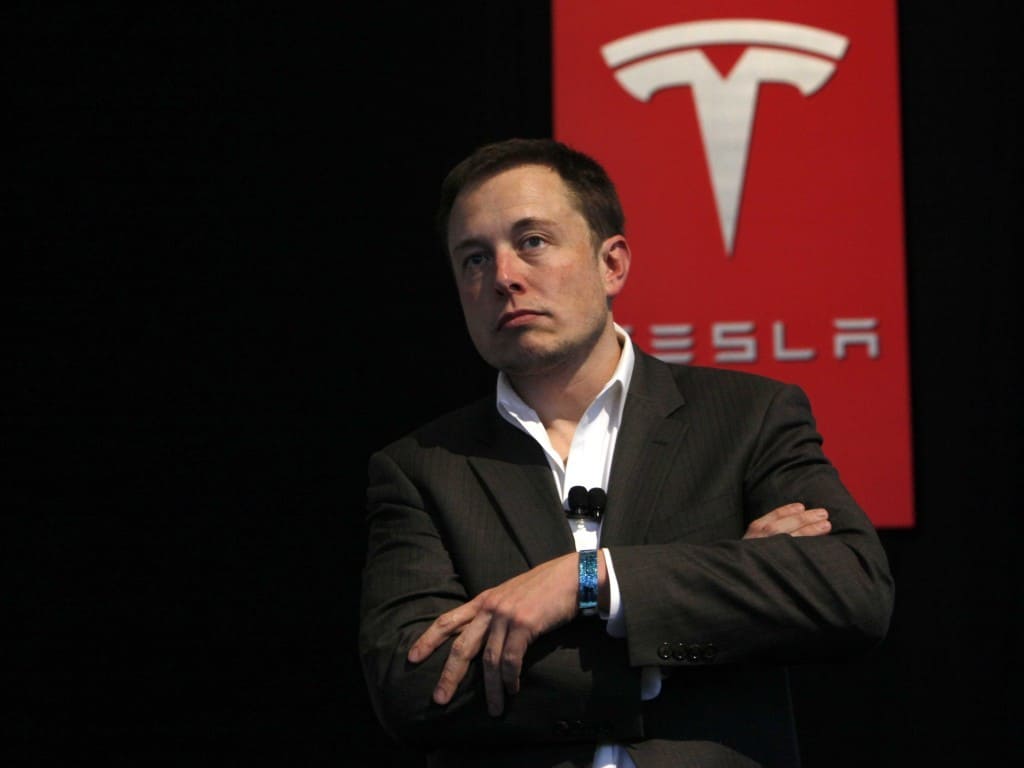

Tesla Motors Inc (NASDAQ:TSLA) has not done as well as forecast in China, and the firm’s shareholders suffered for that in the early part of 2015. Most of the attitudes toward the country, including that of CEO Elon Musk, seem to reflect an ignore and conquer viewpoint for the time being. That may not be possible for much longer.

There are many electric car firms already doing better than Tesla in China’s car market, but a filing on Thursday morning added Xiaomi to the list. The phone-maker is one of China’s most successful start-ups of recent years, and it’s starting to research electric cars. The South China Morning Post said on Wednesday that it had viewed patents related to cars from the firm.

Xiaomi looks to battle Tesla Motors

Tim Chen, who wrote the piece for the Post, says that the reason Xiaomi is getting into the market might be based more on state support than a wish to make money from the market. The state is set to begin giving out EV-making licenses to firms outside the industry soon, and those firms will be able to get subsidies for the cars they sell.

“To qualify, applicants must show expertise in the design, testing and assembly of electric cars, as well as prove they are in possession of the correct patents and have the appropriate intellectual property rights for core technology,” writes Chen.

If the firm is simply trying to prove that it has the research done to get into the car market, it may not end up releasing a car at all, or it may not arrive for many years.

The patents that Xiaomi filed this year are nothing on the huge store of IP that Tesla Motors is sitting on. They cover things like cruise control, navigation and handling rather than the nitty gritty of the EV business.

Xiaomi is looking for growth as the phone market in China slows down. The firm’s CEO Lei Jun said last year that the firm was on course “to become the biggest phone company in the world.” In the first half of the year Xiaomi sold just 34.7m phones, leaving it with little chance of hitting that number.

Global expansion has become a top priority for the Chinese phone maker. The firm has yet to launch its phones in the US and Europe where the margins might be higher, but the competition is even more fierce than back home in China.

Mr. Jun defended his record on July 2, saying “Even with the China smartphone market slowing down, we did a stellar job of posting a 33 percent growth on last year’s numbers.” Elon Musk finds himself in a very different position.

The EV market is far from saturated, but it’s not a product that the masses desire just yet, and that has become clear in Tesla Motors’ China efforts in the last year.

Tesla Motors needs a China partner

Tesla Motors has had real trouble selling its cars in China for a plethora of reasons, but the price of the Model S in the country, boosted by a tariff and a lack of access to state support, is chief among them.

Other problems that have been linked to Tesla’s poor performance in China include the lack of chargers in the country and a sales team that didn’t listen to Elon Musk’s ideas.

Stifel Nicolaus analyst James Albertine says that Tesla doesn’t need to rely on China in order to ensure sales of 500,000 before the end of the decade. The firm can achieve that with sales focused on the developed world says Mr. Albertine and shares are worth $400 as a result.

Tesla has been stung by more than one downgrade this week, and the firm’s shares have lost close to 9 percent of their value since trading began on Monday morning. The reason for the pullback is likely the result of a Wall Street belief that Tesla Motors is headed for trouble any time soon.

Tesla Motors will release earnings numbers for the three months through June at the end of July, though no exact date for the firm’s release has been offered just yet. Demand wasn’t an issue for the firm in the period. Model S sales hit 11,500 for the full quarter, a number released by Tesla Motors last week.

Tesla Motors could get around its pricing and state support problems by forming a joint venture with a Chinese firm, but Elon Musk seems to be against that idea for the time being. Mr. Musk has failed to break the hold of the dealer network in many US states. He’s on likely to be able to loosen the grip the Chinese government has on the country’s car market.

Xiaomi, if it does get into the car market, won’t need to have all that many patents of its own in order to do so. The firm will be able to take advantage of the patents that Tesla Motors has made open for any other firm to use.

That means that even if sales of the Model S in China are poor, there may be many EVs on the roads of the country that use tech from Tesla Motors.

Update 08:10 EST: Added pars on stock pullback, and Tesla Motors earnings release.

Update 11:58 EST: Added pars detailing Xiaomi’s problems in expansion in China.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account