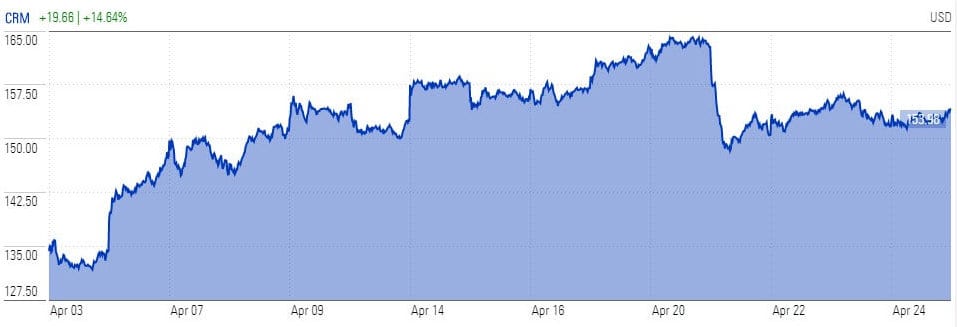

Salesforce (NYSE: CRM) stock price rose sharply after bottoming below $125 level last month as market analysts believe it is among the best ideas during the period of global uncertainty caused by the coronavirus pandemic. Although the stock, of the US cloud-based software firm, has risen more than 15% in the last three weeks, its valuations, revenue growth rate, and increasing market share in software space still make it a good stock to buy say some analysts.

Cowen analyst J. Derrick Wood says Salesforce is a strong defensive play during economic uncertainty due to its growth potential. The firm has provided a price target of $220, implying significant upside from the current stock trading price of $153.

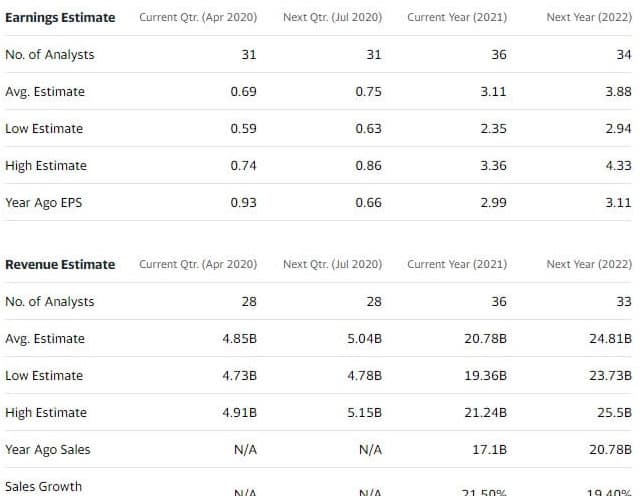

TConsensus estimates show that Salesforce, led by chief executive MarcBenioff, could report a 25% decline in first-quarter earnings from the past year period. However, its revenue is likely to increase by 29% year over year. Its full-year forecast also indicates 21% revenue growth and a 4% increase in earnings per share. Meanwhile, the company’s guidance indicates full-year revenue in the range of $4.8bn, up 30% from last year.

The company’s financial forecasts bode well for stock trading performance. Canaccord Genuity analyst Richard Davis said: “Salesforce rarely drops out of our top 5 best pick slots for the simple reason the company continues to execute well, and the valuation is attractive.” Salesforce stock is trading around 7 times to sales and 4 times to book ratio.

Salesforce develops enterprise cloud computing solutions with a focus on customer relationship management worldwide.

It plans to reach a long-term revenue target of $34bn to $35bn by 2024; Salesforce is also seeking to convert substantial revenue growth into big profits and strong cash flow. Its operating cash flow stood around $4.33bn in fiscal 2019.

If you plan to trade software stocks, you can check out our featured brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account