(Bond Market Recap for August 27th, 2012) Yields on 10-year Treasuries dropped to near two-week lows as prices surged over speculation US Fed chief Ben Bernanke will argue in favor of more bond purchases in his Aug 31 speech in Jason Hole, Wyoming. European Central Bank president Mario Draghi is due to speak at the symposium Saturday as well and investors are worried to see the central bankers lay the foundation for further accommodative policies.

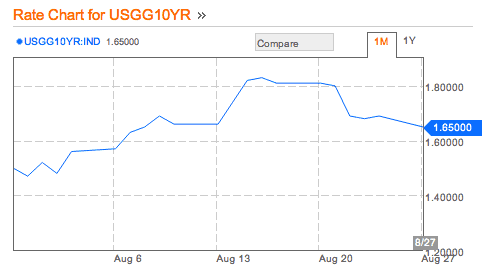

Benchmark 10-year Treasuries fell four basis points, or 0.04 percentage point, to 1.65 percent in late afternoon trading, New York trading after Chicago Fed President Charles Evans favored another round of monetary stimulus to boost the economy. Yield on 30-year treasury bonds dropped three basis points to 2.76 percent.

10 Year Treasury Yield – 1 Month Chart

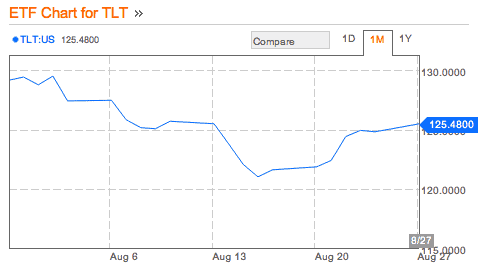

Bond funds were up on the day with the the iShares Barclays 20 Year Treasury Bond ETF (TLT) rising 73 cents, or 0.58 percent, to $125.54 while the Vanguard Total Bond Market ETF (BND) gained 13 cents, or 0.15 percent to end at $84.85.

TLT 1 Month Chart

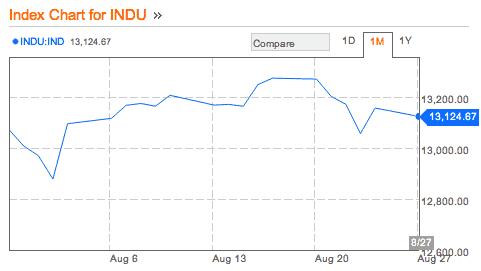

US stocks closed mixed with the blue-chip indexes ending lower as investors decided to wait for signals of further monetary easing by the Federal Reserve ahead of chairman Bernanke’s speech later this week. The Dow Jones Industrial Average (DJIA) dropped 33.3 points, or 0.3 percent, to 13,124.67, with 20 of the Dow’s 30 components closing lower as breadth turned negative. International Business Machines Corp (IBM) slipped 1.1 percent following its announcement to buy human-resources software maker Kenexa Corp (KNXA). United Technologies (UTX), Cisco (CSCO) and McDonald’s (MCD) were among the stocks that ended the day higher.

Dow Jones Industrial Average 1 Month Chart

The S&P 500 Index (SPX) lost 0.69 points to close at 1410.44 with tech and utilizes outperforming and natural resources and telecom lagging among its 10 business groups.

Bucking the trend, the tech-heavy NASDAQ Composite (COMP) added 3.4 points, or 0.1 percent to close at 3073.19 after Apple Inc (AAPL) rose nearly 2 percent to hit a fresh all-time high following its win over Samsung in a patent lawsuit. Hudson City Bancorp Inc (HCBK) jumped 15.68 percent after M&T Bank Corp (MTB) said it would purchase the company for about $3.7 billion. Hertz Global Holdings Inc (HTZ) jumped more than eight percent after the car rental company announced buying out its rival Dollar Thrifty Automotive Group (DTG) for about $2.6 billion in cash.

- Decliners managed to stay ahead of advancers on the NYSE.

- Oil prices for October delivery dropped 48 cents to $95.67 a barrel.

- Gold futures for December delivery rose $2.70 to $1,675.60 an ounce.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account