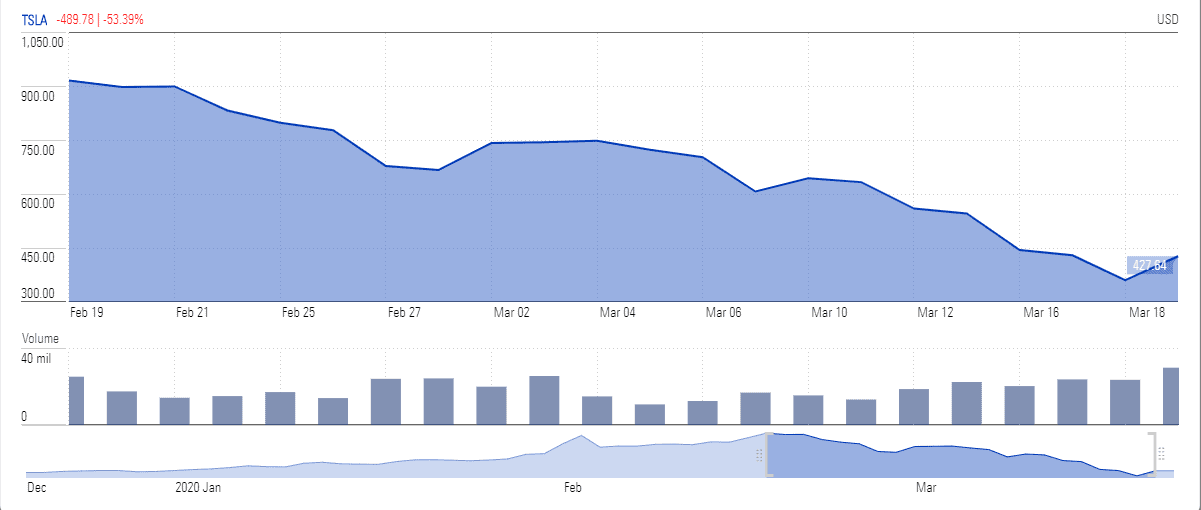

Tesla (NYSE: TSLA) stock price has lost close to half of its value so far during the coronavirus market selloff as its outlook is directly impacted by lockdowns and slowing economic growth across the world.

The electric car manufacturer decided to suspended production at its factory in New York and California on Monday, March 23. The country’s Big Three carmakers Ford (NYSE: F), General Motors (NYSE: GM) and Fiat Chrysler Automobiles (NYSE: FCAU announced production shutdowns earlier in the week.

Tesla, led by chief executive Elon Musk (pictured), claims that it is in a strong cash position to face the production stoppages brought on by the health emergency. It said had $6.3bn of cash at the end of the fourth quarter of 2019; the company has also raised $2.3bn of capital by selling common stock and bonds last month. However, the carmaker’s stock has fallen from dropping from nearly $970 per share in February to around $470 per share currently.

“We believe this level of liquidity is sufficient to successfully navigate an extended period of uncertainty. At the end of [the fourth quarter] Q4 2019, we had available credit lines worth approximately $3bn including working capital lines for all regions as well as financing for the expansion of our Shanghai factory,” said the company.

However, market analysts show concerns over the performance of the firm’s stock in the coming months, expecting production halts to delay the delivery of its new Model 3, estimated to be in the second quarter of this year in many markets. While the production suspension could create a short-term impact on outlook, the prospects for Tesla to deliver over 500,000 vehicles this year look gloomy in the view of several analysts.

“In the US and Europe with consumers in a virtual lockdown facing a once in a century-like outbreak focusing on their health, food, and flattening the curve, buying a new Model 3 and other auto purchases is very low on the priority list,” Wedbush Securities analyst Dan Ives said.

The majority of automaker has posted significant losses across the world amid production suspensions. Slow economic growth could impact long-term demand even if production resumes in the coming months.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account