(Bond Market Recap for August 2nd, 2012) Treasuries advanced for the second day after the European Central Bank said little about reigning in spiraling borrowing costs of Spain and Italy and a surprise decline in US factory orders weakened investor sentiments further.

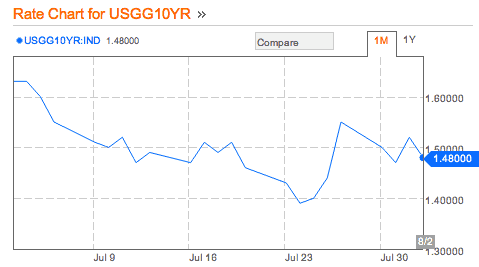

Treasuries reversed an earlier negative course after ECB President Draghi failed to announce concrete measures, despite admitting the EU region’s debt market was malfunctioning. The yield on 10-year benchmark notes slipped four basis points to 1.48 percent in late afternoon trading, New York time. 30-year treasury bond yields shed four basis points to finish at 2.56 percent after factory orders surprisingly fell 0.5 percent in June against a projected 0.6 percent gain.

10 Year Treasury Yield – 1 Month Chart

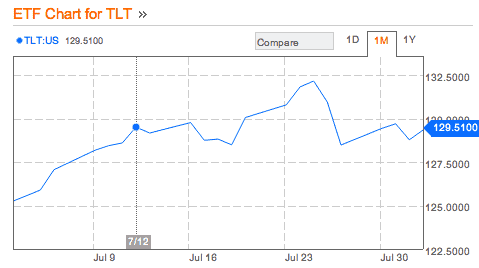

Bond Funds were also up on the day with The iShares Barclays 20 Year Treasury Bond ETF (TLT) climbed 80 cents, or 0.62 percent, to $129.58, while the Vanguard Total Bond Market ETF (BND) gained 16 cents, or 0.19 percent to $85.10.

TLT 1 Month Chart

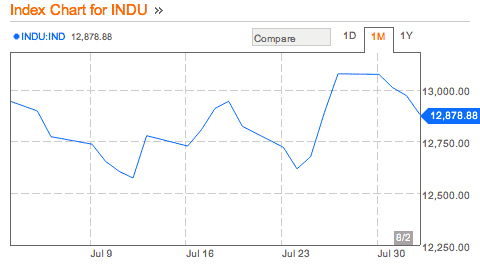

US stocks extended losses for the fourth straight session as the indexes closed lower Thursday after the European Central Bank failed to announce concrete measures to halt the advance of the ongoing debt crisis. The Dow Jones Industrial Average (DJIA) closed 92.18 points, or 0.7 percent, lower at 12,878.88, clawing back from the day’s 193 point loss with 26 of the 30 components falling in red. Aluminum maker Alcoa (AA) was among the day’s biggest percentage decliners, losing 2.97 percent on the day. Chevron (CVX), Coca Cola (KO) and IBM (IBM) were the other biggest losers.

Dow Jones Industrial Average 1 Month Chart

The S&P 500 Index (SPX) shed 10.32 points, or 0.8 percent, to finish at 1365, with energy hitting the ground hardest among its 10 business sectors. Knight Capital Group (KCG) crashed 63 percent to $2.58 a share after estimating losses at $440 million from a software trading glitch. The NASDAQ Composite Index (COMP) slipped 10.44 points, or 0.4 percent, to close at 2909.77. First Solar (FSLR) vaulted more than 21 percent the company’s Q2 profits soared 82 percent. Green Mountain Coffee Roasters (GMCR) rallied more than 26 percent after the company beat earnings forecast and announced stock buyback.

- For every stock advancing, two stocks declining on the NYSE.

- Oil prices for September delivery slipped $1.59 to close at $87.31 a barrel.

- Gold futures for August delivery fell $16.30 to $1,587.40 an ounce.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account