Square (NYSE: SQ) stock price has been struggling to create the bullish trend over the past twelve months. The stock has lost 40% of the value after hitting an all-time high of $100 a share in September 2018. Its shares are currently trading around $60, slightly high from a 52-weeks low of $49 that it had hit at the beginning of this year.

Prior to the latest selloff, Square stock price jumped from $10 in 2016 to $100 in September 2018. Some analysts believe the substantial rally in its stock price has increased its valuations compared to the industry average. They believe the stock price needs some time and support from financial numbers to match valuations.

Joseph Fahmy, Managing Director of Zor Capital said, “The stock went from $10 to $100 in two years and now needs time to digest that huge move. I still like the company but it needs time to build a new technical base and let their earnings catch up to its valuation.”

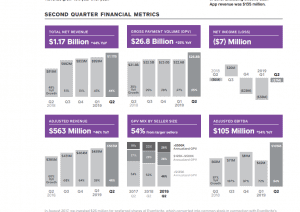

The company has reported solid financial results for the second quarter. Its Q2 revenue has beaten the consensus estimate by $5.33 million. The revenue increased by almost 44% year over year in the second quarter to $1.17 billion. The gross payment volume increased 25% Y/Y to $26.8 billion in Q2. It has also reported positive adjusted EBITDA of $105 million, up 54% from the past year period.

On the other hand, it ended the second quarter with cash, cash equivalents of $1.7 billion. This represents a growth of $80 million compared to the previous quarter.

The company expects to extend the momentum in the following two quarters. The company anticipates Q3 revenue in the range of $1.15 billion compared to revenue of $882 million in the year-ago period. The full-year revenue is expected to hit $4.4 billion. On the whole, Square’s stock price selloff is presenting a buying opportunity. This is because its financial numbers are offering complete support to share price performance.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account