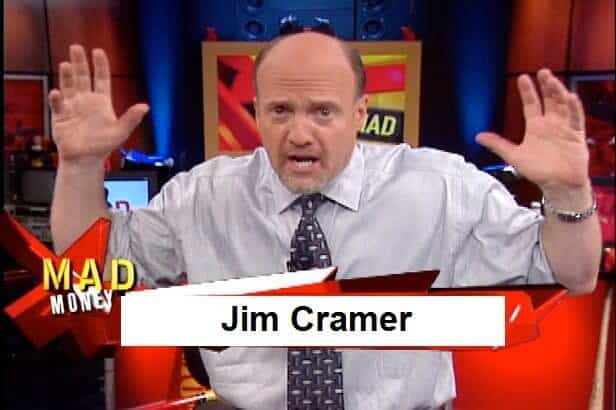

Twitter Inc has lost a lot on Wednesday, and Jim Cramer, who no longer advises people buy the firm’s shares, may be about to turn his back on the firm for good. The famed Wall Street voice says that he’s thinking about moving his investment promotion to Facebook in order to avoid the trouble that Twitter brings with it.

Cramer, host of CNBC’s Fast Money, has long been an outspoken critic of parts of Twitter, though he maintains it’s a great product. Earlier this year he asked the site’s CEO to make it easier to sue people for slander on the social network. Now, it seems, he’s thinking of leaving to avoid just that.

Twitter Inc loses users

The single biggest problem in the earnings report Twitter revealed on Tuesday July 28 was a slow down in its user numbers. The firm said it added just 2m monthly users in the three months through June, bringing its total to 304m, well below the forecasts of Wall Street.

Jim Cramer may soon be the latest voice to leave the network behind. A fan asked him what were the benefits of getting questions for his Cramer Qs segment through the social network. Every market-day morning Cramer tells users to send in question through Twitter that he will answer on the site or live on TV.

Cramer responded, “believe me, I am on the fly, reconfiguring just that. $TWTR-v. $FB.” It seems that Mr. Cramer may soon be about to leave behind one of the most important reasons for users to tune into his Twitter account.

Those entranced by his tomato growing will hope he keeps tweeting about his plants until the season ends at the very least.

Being on TV it’s unlikely that he’ll get rid of it entirely, but it does highlight the kinds of issues that people across the globe are having with Twitter.

Twitter user experience matters

Twitter’s team seems to have reconciled itself to the idea that the experience it offers to users isn’t good enough. That’s why the firm is no longer growing its user base. New users find it difficult to work the platform while older users, like Mr. Cramer, are getting worn down by a lot of the problems on the network.

For Mr. Cramer the biggest issue is constant harassment. Twitter says that it’s going to try its best to limit those problems as it improves its product. Cramer, who has been complaining about trolls on Twitter for a long long time, reckons that it’s not happening fast enough.

Cramer has given no clear sign that he is going to abandon the platform, though his tweet from this morning seems to show that he’s at leas thinking about it. With almost 900 thousand people looking for his advice on the network, his loss would be big for Twitter.

If Jim Cramer, who was once a big supported of Twitter stock as well as the firm’s product, does decide to leave the platform it isn’t likely to teach Jack Dorsey and his team anything they don’t already know. Twitter isn’t good enough for most people. If the firm wants to survive they’re going to have to make it better.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account