Tesla (NYSE: TSLA) stock price continues to rise following a selloff due to the impact of coronavirus. Market analysts have been raising their target prices and are seeing further upside potential despite a massive share price gains in the past six months. Analysts and investors are also showing confidence in its strategy of raising capital by selling $2bn of stock.

Wedbush Securities analyst Dan Ives says the capital raise will put the company in a much stronger position to expand its production from the Shanghai factory. TSLA share price bounced 85 per cent in just 2020 alone and has tripled in value since Q3 results were reported in October. Tesla’s stock price is up 250 per cent in the past six months.

Morgan Stanley Expects Tesla Stock to Hit $1,200

Morgan Stanley lifted the base case price target from $360 to $500; the firm raised the bull case price target from $650 to $1,200. “We believe investors should expect a very challenging 1Q, with our bull case moving to expansionary mode on battery capacity. The price targets are based on aggressive unit volume outcomes that may push the limits of both demand and capacity to supply,” advises analyst Adam Jonas.

On the other hand, the Baird analyst team says investors are significantly optimistic about Tesla’s ability to generate sustainable growth in profits. Baird team claims that Tesla’s Model 3 demand is healthy and the company’s production pipelines are strong. Wedbush sets a price target of $1,000 amid its production potential.

Move to Profitability is Enhancing Sentiments

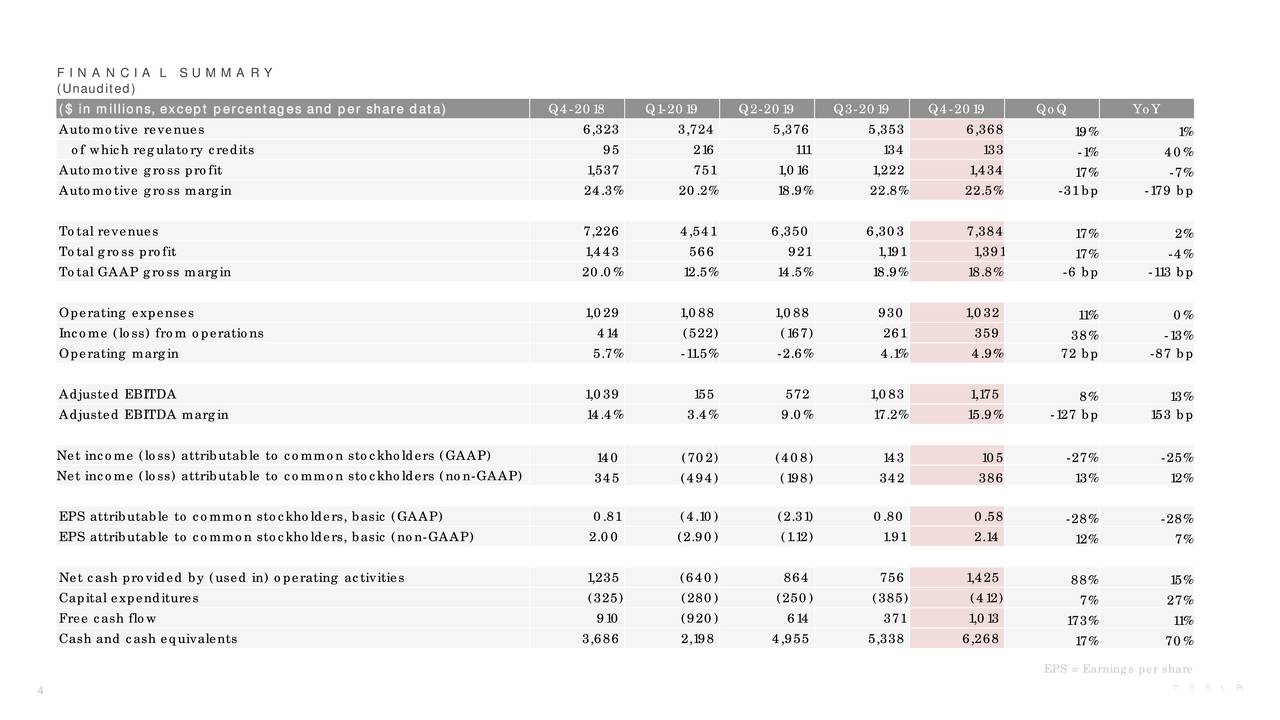

The company had generated profits in the past two consecutive quarters. The worlds’ largest EV maker expects to remain profitable in fiscal 2020. Its earnings per share of $2.06 topped the consensus estimate by $0.38 per share in the latest quarter. The company says its strategy of enhancing operational efficiencies along with investing in high margin products is driving profitable growth.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account