Triple net lease real estate investment trusts (REITS) may be the ultimate alternative for the stock investor seeking a bond-like equity vehicle.

What Are Triple Net Lease REITs?

A REIT is an investment vehicle that owns varying types of real estate. There are healthcare-, commercial-, hotel-, self-storage, and even timber-related REITs. Some REITs are diversified and own a mix of property types. A triple net lease REIT is one in which the tenant, in addition to contractual rent, is responsible for three (hence triple) additional property costs: taxes, insurance, and maintenance. REITs that write triple net leases with tenants typically own stand alone properties like drug stores, warehouses, restaurants, banks, etc….

Triple net lease REITs are similar to bonds since number one, they are income producing vehicles. Most of them yield in the neighborhood of 4-6%, although there are outliers both above and below that range. Secondly, REITs enter into typically long-term lease agreements with their tenants just like a bondholder enters into a contract with a issuer. A third common “bond” is interest rate sensitivity – net lease REITs tend to drop in value as interest rates rise and vice versa.

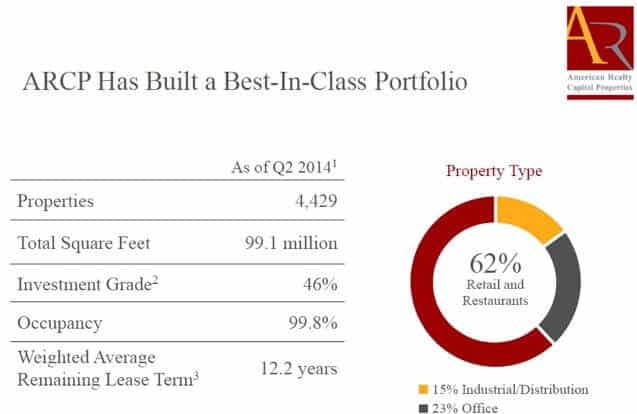

When an investor evaluates a triple net lease REIT, the average lease term of the portfolio should be considered, just like the bond investor needs to determine how far out on the yield curve they will invest. Take a look at a recent portfolio profile for American Realty Capital Properties (ticker ARCP), the nation’s largest primarily triple net lease REIT.

The company owns over 4,000 properties and maintains a 12.2 year average lease term with tenants. So theoretically if you were to buy shares in this company, you are buying contracts that are locked in for about 12 years. And the current yield on ARCP is about 7.5 percent. But the yield on a REIT and its remaining lease term should not be considered apples to apples with a bond and its duration or maturity for a number of reasons.

First, REITs like most companies in America today, are levered, which means they are borrowing money to increase their capability of growing their business. Secondly, unlike a bond coupon rate which is typically static over the life of the bond until maturity, triple net REITs are able to charge annual step-ups to tenants on an annual basis, usually in the 1-2% area. So if a tenant is paying $1,000 in rent monthly this year, they may pay $1010-$1020 next year.

Thus, for these two reasons REITs are able to grow dividends and achieve periodic dividend growth for investors, something a bond is not capable of doing.

Should You Invest In A Triple Net Lease REIT

There are a variety of triple nets available on stock exchanges; some of the larger ones include ARCP, Realty Income (O), and National Retail Properties (NNN) just to name a few. When looking at these companies, I certainly would not characterize them as bond substitutes, but more as bond alternatives. The semantic distinction is important, because there are substantive differences, with pros, cons, and analytical variances making them very different animals. So while there are similarities between ‘NNN’ REITs and bonds, a stock should never be confused with a bond.

As part of a diversified income portfolio, ‘NNN’ REITs may well make sense. But unlike many analysts who recommend abandoning bonds in favor of bond “substitutes,” I have no such inclination. Bonds are an important part of an investment portfolio, providing income and balance. And while they may not figure in prominently into today’s allocations, they should still figure in nonetheless.

About the author:

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account