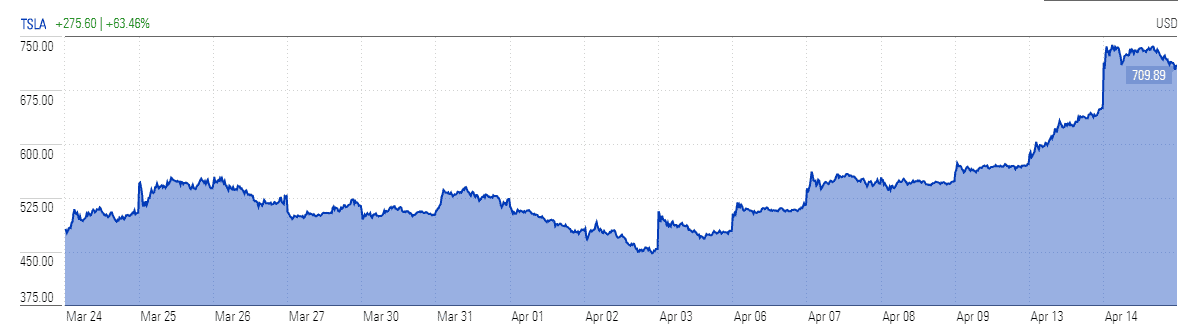

Tesla (NYSE: TSLA) stock price has so far recovered more than half of the losses it suffered during the coronavirus selloff as some pundits believe Tesla is well-placed to recover at a faster pace than legacy automakers because the coronavirus spread will slow their move towards electric vehicles.

Investors’ confidence in Tesla’s production capacity is adding to share price gains. Tesla’s China car registrations jumped by 450% in March compared to the previous month.

The company has resumed its Shanghai factory operations with plans of selling two more versions of its Model 3 vehicle in China. The electric vehicle maker plans to begin delivering Long Range Model 3 in June priced at 339,050 yuan while it also seeks to deliver a Performance Model 3 next year.

The automaker still anticipates delivering more than 500,000 units this year, while its California factory remains closed. However, analysts expect Tesla to see softer demand in the coming months and supply shortages due to shutdowns.

Investor’s optimism is also backed by stronger-than-expected deliveries for the first quarter. It delivered almost 88,400 vehicles in the first quarter, up significantly from the consensus estimate for 79,900 deliveries

Tesla stock price has risen 60% after seven days of consecutive gains, the best seven-day stretch since 2013. The shares are still trading well below the all-time high of $970 that it hit in February. Meanwhile, Goldman Sachs has provided a price target of $864 with a buy rating.

“We are positive on Tesla because we believe that the company has a significant product lead in EVs [ electric vehicles], which is a market where we expect long-term secular growth,” Goldman Sachs analyst Mark Delaney said. The analyst claims that Tesla looks strong compared to peers based on valuations and revenue growth potential. The product leadership and early mover advantage will add to the Tesla stock price rally in Mark Delaney’s view.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account