Philip Morris (NYSE: PM) stock price slumped sharply in the last two months following reports of an expected ban on e-cigarettes. The stock price plummeted from $88 a share in July to $75 a share at present. Traders concerns over merger talks have also been impacting its share price performance.

The Donald Trump administration is planning to ban flavored e-cigarettes. The potential ban is the outcome of a lung problem that killed almost six people in the last couple of months. In addition, federal agencies have reported the sickness of hundreds of others due to flavored e-cigarettes.

“While this investigation is ongoing, people should consider not using e-cigarette products,” the CDC wrote in a news release.

Philip Morris stock price regained some momentum following the latest dividend increase. It recently announced a dividend increase of 2.6%.

On the other hand, traders and investors are not very much clear about Philip Morris and Altria (NYSE: MO) merger discussions. Both companies recently confirmed that they are working on a possible deal.

Citi says “The current arguments from Altria and Philip Morris International on a merger may not be strong enough to convince shareholders to approve a deal.”

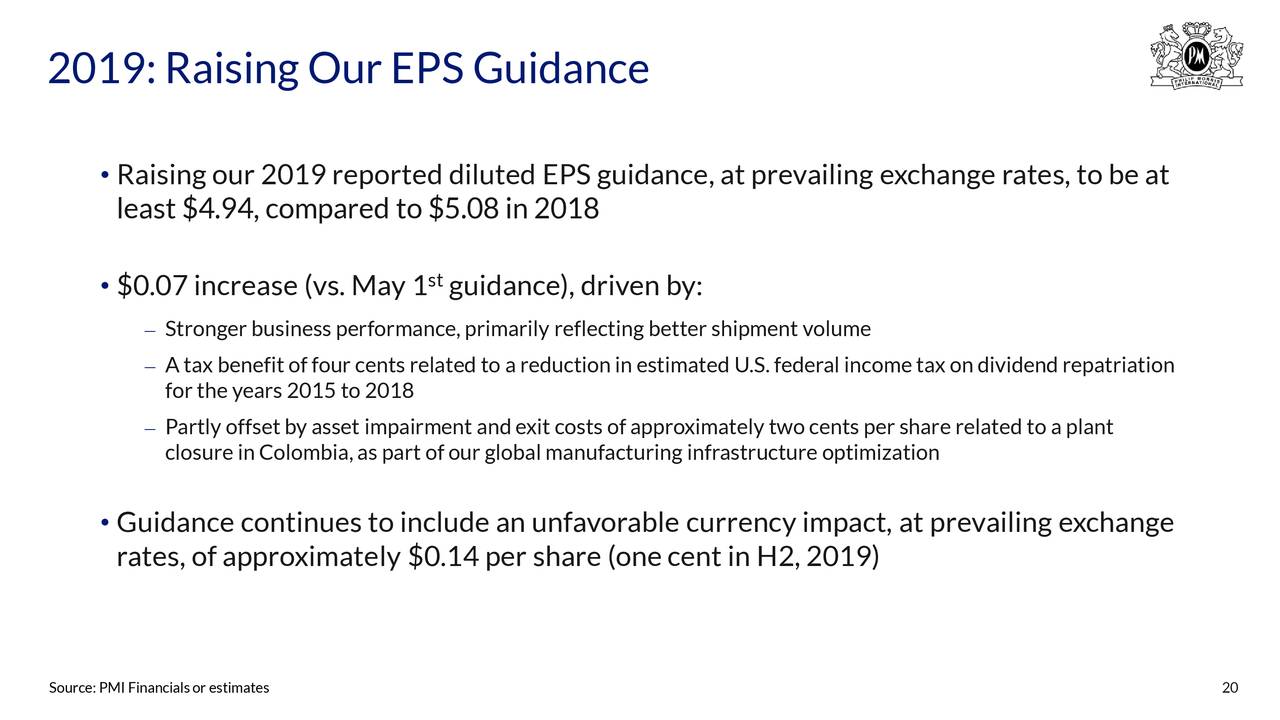

On the other hand, the company has recently reported stronger than expected results for the second quarter. This prompted the management to raise the full-year outlook.

Its second-quarter earnings per share of $1.49 increased 10% Y/Y on a constant currency basis. The company now expects FY 2019 adjusted earnings per share of $5.14 compared to the previous guidance of $5.09. Meanwhile, the analyst consensus estimate for earnings per share stands at $5.15.

Philip Morris stock price looks undervalued based on price to earnings ratio of 14 compared to the industry average of 20.

The shares are also currently trading well below from 52 weeks high of $92. Overall, several catalysts are supporting upside momentum for Philip Morris stock price. However, investors should look at the potential ban on e-cigarettes – which is one of the major product of this company.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account