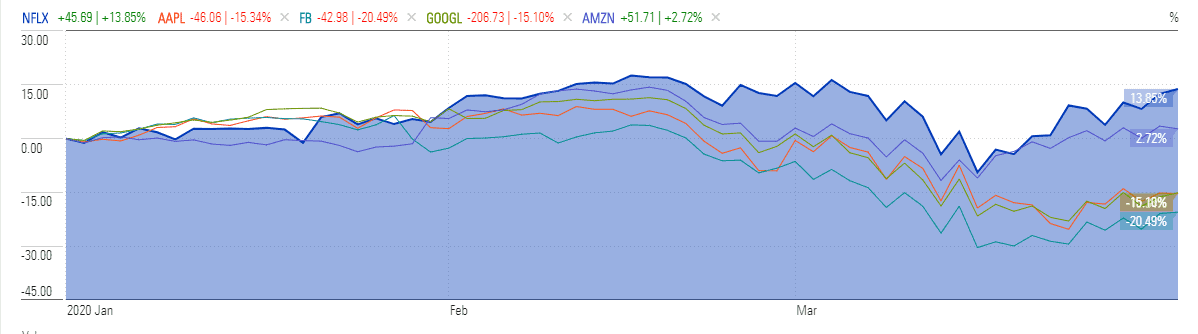

Netflix (NASDAQ: NFLX) stock is outperforming other US Big Tech giants as investors are betting on the world’s largest streaming service to push ahead during the coronavirus outbreak, which forces people to stay at home. Its shares rebounded sharply in the last couple of weeks; the stock is currently trading at slightly below an all-time high of $375 and are up 15% in the year to date. After a record number of streaming minutes in March, Netflix expects to generate robust growth in subscribers and user engagement in April due to lockdown measures. Although Netflix company has suspended its production activities, it claims to have enough content to keep users entertained over the next few months.

California-based Netflix this month experienced a 57% growth in downloads in Italy and a 34% jump in Spain according to the data from SensorTower. Its user growth is also high in the US, Canada, and Asia Pacific region where streaming demand surged 85% year-on-year in March.

The business is nabbing the biggest share of any streaming platform in more than 180 countries.

“Streaming is a big part of a lot of consumers’ lives right now. We have seen tremendous growth in just how much streaming is going on over the last few weeks as COVID-19 becomes more prevalent across many parts of the country,” said Scott N. Brown, head of TV product at data firm Nielsen.”

Netflix’s Spenser Confidential (pictured) has generated the largest streaming minutes while it’s other shows including On My Block and Love Is Blind has also been gaining consumer’s attention.

Netflix had added 28 million users last year despite increasing competition from Disney (NYSE: DIS) and Apple (NASDAQ: AAPL). The company’s earnings are also likely to improve amid the uptick in pricing and operation efficiencies, which will also help it in enhancing its cash flow generation potential. The company expects it will burn $2.5bn in cash this year, an improvement from negative cash flow of $3.3bn in 2019.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account