Tesla (NASDAQ: TSLA) stock price surged significantly after beating analysts’ revenue and earnings estimates. In addition, TSLA shares received support from the launch of the Shanghai factory ahead of schedule.

Trader’s sentiments are also optimized by the launch of Model Y next year. Tesla stock price hit the highest level in the last ten months. TSLA shares gained almost 27% of value in one day alone after the earnings announcement.

The market analysts believe TSLA has the potential to stun market players amid its operational efficiencies and capital allocation strategy.

Q3 Sparked Tesla Stock Price Rally

The company has stunned investors by reporting a surprise profit in the third quarter. Its earnings per share of $1.91 topped analysts’ consensus estimates by $2.14 per share. The strong earnings growth is driven by a boost in the EBITDA margin. Its EBITDA margin jumped to 13.9% compared to 5.8% in Q2.

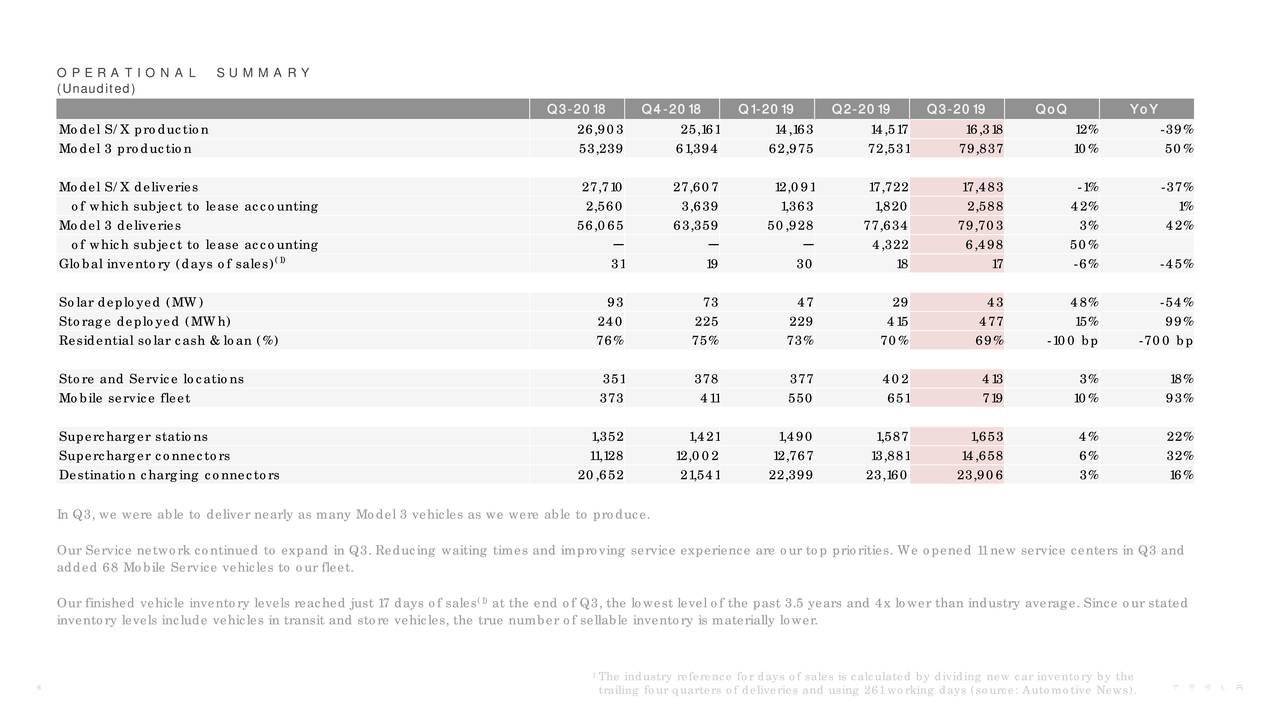

The electric vehicle company has delivered 17,483 Model S/X vehicles in Q3 and 79,703 Model 3 units.

The company claims that higher profitability is the result of greater efficiency. This includes reductions in certain material, higher fixed cost absorption and lower manufacturing costs.

The company has started production from its Shanghai Gigafactory 3. The company says, “We are already producing full vehicles on a trial basis. The production includes the body, paint and the general assembly.”

Analysts are Seeing Extension of TSLA shares Upside Trend

Canaccord Genuity has increased its price target to $375 from the previous target of $350. Evercore ISI says, “While we remain concerned on 2020 momentum/profitability, we acknowledge this was an outstanding quarter relative to lowered expectations. The company has repelled headwinds which we expect could increase as Model Y launches.”

Some analysts, on the other hand, are seeing the significant pop up in Tesla stock price as a selling opportunity for the value investors. They doesn’t consider the latest results as a breakout moment for the company.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account