Johnson & Johnson (NYSE: JNJ) stock price has been experiencing a bearish trend over the past few months. The stock price declined from 52-weeks high $148 at the beginning of the year to $129 a share at present.

The concerns over sluggish revenue growth impacted investor’s sentiments.

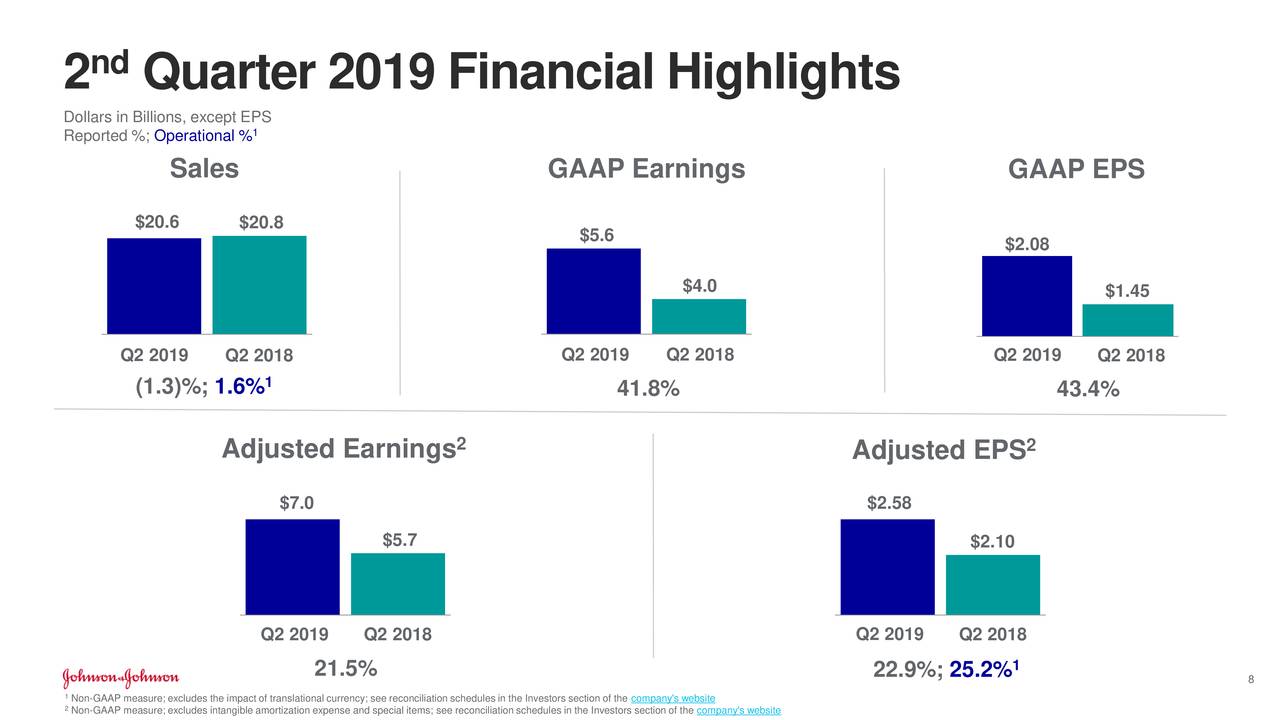

The company has generated negative revenue growth of 1% in the latest quarter. Although its consumer and pharmaceutical revenue increased slightly, its medical devices segment declined 7% year over.

On the flipside, JNJ has generated robust earnings growth. This is due to its focus on investments in high margin products along with cost savings. The focus on share buybacks has also been enhancing earnings potential.

Its earnings per share increased 22% year over year in Q2 despite negative revenue growth. Its cash flow generation also remains strong enough to support dividends.

JNJ has generated $6 billion in operating cash flows during the second quarter. It’s capital investments were standing around $2.7 billion. Thus, the company was left with $3.3 billion in free cash flows. The dividend payments were standing around $2.5 billion. The gap in free cash flows and dividend payments offer a room for share buybacks.

Johnson & Johnson has increased the annual dividend in the last 57 successive years. It currently offers a quarterly dividend of $0.95 per share. Its dividend growth is safe considering the huge gap in free cash flows and dividend payments.

Alex Gorsky, Chairman, and Chief Executive Officer, “Our pipelines continue to progress with the launch of new products and several regulatory submissions and approvals, which positions us well to deliver the next wave of transformational products and solutions.”

The company expects to generate sales growth of 3.2% for the full year. It expects earnings growth in the range of 4.3% to 5.5% for full year. Johnson & Johnson’s stock price is likely to bounce back in the coming days. The dip in share price is presenting a buying opportunity for dividend investors.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account