Procter & Gamble (NYSE: PG) stock price has been smoothly moving in an upward direction over the last ten months. The high mid-single-digit growth in revenues and double-digit growth in earnings are adding to the trader’s sentiments.

PG shares had hit an all-time high of $125 last month. Procter & Gamble stock price is currently hovering close to its all-time high.

The market analysts are predicting PG shares to extend the bullish trend. This is because of stronger than expected growth in the third quarter along with upward guidance for the rest of the year.

Strong Q3 Results Supports Procter & Gamble Stock Price

The company has topped revenue and earnings estimates for the third quarter by $37 million and $0.13 per share. In addition, its revenue grew 7% compared to the year-ago period.

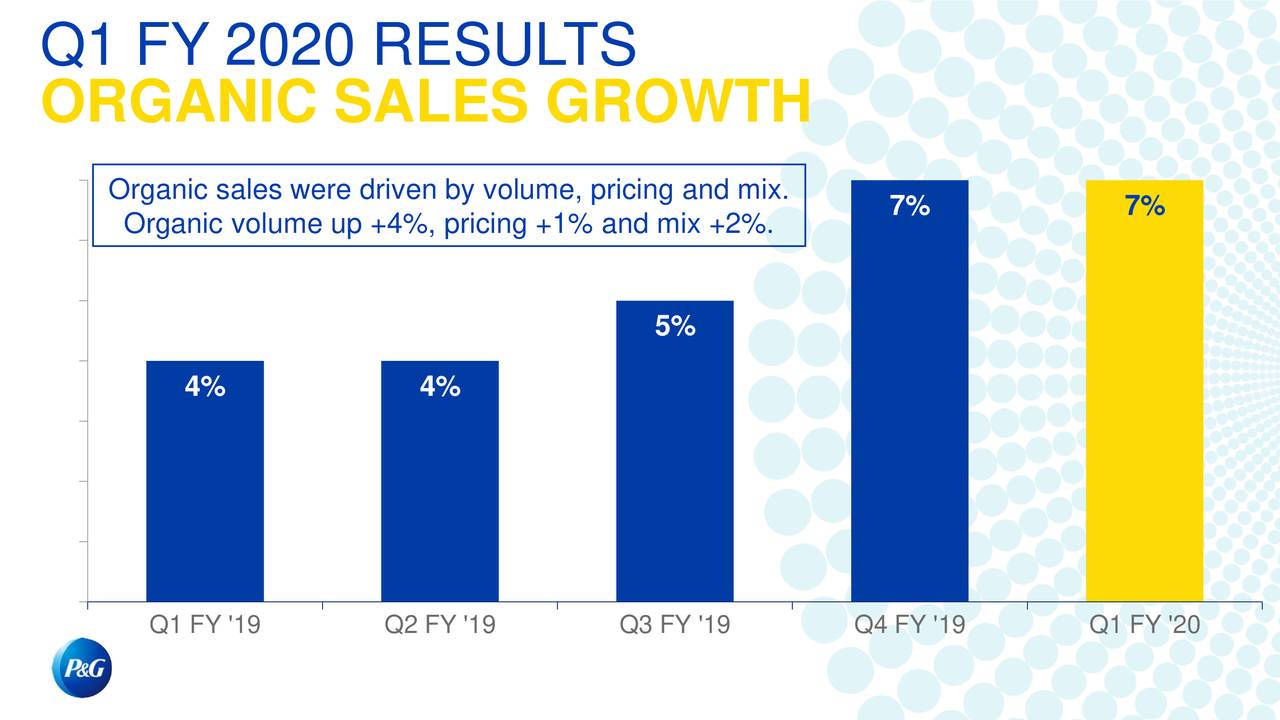

Moreover, its organic sales jumped by 7% year over year, higher from analyst’s consensus estimate for organic growth of 5%. The sales growth is driven by a 10% gain in the beauty segment along with a 9% increase in the health care segment.

Volume growth and higher pricing supported sales growth. Its all 10 global categories reported positive organic growth in Q1.

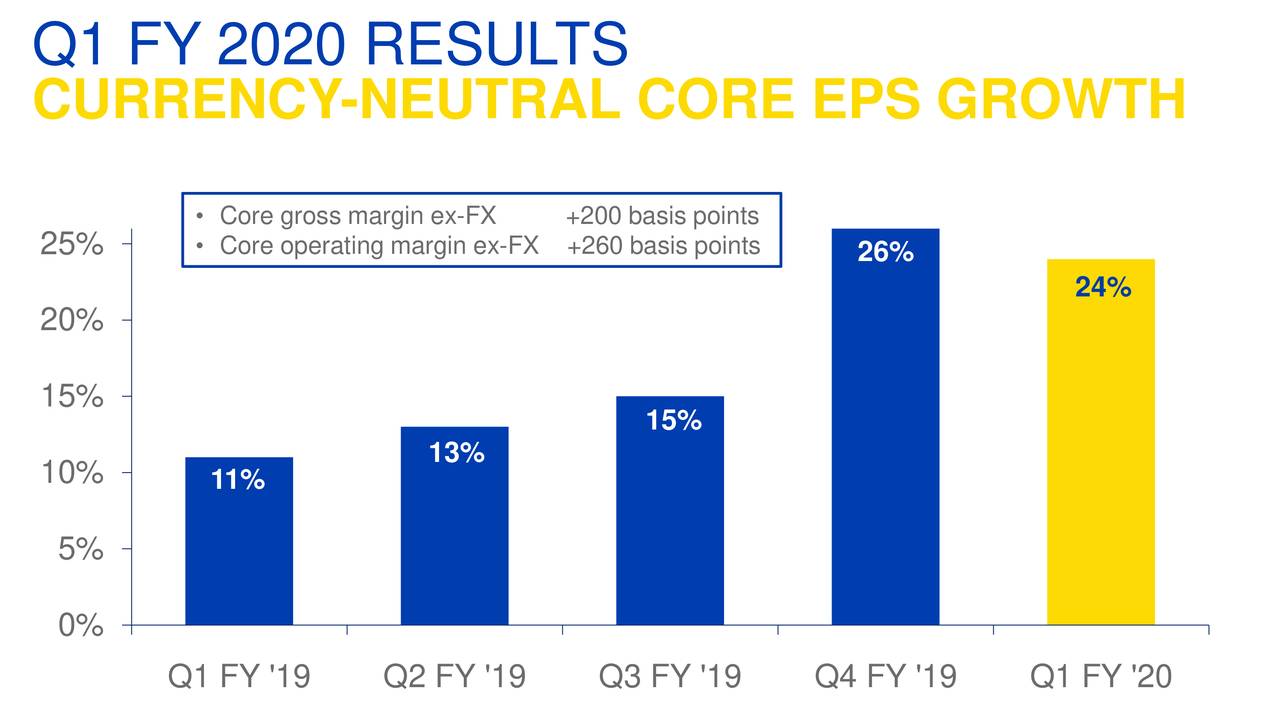

Above all, the company has turned strong revenue growth into big profits. PG’s core earnings per share grew 22% from the past year period. Earnings grew 24% on a currency-neutral basis.

Solid Outlook and Cash Returns are Catalysts for Share Price

Procter & Gamble is popular for offering sustainable growth in dividends. It has increased the quarterly dividend in the past 63 consecutive years. It currently offers a quarterly dividend of $0.74 per share, yielding around 2.5%.

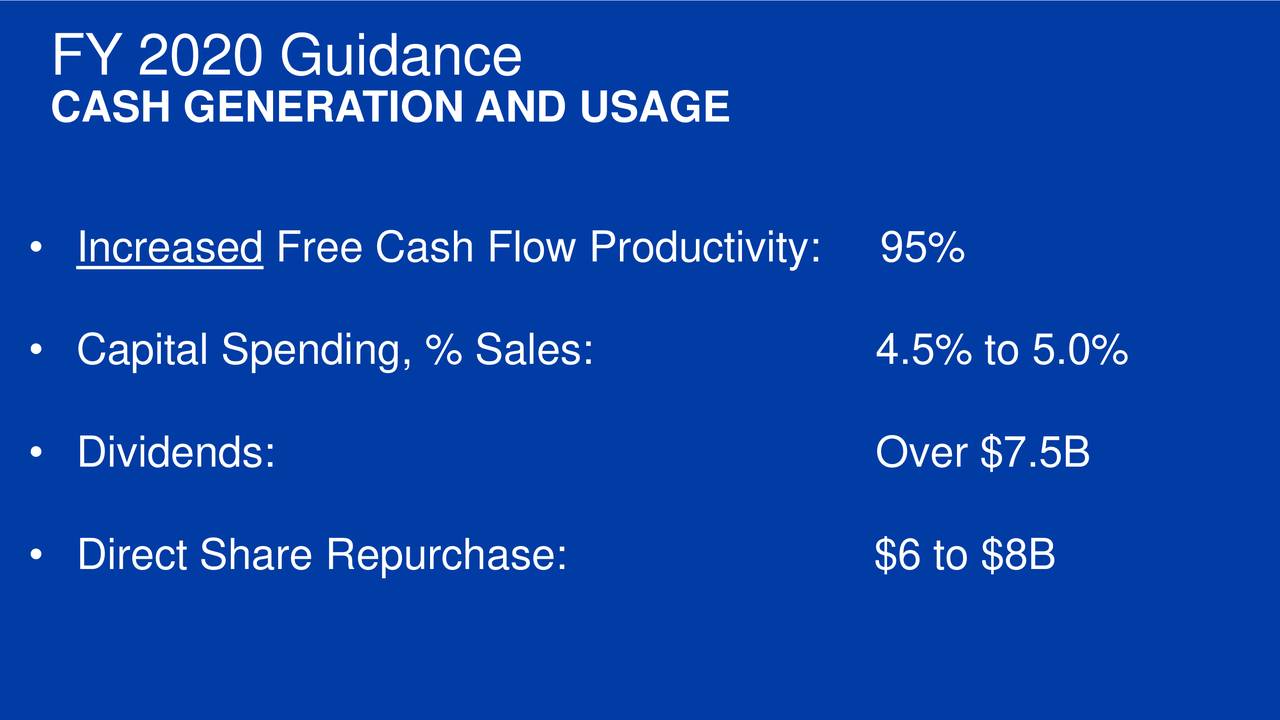

PG’s dividends are safe. This is due to its solid outlook for the full year. It expects mid-single-digit growth in organic sales for fiscal 2020. The core earnings growth guidance stands in the double-digit range. The company plans to return $7.5 billion to investors in the form of dividends and around $8 billion in share buybacks.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account