Qualcomm (NYSE: QCOM) stock price extended the upside momentum after beating fourth-quarter estimates. Analyst’s positive comments and target hikes are adding to investors. QCOM stock bounced to 52-weeks high amid expectations for improving market fundamentals for semiconductor companies.

Qualcomm stock price is currently trading around $90; analysts are expecting QCOM shares to hit $100 in the coming days. The company topped revenue and earnings estimate for the fourth quarter by $100 million and $0.07 per share.

Analysts Raised Qualcomm Stock Price Target

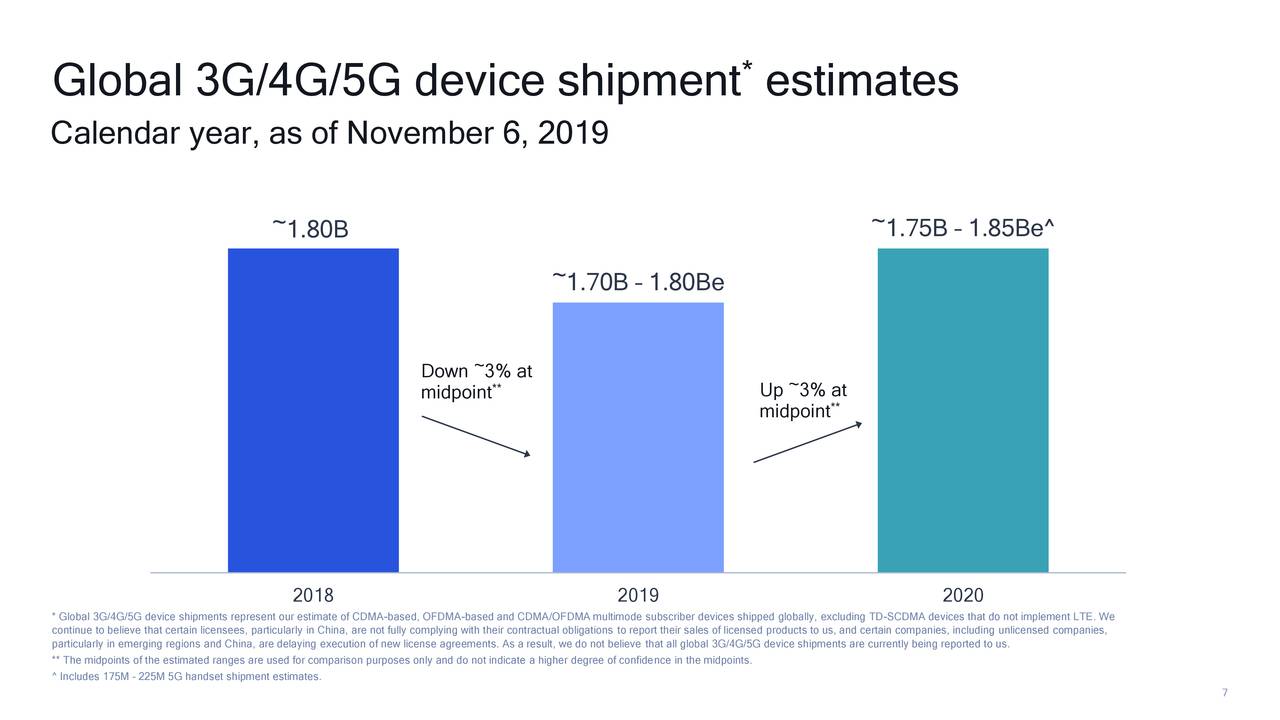

The majority of market pundits have increased QCOM shares price target. For instance, Mizuho lifted the price target by $20 to $100 with a buy rating. Mizuho analyst Vijay Rakesh claims that the company is well set to take advantage of 5G investments. The analyst expects revenue and margin growth in next year through these investments.

On the other hand, Cowen also appears bullish about Qualcomm. The firm raised the price target to $100. The firm says “The earnings beat and stronger-than-expected guidance, seeing benefits from the Apple settlement earlier this year and the potential for 2020/21 5G modem/RF chip ASPs to shift sharply higher.”

Morgan Stanley, however, is showing some concerns over growth potential in the short-term. The tailwinds include autos, IoT, and networking, according to Morgan Stanley.

Fourth Quarter Results and 2020 Guidance Supports Bullish Trend

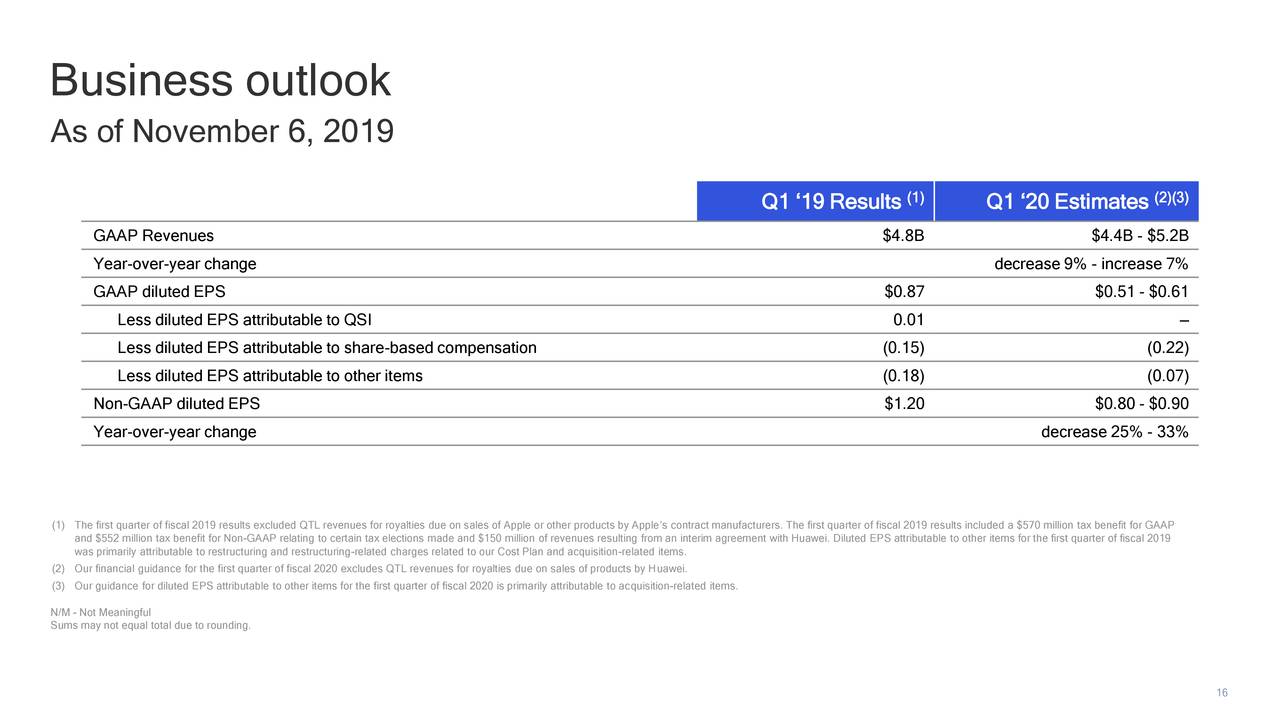

The company has generated $4.1 billion in Q4 revenue, up almost $100 million from consensus. Its fiscal 2019 revenue grew 7% from the previous year. In addition, it’s fiscal 2019 operating cash flows rose 86% from the past year. Strong cash generation enhances its investment potential and cash returns for investors.

The company expects fiscal 2020 revenue in the range of $5.2 billion, higher from $4.8 billion in the previous year period. QTL segment is likely to drive revenue growth in the first quarter. QCOM anticipates 28% to 47% revenue growth from the QTL segment. Overall, Qualcomm’s stock price is well set to extend the upside momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account