Qualcomm (NASDAQ: QCOM) stock price rallied close to 55% in fiscal 2019 amid prospects for a rebound in revenues. Apple’s collaboration with QCOM regarding 5G iPhone is adding to analyst’s and investor’s sentiments. The market analysts have lifted their price targets for QCOM shares due to improving fundamentals.

Qualcomm stock price is currently trading around $90, down slightly from 52-weeks high of $95 a share. The stock price is also trading at attractive valuations considering the price to earnings ratio of 21 compared to the industry average of 24. The shares also appear fairly valued based on price to sales ratio of 4.

Analysts Expect Qualcomm Stock Price to Hit $100 Shortly

The majority of analysts have issued a bullish outlook for QCOM. For instance, Bank of America is among those firms that are seeing the upside momentum in the coming days. The firm claims Apple’s 5G iPhone as the biggest catalyst for Qualcomm in 2020.

Its analyst Tal Liani predicts QCOM could generate $4 billion in revenue from Apple in the following years. Liani said, “Qualcomm is a long term beneficiary of growing tablet and smartphone adoption.” The analyst has set a $100 price target for QCOM.

On the other hand, Mizuho has also presented a similar opinion. Mizuho analyst Vijay Rakesh believes the company is well set for the 5G investment ramp, which could help it in enhancing margins and revenues in the coming quarters. Vijay Rakesh also provides a $100 price target with a Buy rating.

Financial Numbers are Supporting Upside Momentum

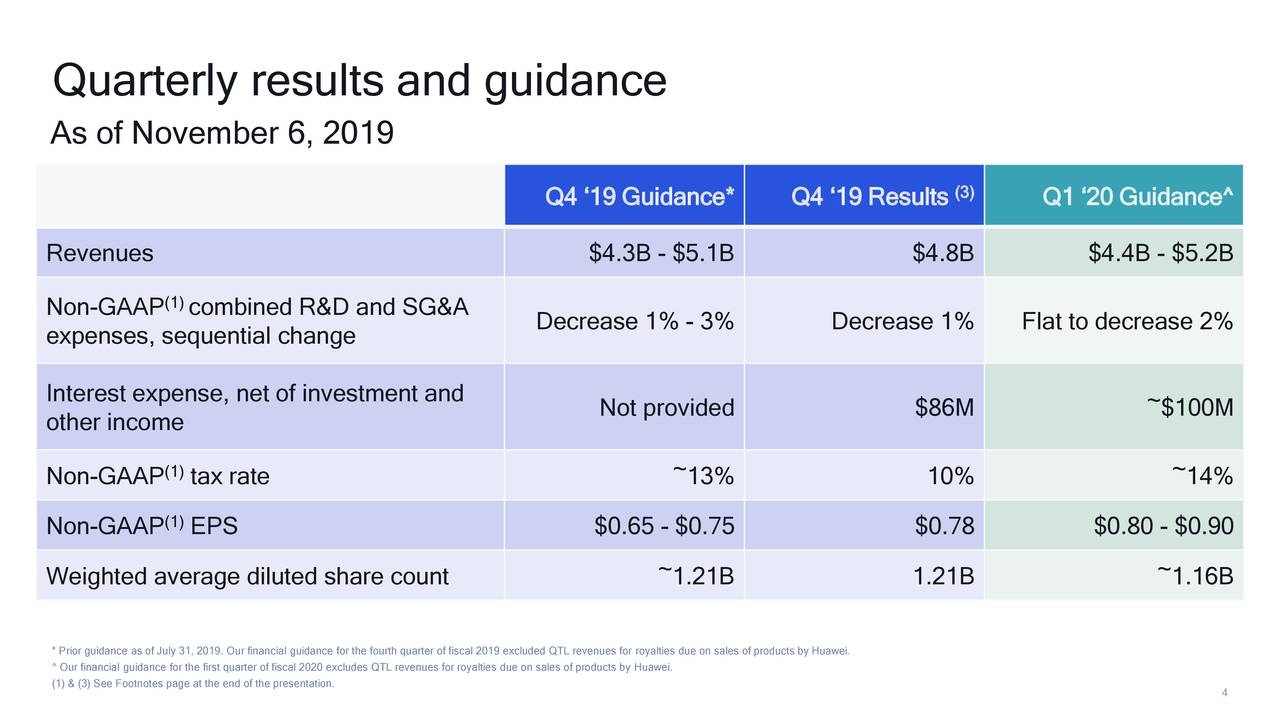

Qualcomm reported fourth-quarter revenue of $4.8 billion while earnings per share came in at $0.42 per share. It’s fiscal 2019 revenue of $24.3 billion increased 7% from the past year.

Moreover, the company expects Q1 2020 revenue in the range of $5.2B compared to the consensus of $4.83B. The earnings per share are likely to stand around $0.80-0.90. Overall, future fundamentals are improving for Qualcomm’s stock price amid investments in 5G.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account