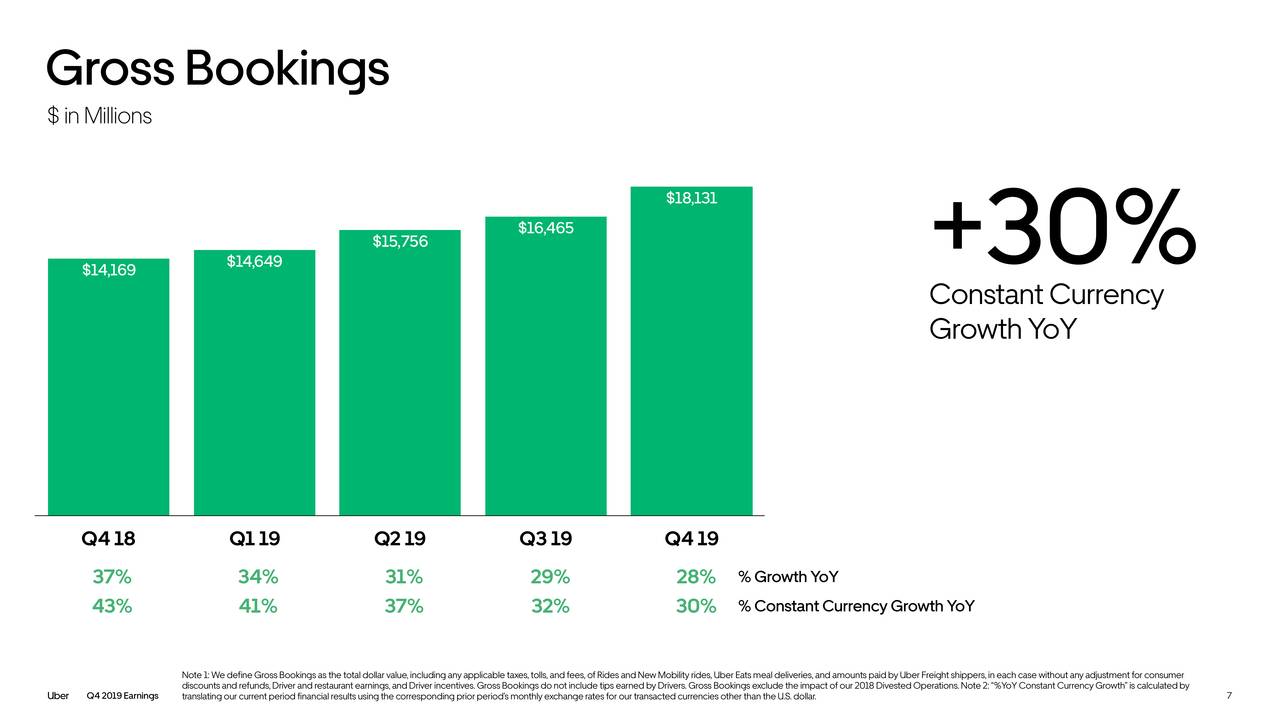

The company topped fourth-quarter revenue and earnings estimate by $10ml and $0.04 per share, respectively. Its fourth-quarter revenue of $4.7bn increased 38 per cent from the past year period. The gross bookings enlarged 28 per cent year over year to $4bn. The Rides and Eats revenue soared 20% and 73% year-over-year, respectively. Its margin grew $200ml from the year-ago period.

“We recognize that the era of growth at all costs is over. In a world where investors increasingly demand not just growth, but profitable growth, we are well-positioned to win through continuous innovation, excellent execution, and the unrivaled scale of our global platform,” said Dara Khosrowshahi, CEO.

Although the company generated negative earnings for the fourth quarter and fiscal 2019, it expects to move to profitability in the final quarter of 2020. Previously, the company anticipated being profitable in fiscal 2021.

Analysts Lifted Price Targets

RBC Capital Markets analyst Mark Mahaney increased the price target to $45, saying Uber should join the FANG stocks amid strong growth prospects. Wedbush lifted the UBER share price target to $50 with an outperform rating. MKM Partners provided a Buy rating from Neutral after strong earnings and a solid outlook. The high double-digit revenue growth is among the biggest aspects behind the analyst’s confidence in Uber stock.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account