Tesla (NASDAQ: TSLA) stock price lost 31% of value since the start of this year amid concerns related to trade tensions and rising competition in the EV industry. The stock is currently trading slightly higher from $200 level. China has been imposing tariffs on automakers in response to big tariffs from the U.S. on Chinese products.

The trade war tensions and rising tariffs are likely to impact sales and margins. Tesla, on the other hand, plans to significantly increase its market share in Chinese markets. They are working on building a Gigafactory in Shanghai – which they plan to launch next year.

Market analysts expect a massive drop in Chinese auto sales. UBS anticipates negative 8% car sales growth this year in China.

“China auto sales year-to-date has been much weaker than we anticipated at the beginning of the year,” UBS analyst Gong wrote. “Continuous trade conflict and lukewarm economic growth, coupled with the absence of strong stimulus policy, probably explain this prolonged down-cycle,” Gong added.

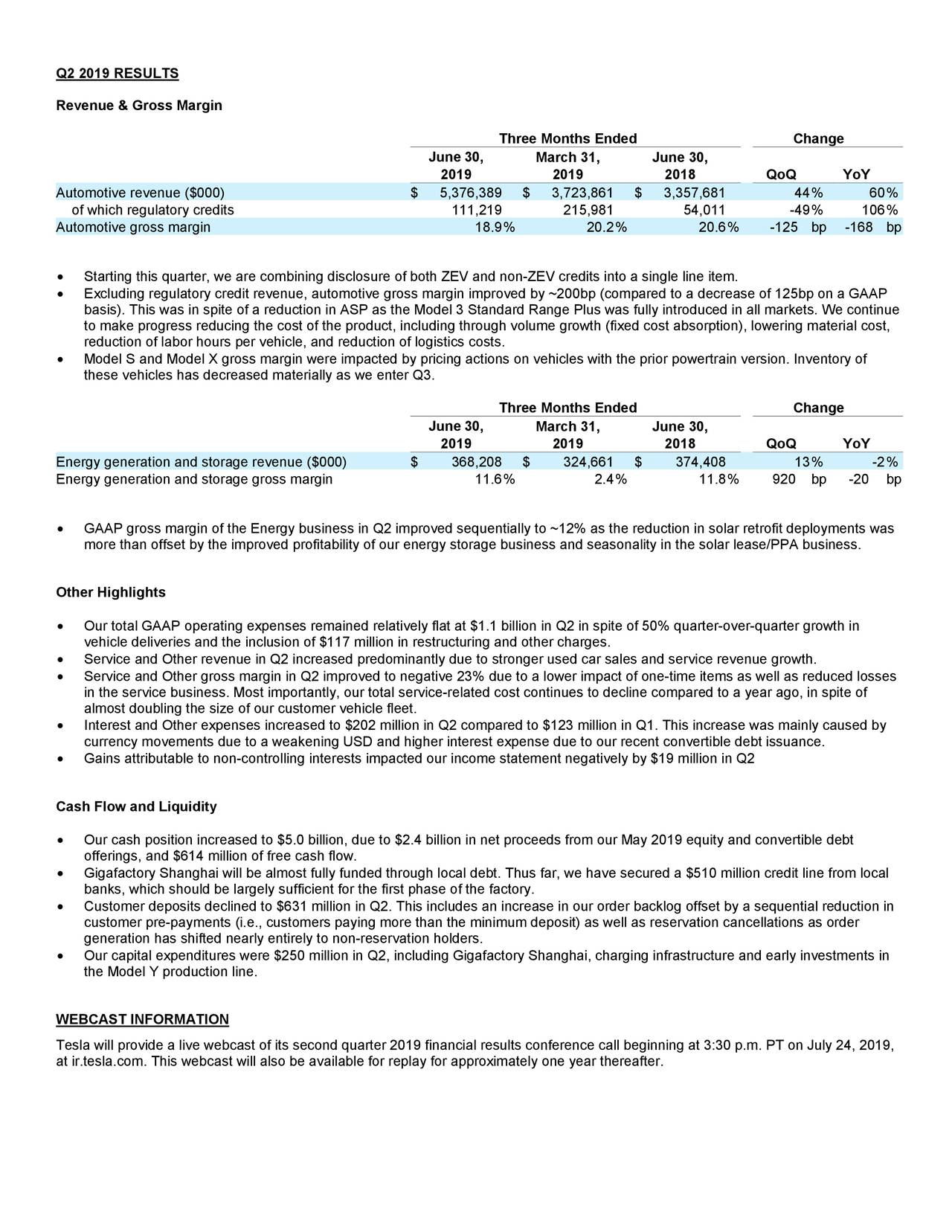

Tesla has missed its earnings expectations for the latest quarter due to higher costs related to China. The company announced to increase vehicle prices in China. Higher prices could create a negative impact on sales. It generated negative earnings per share of $1.12 in the second quarter, missing analysts estimate for negative $0.71 per share.

Morgan Stanley has dropped its full-year gross profit margin estimate from 19.6% to 17.4%. The drop is due to rising costs and higher operational expenses. Tesla has always tried to keep gross margin around 25%

Besides from trade war worries, Tesla has also been experiencing rising competition in the EV industry. Several well-established brands such as General Motors and others are aggressively working on offering various types of EV cars. The performance of Tesla stock price depends on several factors such as tariffs, growth in sales and margins. Investors need to look at these factors before creating any position in this company.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account