The escalation of trade war tensions between China and the United States negatively impacted JD.com (NASDAQ: JD) stock price upside momentum.

The United States plans to impose new restrictions on China. This time they are seeking to hurt Chinese access to international financial and capital markets.

JD.com stock price dropped from 52-weeks high of $30 to $27 following the news. The market pundits are expecting further stock price selloff in the coming days. This is because the new plan from White House includes de-listing of Chinese stocks from U.S. stock markets.

The actual plan behind these actions is limiting the U.S. investors’ portfolio flows into China.

The U.S. stock market responded negatively to these reports. Indeed, Chinese tech stocks have lost high mid-single-digit value following the news.

“If the White House was to go through with the plan to restrict U.S. – China capital flows, “it would be an unmitigated disaster,” said Stephen Roach, former chairman of Morgan Stanley Asia.

“Open access to each other’s markets is really important, especially with China likely to be the biggest consumer market in the world in the first half of this century,” Roach said.

Some market analysts are seeing this move as a pressure tactic to get a win-win deal on the negotiation table.

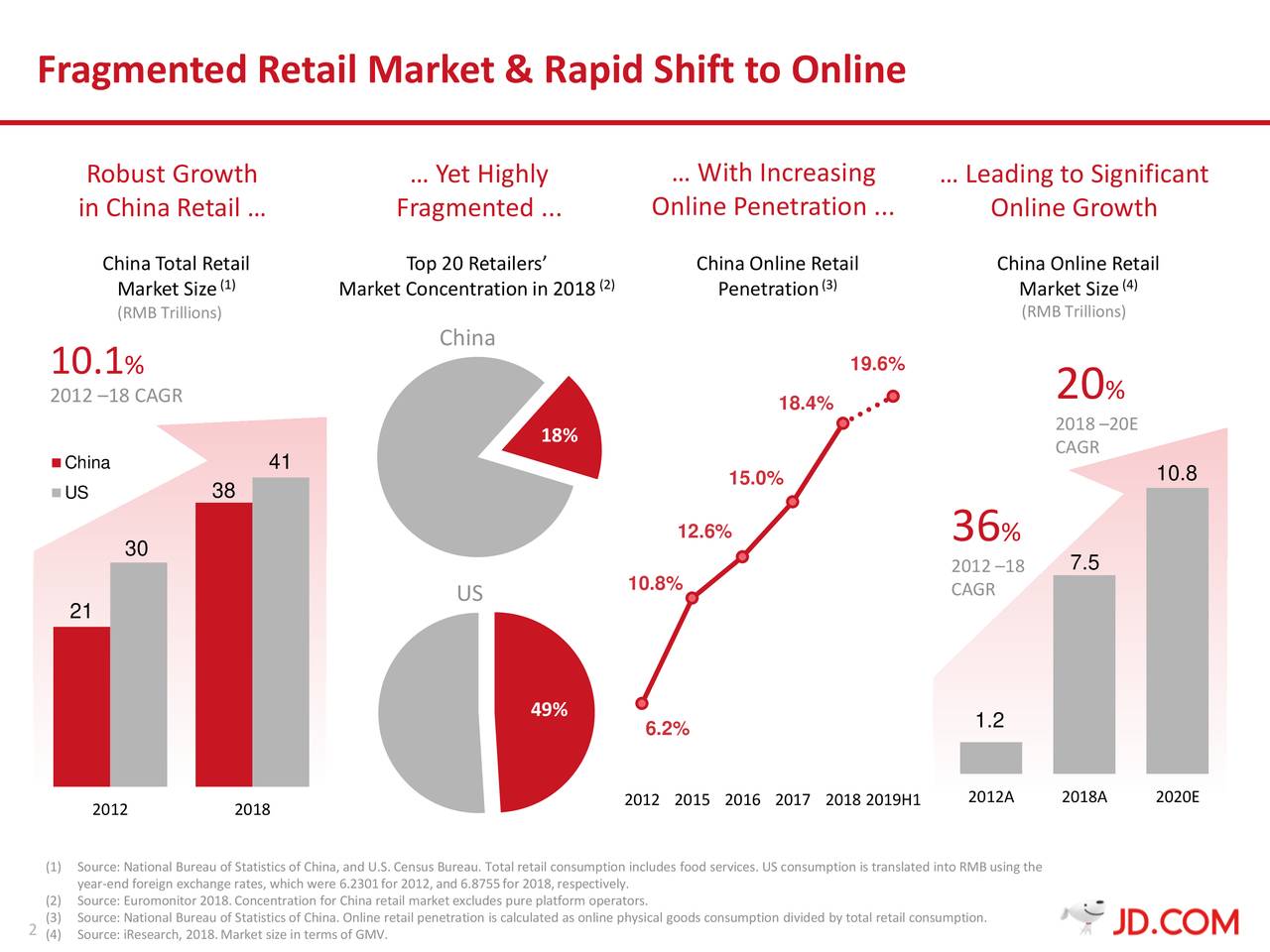

JD.com is among the fastest-growing Chinese tech companies. It has generated a 23% Y/Y revenue growth in the second quarter. The company’s earnings per share of $0.33 in Q2 topped the consensus estimate for $0.25 per share.

The company is expecting to generate Q3 revenue growth in the range of 20-24% from the previous year period. The company appears in a strong cash position to support its aggressive growth plans

JD.com stock price rallied close to 35% this year. The stock price upside momentum now depends on trade relations between the two largest economies. Therefore, keeping a close eye on trade war negotiations could help in making wise investment decisions.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account