According to reports from an article on FT, SolarCity Corp has formed an advisory panel regarding Tesla Motors Inc’s potential purchase of the firm. The committee will feature 2 of the boards members. It has been nearly 1 week since Tesla made an offer to acquire SolarCity. Elon Musk is the founder of SolarCity, & he is the current CEO of Tesla Motors Inc. When reports emerged regarding the offer & potential acquisition, shares in Tesla fell by around 10%, while SolarCity’s stock was rallying.

The FT article provided more details on the panel, reading “Despite being made up of only two of SolarCity’s eight board directors, however, the committee still includes one who was also once on the board of Tesla.The overlap highlights the difficulties the solar company faces in persuading shareholders that it will evaluate the Tesla bid approach objectively. It will also have to lay the ground for what legal experts said would be an inevitable challenge in court if a deal is ever completed.”

Tesla Motors Inc & SolarCity Are Similar Firms

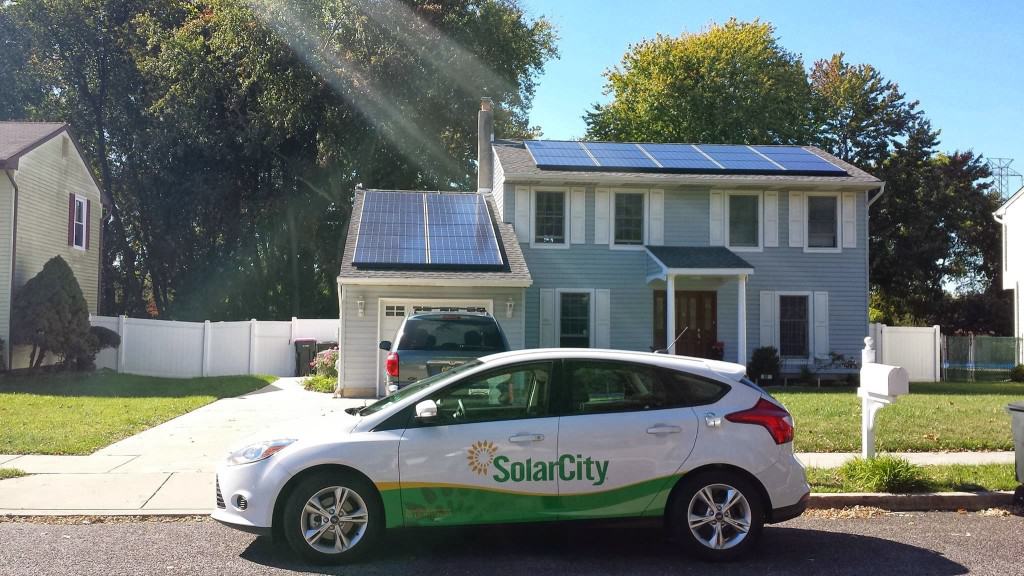

California based Tesla Motors Inc is internationally renowned as a developer & manufacturer of luxury electric vehicles (although they launched a relatively cheap EV on the 31/03/2016, called the Model 3.) SolarCity is also headquartered in the state of California, & is listed on the same stock exchange as Tesla (the NASDAQ.) They operate in the energy sector, specifically, the installation & maintenance of Solar panels. Therefore, both firms are highly innovative, & are active in the “Clean Tech” sector.

CEO of Tesla, Elon Musk, has previously said “I think the tide of history very strongly supports … a sustainable energy future — primarily solar, and almost virtually entirely electric vehicles. And there will be things that temporally interrupt that tide of history, but in the long term it will overwhelm everything — and our goal is to accelerate the advent of that future as fast as possible.” He owns approximately 20% of both firms.

Outlook for Tesla Motors Inc

This potential acquisition has split investor & analyst opinion. Many see the move as problematic, while others believe that it is a “no-brainer”. Based on how both of the businesses are acting, & the measures that they are implementing, it is likely that Elon Musk will try & push the deal forward.

A share in Tesla Motors Inc was up by 2.80% as the NASDAQ closed on the 27/06/2016, trading at $198.55 per share. The firm’s current market capitalization is at $28.49 billion.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account