Tesla (NASDAQ: TSLA) stock price obtained much-needed support from its third-quarter results. This is because of its unexpected move towards profitability and strong deliveries in Q3. TSLA shares tumbled significantly this year amid traders’ concerns over profitability and trade war tension.

TSLA shares had hit $170 level at the end of the first half of this year. Tesla stock price is currently trading around $250, down significantly from an all-time high of $380 that it had hit at the beginning of this year.

Q3 Surprise Profit Supports Tesla Stock Price

The company has topped earnings estimates by a wide margin of $2.17 per share. The company’s strategy of cost reductions helped it in beating estimates.

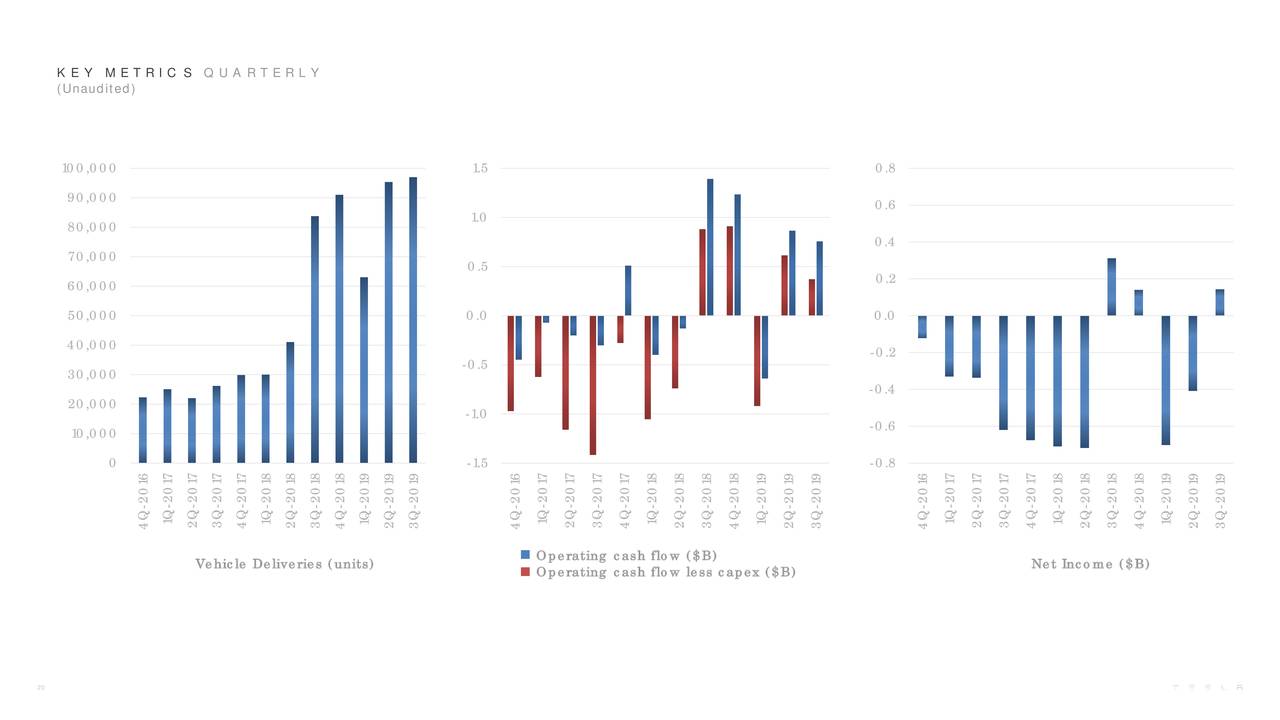

Its adjusted EBITDA stood around $876 million in the third quarter, higher considerable from the consensus estimate for $646M. The EBITDA margin grew to 13.9% in Q3, up from 5.8% in the previous quarter.

Higher deliveries have also added to the trader’s confidence. The electric vehicle company has delivered 17,483 Model S/X vehicles in Q3 and 79,703 Model 3 units. Its total vehicle production came in at record level of 96k and deliveries of 97k.

Moreover, the TSLA has started production on a trial basis from its new $2B factory in Shanghai. The company says “We are already producing full vehicles on a trial basis, from the body, to paint and to the general assembly, at Gigafactory Shanghai.”

Solid Outlook Adds to TSLA Shares

The electric vehicle company is planning to extend momentum in the following quarters. It anticipates delivering almost 360K vehicles this year.

Its strong cash position supports growth strategies. It generated $371 million in free cash flows during the third quarter. The company says it is on the path to generate positive quarterly free cash flow in the final quarter this year. Tesla plans to launch Model Y by summer 2020; the company seeks to release Tesla Semi trucks next year. Overall, the trader’s sentiments are improving for Tesla stock price following Q3 results.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account