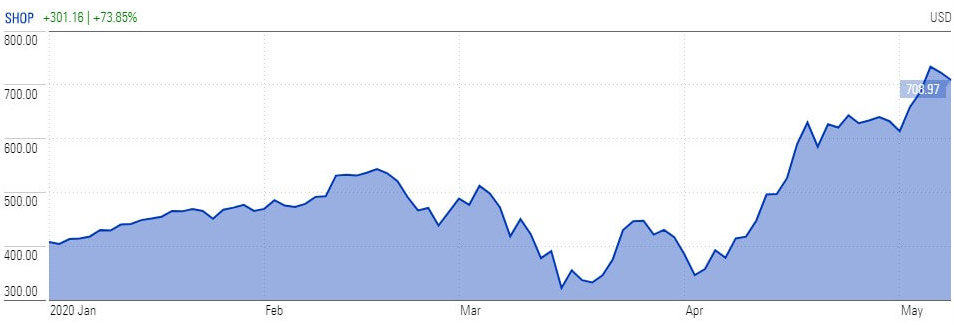

Shopify (NYSE: SHOP) stock has more than doubled in two months making the online shopping platform one of the biggest gainers of the coronavirus pandemic. This sentiment has been bolstered further by a surprise adjusted profit for the first quarter along with news that shows gross merchandise volume grew sharply in April compared to the first quarter.

“We are seeing US Black Friday-type of traffic as the company has added thousands of businesses to its platform amid social distancing policies,” said chief technology officer Jean-Michel Lemieux said.

The shares of Canada based e-commerce company rose more than 100% from March lows to the highest level of $740 last week before retreating to $708, on the announcement of class A subordinate voting shares priced at $700 per share.

The company expects to generate $1.295bn in gross proceeds from the offering to strengthen its balance sheet and support investment.

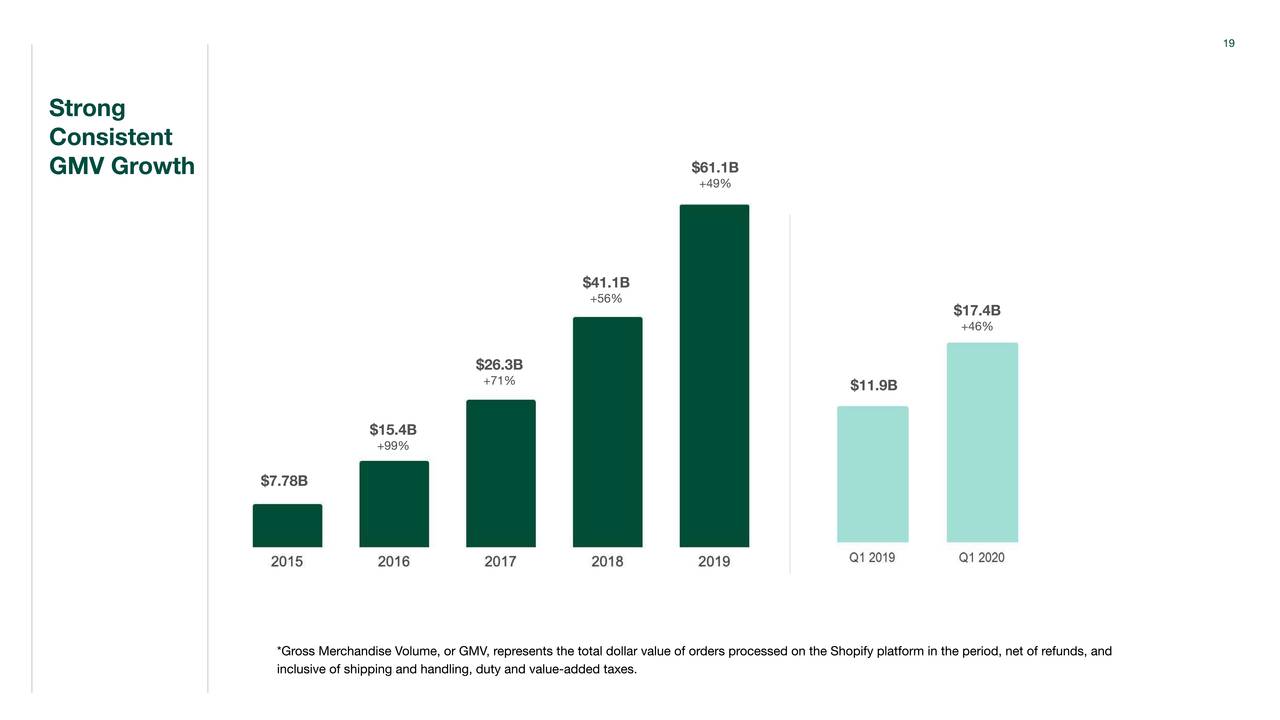

Its first-quarter revenue grew 47% year over year to $470m – beating analysts’ expectations by $27m amid 46% gross merchandise volume growth to $17.4bn, with expectations of more acceleration in the second quarter as the number of new shoppers rose 8% in April from the March quarter.

“While the COVID-19 pandemic has subdued commerce globally and especially strained small and medium-sized businesses, it has accelerated the shift of purchase habits to e-commerce,” Shopify said in an earnings release last week.

Along with strong growth in revenues, its first-quarter adjusted gross profit jumped 44% to $263.8m, and adjusted net income came in at $22.3m compared to $7.1m in the year-ago period.

Robert W. Baird analyst Colin Sebastian said he was confident about the strong product and engineering capabilities of the Ottawa-based e-commerce platform, but the analyst believes Shopify stock trading momentum will now depend on the sustainability of the recent sales growth.

If you plan to invest in stocks, you can use our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account