Merck (NYSE: MRK) stock price is only among few drug manufacturers that have generated positive momentum this year. Its share price rallied almost 9% year to date despite the threat of a new pricing policy. The stock is currently trading slightly below from 52-weeks high of $87.

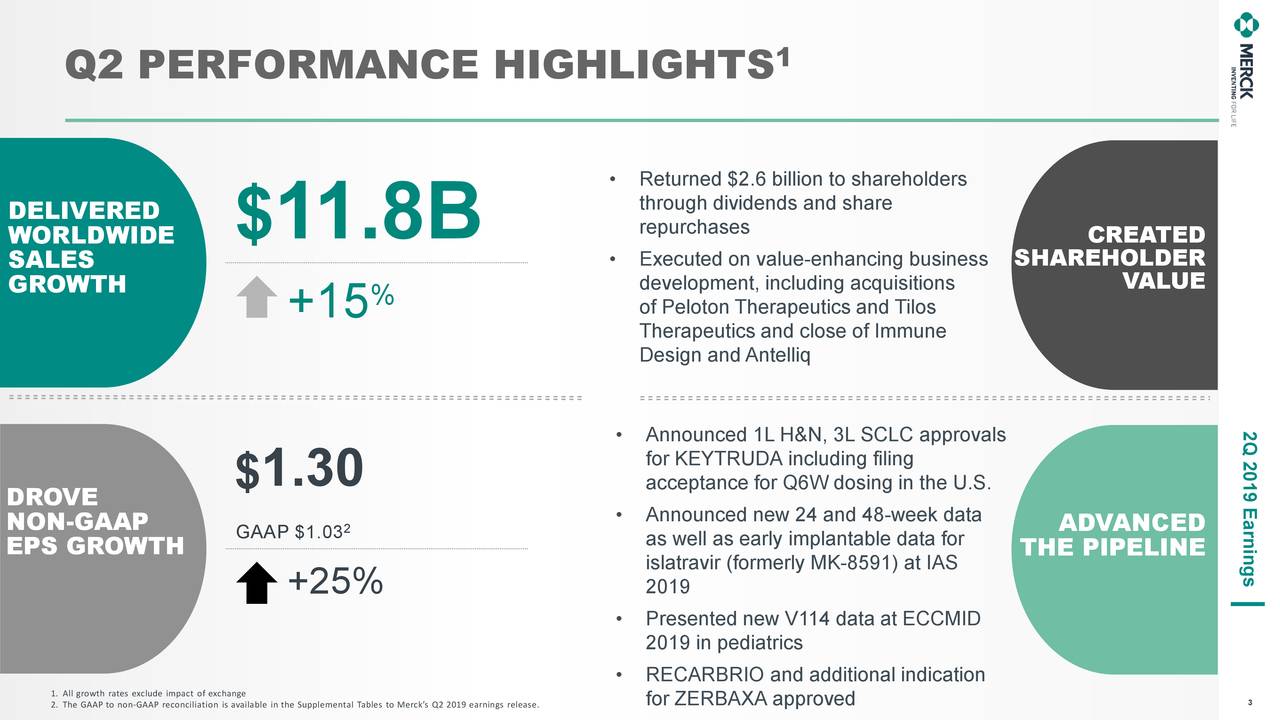

Merck stock price momentum is supported by its innovative products and solid financial numbers. The company has topped second-quarter revenue and earnings estimates by a wide margin.

Its revenue of $11.8 billion increased 15% year over year in the second quarter. The revenue growth is driven by Human Health Vaccines and Oncology.

Along with the revenue growth, its strategy of investing in high margin products is adding to earnings potential. The company has generated earnings growth of 17% in the second quarter from the previous year period.

Kenneth Frazier, Chairman, and Chief Executive Officer said, “Our results demonstrate the continued momentum of our business through the first half of the year. The results further show our focus on the kind of innovation that significantly improved health outcomes is paying off.”

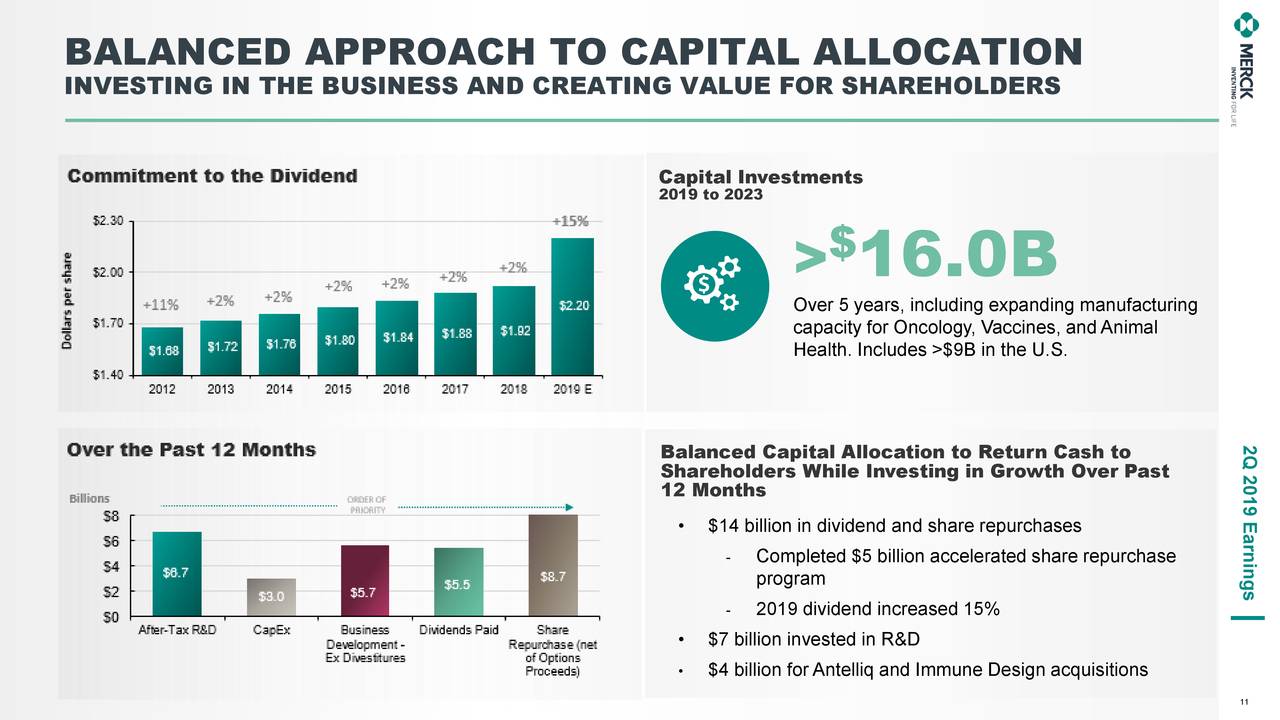

Merck also appears like a good stock for dividend investors. The company offers an annual dividend of $2.20 per share, yielding around 2.65%. The company has increased dividends over the past eight successive years.

It had increased annual dividend by 14.5% in 2018. The investors are expecting similar dividend growth for this year.

Its financial outlook and strong product line offer a room for dividend growth.

Merck expects to generate full-year revenue in the range of $46.2 billion, significantly higher from revenue of $42 billion in the past year. The guidance for full-year earnings per share stands around $3.88, up from $2.32 in the previous year.

Despite the steady share price rally, the stock looks fairly priced based on valuations. Merck stock price is currently trading around 16 times to earnings compared to the industry average of 20 times. Overall, Merck appears like a good play for dividend and value investors.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account