Tesla Motors Inc grabbed our attention a few times this week. The electric car giant — soon to be energy giant, by the looks of things — was in no way lacking in news coverage over the last few days. Wall Street is unanimously upset with the company’s pending SolarCity buyout. The the public may have got an interesting glimpse at the Model 3’s interior. Tesla also seems to be moving forward on expanding itself in China.

Next stop for Tesla: China

We start off in China, where Tesla Motors is said to be moving forward on its plans to build a production plant. Talks of the EV company expanding itself in the East Asian country have been circulating for years. It is not difficult to hazard a guess at why Tesla wants to there. In China, the electric car market is quickly ripening and a lot more so in recent months. The Republic imposes heavy taxes on the cars that Tesla exports there, too. Setting up in China gets would rid the EV firm of a few financial concerns regarding exports to region.

Tesla is reported to have just made a deal with China’s Jinqiao Group. The Chinese state-owned entity is to help the EV company build a production plant in Shanghai. Sources say the collaboration could cost a total $9 billion, with each side giving about half that figure.

Six months ago, CEO Elon Musk said the firm was in search of an ideal location to set up its China factory. The plant would not only allow Tesla to enhance itself in the region but its operation would come with a few cost-saving benefits too. Currently, Tesla Motors pays a hefty 25 percent import tax for every car it ships to china. This, in turn, translates into the upped price of its EVs for Chinese consumers.

No official note has been made about the deal as of yet. However, it is only a matter of time before we learn how much truth these reports hold. Although, it is becoming more clear that the U.S. auto firm has to heighten its presence in Asia or risk being drowned out by the growing number of EV makers in the region.

Tesla needs to expand in Asia

The new electric car concepts are far from boring. Some may be hugely impractical (FFZero1), but they certainly aren’t unappealing. It is understandable that most would picture something along the lines of a Toyota Prius or Nissan Leaf when any EV other than a Tesla is brought up. The luxury EV market seems to hold one name. However, anyone who entertains the idea that no upcoming electric car could rival Tesla’s Model S, Model X and soon-to-arrive Model 3 would be sorely mistaken.

EV start-ups and auto industry legends alike have quickly caught on to the inevitable future of the auto industry. From the likes of Porsche and BMW down to newcomers like LeEco and Faraday Future, there is no shortage of budding competitors in the EV scene today. True, Tesla is holding itself down well in Western demographics. It even has some growing demand among China’s wealth class. But underestimating the influence of Asia and its trends on the rest of the world would be a grave mistake indeed.

Recharging stations for electric vehicles are already common place in most Asian capitals. Sources say the establishment of a network that could resemble Tesla’s Superchargers is already in the works for China. It is being backed by a number of key industry players.

Tesla’s multi-billion dollar lead in the luxury EV segment is hard to ignore. There is, however, still plenty room for others to gain a foothold much like its own. In terms of demand, with population counts that rank in the billions and a growing fascination with alternative energy, Asia is well-poised to be the world’s biggest consumer EVs.

Model 3 interor images leaked

Towards the end of this week, the EV world was given what seems to be a peek at the Model 3’s interior. Pictures were allegedly leaked on Reddit and depict the upcoming car’s astonishingly minimalist inside. From what we’ve seen, the inside of Tesla’s Model 3 certainly has a futuristic charm to it. Not everyone is on the same page though. For some, minimalist is synonymous with boring.

A look of the car’s dashboard, for instance, or lack there of, shows just the steering wheel. It is joined only by a large tablet-sized monitor that sits between the driver’s and front passenger seat. The EV world is left to assume that most of the essential controls and gauges will be on this display.

The Model 3 is a highly awaited car that has gathered a near 400,000 worldwide orders. Currently, Tesla is pulling going taking huge measures just to accommodate the vehicle. The company aims to push out around 200,000 Model 3’s next year. The following year will hopefully see the it producing half a million cars, according to its CEO. That goal alone has most of Wall Street shaking their heads. It would require the company to up its production ten times its current rate.

Haters won’t kill Model 3 success

Regardless of its doubters, the upcoming Model 3 promises to be Tesla’s most afforable vehicle yet. It will go for around $35,000 at its most standard. Despite the many analysts poking furiously at the concept, next year’s Tesla is already off to a huge start. Further yet, the couple hundred thousand pre-orders it has pulled in so far come a year before it is due to be built.

Fans of the EV company insist that the Model 3 appeals mostly as the car that will let consumers drive a Tesla at a discount. For most enthusiasts, whether the interior is full of gadgets or just a single console, the EV world would still recognize car as a Tesla. It will be of the same brand that builds the mind-boggling Model X and luxury Model S sedan. That, according to some, coupled with its very low price tag, positions the Model 3 as the car that will expand the EV brand’s global recognition tenfold.

Musk buys Musk

However, this week’s biggest Tesla story is the pending purchase of SolarCity. Experts and company fans appear mostly against the buyout though. While some site the venture as a self-indulgent spent, others point out that Tesla Motors is in no position to spend $2.86 billion on an already struggling company.

Musk assures that the two energy firms could work better as one. He pointed out that Tesla’s own energy ventures aren’t whole. SolarCity would not only fill that void but draw increased profits as well.

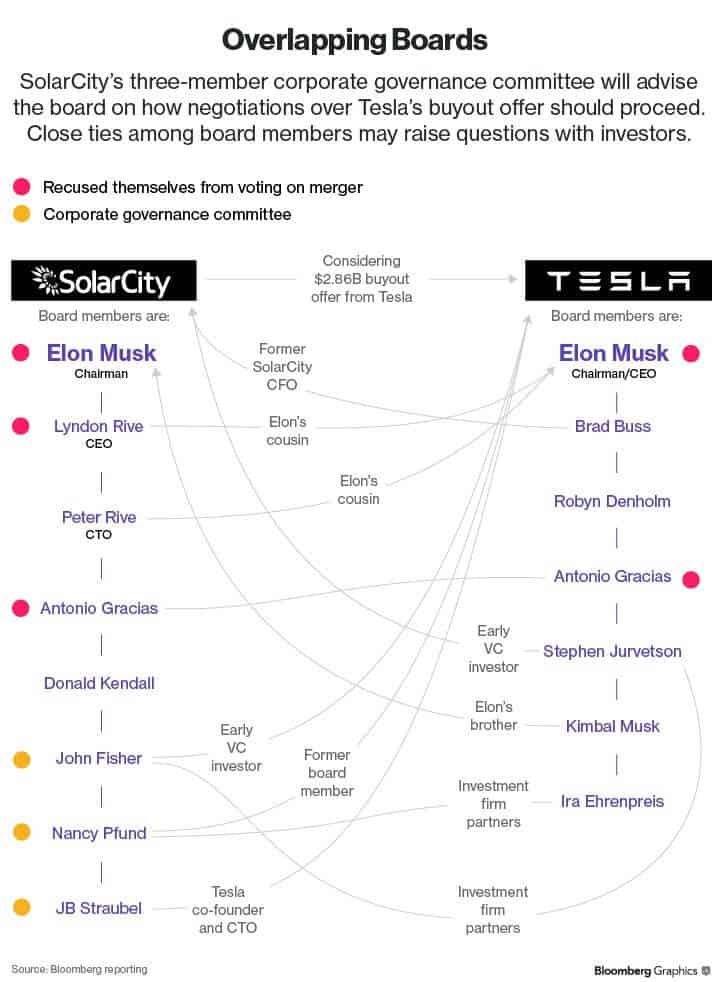

Although the two firms work in different parts of the energy industry, Elon Musk and few others at Tesla sit at the top of both companies. Musk is chief whip at Tesla and chairman at SolarCity. The tech-energy billionaire is also the co-founder of both. Bearing this, it didn’t take long after the announcement for analysts to turn to the many interrelations that the two firms hold. Musk and others at Tesla sit on the board of both corporations. There are a number of blood relations at the top as well.

Musk and Rive in tricky situation

Clearly, it would be very difficult for a merger to be made without any kind of bias from both sides. The fact that Rive power company’s CEO is Musk’s cousin does very little to lower the raised eyebrows of Wall Street. However, Musk and his counterpart at SolarCity, Lyndon Rive, have chosen to stay out of the negotiations. News outlet Bloomberg has carefully taken the time to draw out the many ties between the boards.

“Any special committee they put together is going to have issues with ties to the other side,” says Patrick Jobin, analyst at Credit Suisse Group AG.

The day after the merger offer was made public, Tesla stock fell 10 percent. SolarCity, which is already reported to be in deep water, is now trading below its offer price. Assuming SolarCity approves the deal, both firms will have a lot of concerns to sort out.

“Corporate governance concerns and SolarCity’s well documented financial position, will be at the forefront when investors.” — Angela Zino, S&P Global Market Intelligence.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account