Tesla (NASDAQ: TSLA) stock price is on the verge of reversing losses that it had made early this year. The stock price already rallied more than 45% from a 52-weeks low of $180 a share. The share price upside momentum is supported by significant expansion in profits and cash flows.

In addition, the growth prospects, particularly in China and Europe, are adding to investor’s sentiments.

The company has successfully enhanced investor’s confidence through its operational efficiencies. The shares are currently trading around $337, down slightly from an all-time high of $380. The market analysts believe the Tesla stock price rally is sustainable amid new revenue growth opportunities along with increasing profitability.

Increasing Profitability and Cash Flows Are Supporting Tesla Stock Price Rally

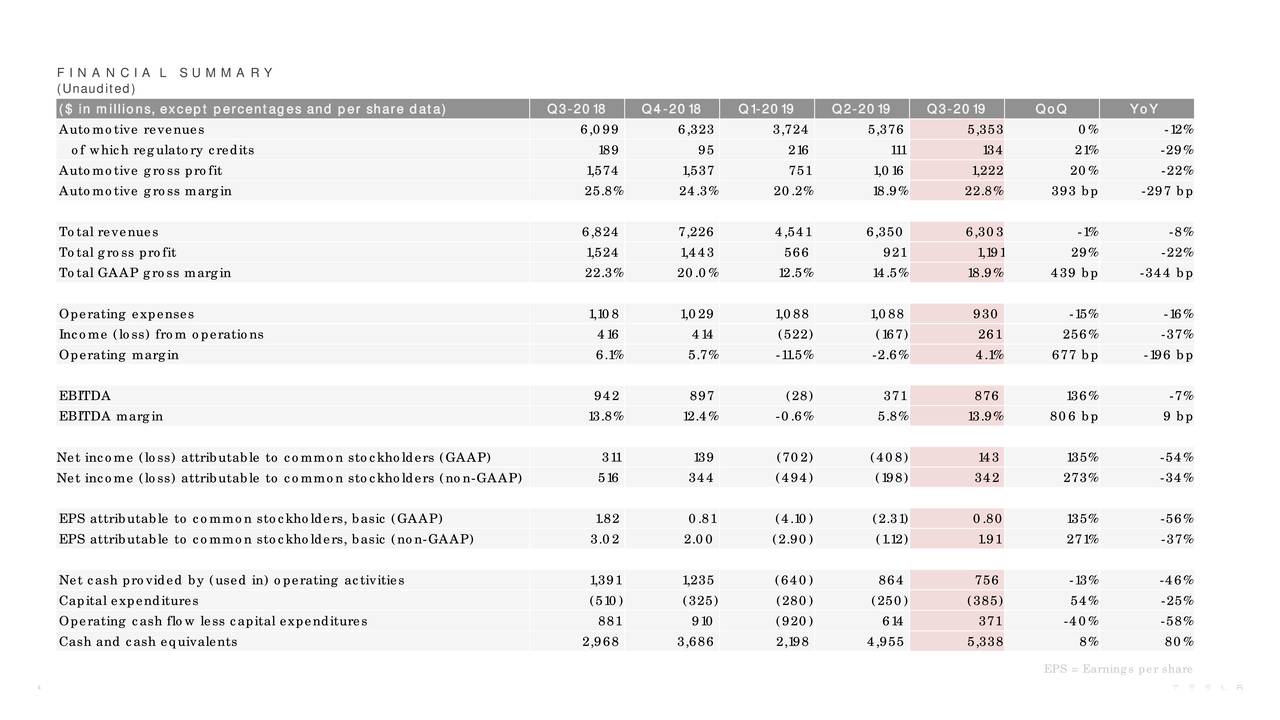

The company has reported a surprise profit in the third quarter. Its earnings per share of $1.91 increased by $2.17 per share from the consensus estimate.

The company claims that improved profitability is because of greater efficiency. Lower fixed costs along with savings in material and manufacturing costs are adding to earnings growth.

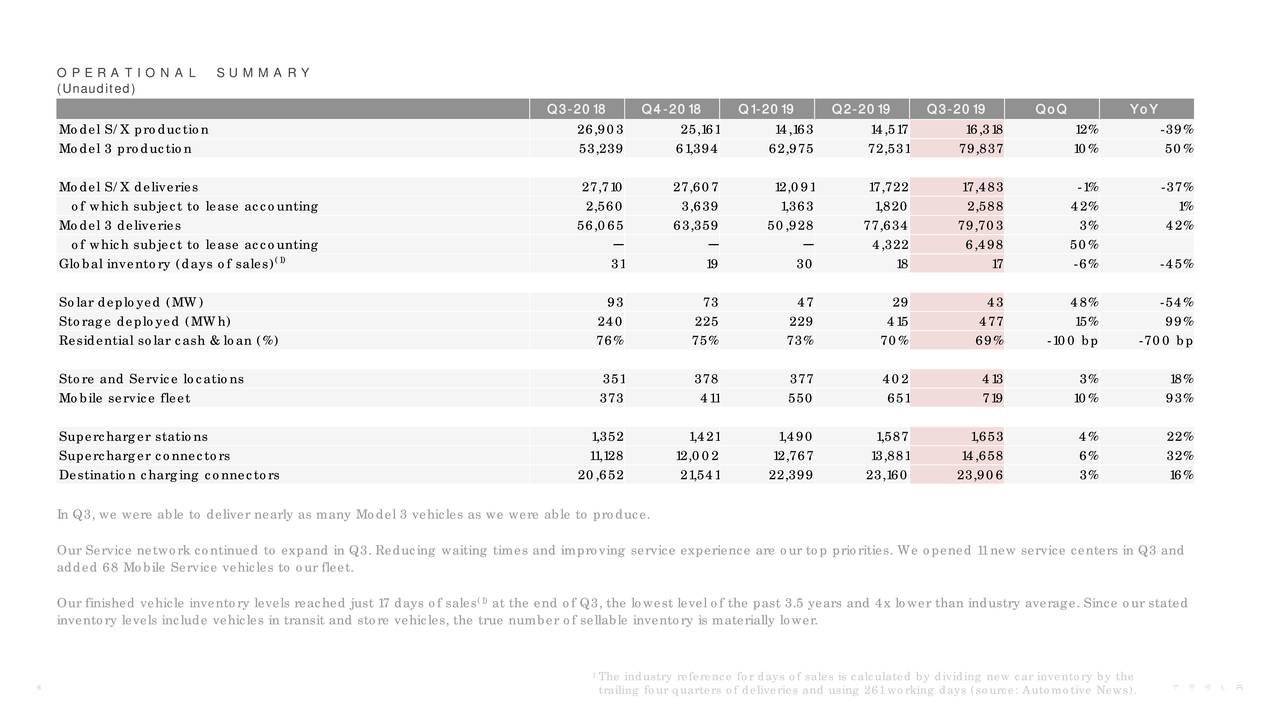

Moreover, the company has also generated growth in production. The EV automaker had delivered 17,483 Model S/X vehicles and 79,703 Model 3 units in the third quarter.

On top, Tesla has reported positive free cash flows in the third quarter; its cash position also strengthened significantly from previous periods. It generated $371 million in free cash flows while the cash position stood at $5 billion.

Expansion in China and Europe Is Strengthening Sentiments

The company has been aggressively seeking to expand its footprints in China and Europe. Its China Gigafactory already started initial production in the third quarter.

Tesla seeks to increase service centers to 63 from 29. Furthermore, the EV Company is boosting fast-charging stations by 39% to 362 and converts some of its showrooms into “Tesla Centers.”

On the other hand, Tesla plans to capitalize on increasing demand for EV’s in Europe. Overall, Tesla stock price is likely to receive support from its aggressive business expansion plans.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account